CEA Industries' Stance on BNB Treasury

CEA Industries (NASDAQ: BNC) has unequivocally reaffirmed its commitment to retaining BNB as its sole digital asset treasury. This clarification was issued on December 4, 2025, in response to recent statements from YZi Labs. The company's decision highlights a strategic focus on stability within its cryptocurrency treasury management, aiming to provide reassurance to shareholders during periods of market fluctuation. This contrasts with YZi Labs' proposals for enhanced oversight and a restructuring of the BNC board.

CEA Industries has explicitly stated that no alternative tokens or competing projects are currently being considered as part of its digital asset strategy. This exclusive focus on BNB was reinforced following the company's July PIPE financing. According to the CEA Industries Board, "We have reaffirmed our commitment to the BNB token as our sole digital asset treasury strategy, holding 515,554 BNB tokens valued at approximately $464.6 million."

Dialogue with YZi Labs and Shareholder Engagement

YZi Labs has proposed an increase in board oversight through a restructuring initiative, with the stated goal of refining CEA Industries' strategic guidance. Despite these proposals, the company has assured its shareholders that there is no immediate necessity for action. CEA Industries has initiated open discussions with YZi Labs to address these concerns and foster collaborative dialogue.

The market's reaction to CEA's affirmation of its BNB strategy has remained stable, with no significant price fluctuations reported. However, the ongoing dialogue between CEA Industries and YZi Labs has garnered considerable attention from investors who are closely monitoring the dynamics of corporate governance within the company.

BNB Market Performance and Valuation

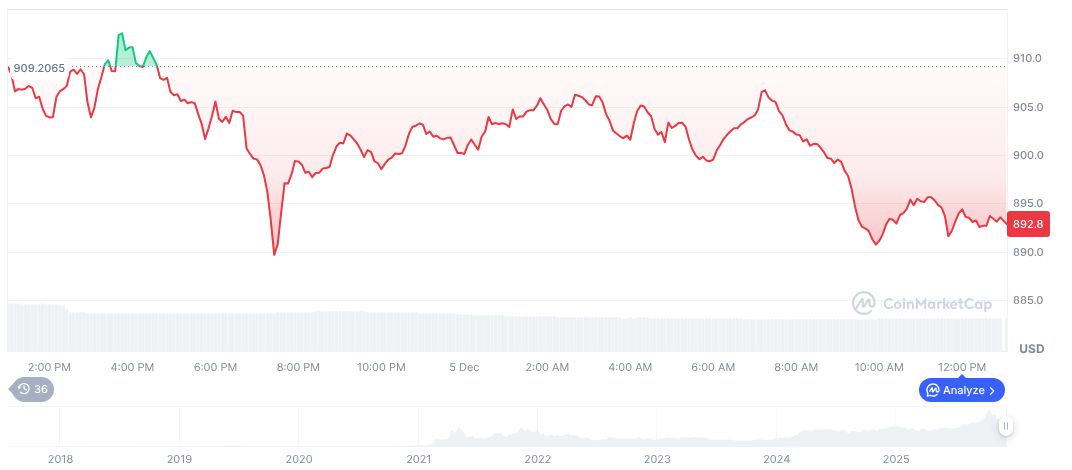

As of December 5, 2025, BNB is valued at $893.22, with a market capitalization exceeding $123.03 billion. This valuation represents 3.96% of the total cryptocurrency market dominance. While BNB's price experienced a 1.75% decline in the preceding 24 hours, it has shown moderate gains over the past week. Historical governance restructurings in cryptocurrency firms have often preceded board refreshes, suggesting a potential for improved oversight at CEA Industries following YZi Labs' proposal.

Analyst Insights and Stakeholder Confidence

Coincu analysts have observed that while regulatory outlooks remain consistent, the current board discussions could lead to increased transparency. Active engagement in dialogue is seen as a potential factor in fortifying stakeholder confidence in CEA Industries' governance practices. Insights from 10X Capital, an institutional partner, suggest that stockholder decisions are often influenced by such strategic dialogues.