The Central Bank of Nigeria (CBN) has declared Zuldal Microfinance Bank Limited an unauthorised financial institution, stating it operates without a licence or regulatory approval. Zuldal, which reportedly operates in Lagos, Abuja, Kaduna, and Kano, has been officially identified as an illegal operator.

In a disclaimer released on Wednesday, the financial regulator explained that Zuldal is an unregistered entity and, therefore, unlicensed to conduct any form of microfinance banking operations within Nigeria. The statement explicitly reads: "The said Zuldal Microfinance Bank Limited is not a licensed Microfinance Bank and has no authorisation from the Central Bank of Nigeria to operate or carry out any form of banking or microfinance business in Nigeria."

The CBN referenced Section 2(1) of the Banks and Other Financial Institutions Act (BOFIA) 2020, which stipulates that "no person shall carry on any banking business in Nigeria except it is a company duly incorporated in Nigeria and holds a valid banking licence issued by the CBN." This legal framework supports the CBN's action against Zuldal.

Furthermore, the CBN has advised Nigerians to exercise caution and be wary of engaging in any financial transactions with Zuldal Microfinance Bank, as any such dealings will be at the individual's own risk. The public is urged to disregard any claims made by the entity suggesting it is a licensed financial institution in Nigeria. The CBN reaffirmed its commitment by stating, "The CBN remains committed to safeguarding the financial system and protecting members of the public from unlicensed and fraudulent institutions."

Current Status of Zuldal Microfinance Bank

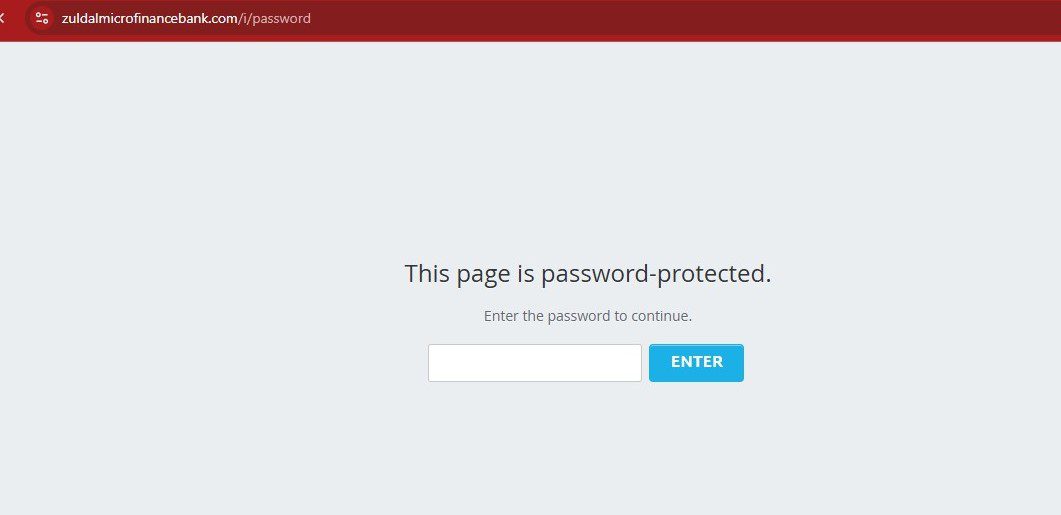

Online investigations indicate that Zuldal Microfinance Bank's website, zuldalmicrofinancebank.com, is currently inactive and password-protected. The website displays the message: "This page is password-protected. Enter the password to continue."

Further searches suggest that Zuldal is a relatively new entity that has recently promoted itself as a Microfinance Bank in Nigeria. Reports and social media claims indicate that the company held its "grand opening" event at the National Women Centre in Abuja on September 22, 2025.

CBN's Regulatory Efforts

This disclaimer from the CBN occurs amidst the central bank's ongoing efforts to enhance transparency, accountability, and responsible operations within the financial sector.

Among these initiatives are the Draft Guidelines on the Operations of Automated Teller Machines (ATMs) in Nigeria. This document aims to redefine ATM operations by banks through revised and comprehensive guidelines, establishing minimum standards for ATM deployment, operation, and maintenance to ensure customer safety and align with international best practices.

Another significant regulatory update includes the revised guidelines for Point-of-Sale (PoS) banking agents' operations. These guidelines are designed to foster a robust and efficient payment system nationwide. Key aspects include a N1.2 million daily transaction cap for PoS operators and the requirement for agents to register with only one financial institution.