Key Insights

- •Analysts foresee a potential Cardano price surge toward $1 by 2026, contingent on clearing key resistance levels.

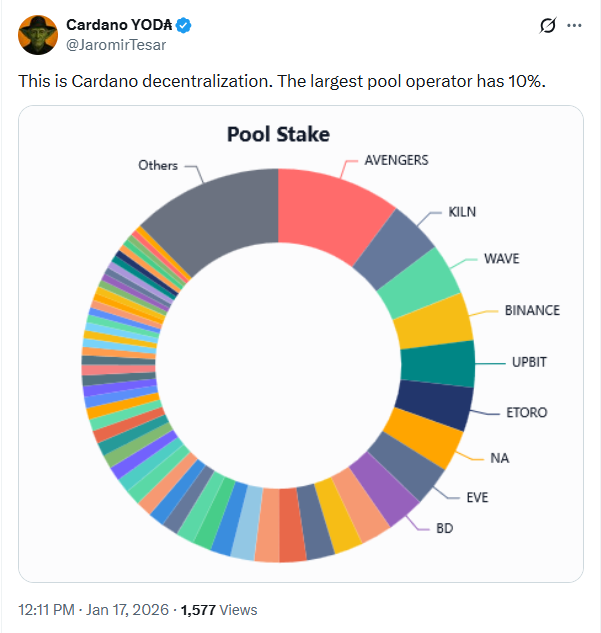

- •A prominent validator has affirmed that Cardano's decentralization remains broadly distributed, even with one operator holding 10% of the stake.

- •Delegators are positioned to earn both ADA and NIGHT rewards upon the launch of the Midnight Mainnet.

Cardano's price is drawing significant attention as discussions around its decentralization are driving ADA trades close to the $0.40 mark. Concurrently, a leading validator has emphasized how the broad distribution of stake bolsters the network's security and resilience. This development adds considerable value for delegators and strategically positions the blockchain for future growth, especially with the anticipated launch of new Midnight rewards in the upcoming months across global markets.

Cardano Decentralization And The Big Picture

Cardano's decentralization is undergoing a real-time test, and recent data is providing its supporters with renewed confidence. Jaromir Tesar, a prominent figure in the ecosystem, noted that the largest stake pool operator currently manages approximately 10% of the total delegated ADA. While such a concentration of power might raise concerns on many other networks, on Cardano, it is being presented as evidence that control remains widely dispersed. The stake is distributed across numerous independent pools rather than being concentrated within a small group of large entities. This structure ensures that no single entity can unilaterally dictate network upgrades, block production schedules, or transaction fees. The fact that the top operator holds only 10% means that the remaining ninety percent is in the hands of other stakeholders, which proponents argue represents a healthy equilibrium.

This decentralized architecture fundamentally shapes how network upgrades are implemented. Proposed changes undergo a rigorous process involving open proposals, thorough testing, and extensive community feedback before they are fully deployed. Although this methodical approach can sometimes appear slow to traders, it significantly mitigates the risk of network disruptions that could negatively impact users. Reliability is another key benefit derived from this model. Should a major stake pool experience failure, the network continues to operate seamlessly as hundreds of other pools maintain block production. Furthermore, smaller stake pool operators are afforded equitable opportunities to earn rewards, thereby fostering a broad and competitive validator landscape.

Simultaneously, the principle of decentralization is intrinsically linked to Cardano's future growth initiatives. A notable example is the upcoming Midnight chain, which is designed to leverage existing Cardano stake pools for its validation processes. Instead of establishing a new trust framework from the ground up, Midnight will inherit the robust security and established decentralization of Cardano's widely distributed system. For the community, this integration demonstrates that Cardano's decentralization is not merely a theoretical concept but a functional model with tangible value.

Dual ADA And NIGHT Reward Advantage

In parallel, Cardano delegators are poised to experience a significant financial advantage. Specifically, upon the launch of the Midnight Mainnet, Cardano stake pools will be enabled to validate both Midnight and regular Cardano blocks. The project Cardanians has officially confirmed its intention to operate a Midnight validator, signifying that a single ADA delegation can yield two distinct streams of rewards. Delegators will continue to earn ADA from their participation in the Cardano network while simultaneously receiving NIGHT tokens from the Midnight network. Supporters of this model highlight its attractiveness, as it allows users to benefit from a new ecosystem without requiring them to relocate their funds or undertake additional risks. The inherent simplicity of this design means users only need to delegate once, with their stake effectively supporting two chains concurrently.

This dual reward system is particularly beneficial for smaller holders, as it reduces both the financial outlay and the operational effort required to gain exposure to a new and potentially high-growth ecosystem. Furthermore, many anticipate that this strategic linkage will foster increased loyalty towards the Cardano ecosystem. Should the Midnight network achieve substantial growth, the demand for ADA staking could see an upward trend, as it becomes the primary gateway for acquiring NIGHT rewards. Cardano's established decentralization plays a crucial role here, as a broad and diverse validator set is fundamental to building and maintaining trust in the network.

Altcoin Pressure and Cardano (ADA) Price Expectations

Current market conditions present a challenging environment for many altcoins, including the Cardano price. Capital has largely shifted towards Bitcoin, resulting in depressed valuations for assets like ADA, despite their underlying technological strengths. The introduction of Bitcoin Exchange-Traded Funds (ETFs) and broader macroeconomic uncertainties have contributed to a significant increase in BTC's dominance in the market. This trend is occurring even as rising global liquidity in March 2025 has predominantly flowed into what many perceive as the safest cryptocurrency asset. Concurrently, a number of altcoins are grappling with issues such as treasury dilution, slow user adoption rates, and unconvincing market narratives. While many of these projects demonstrate considerable potential, their solid technology has not yet translated into rapid price appreciation.

In the current market cycle, factors such as liquidity, established trust, and operational simplicity are being rewarded more significantly than future potential. It is likely that most altcoins will not completely vanish from the market, but many may underperform Bitcoin until a rotation of capital back into altcoins occurs. The anticipated "alt season" is not absent, but rather delayed. Against this prevailing market backdrop, the ADA price is trading at approximately $0.3977, showing a modest movement of about 2% in the last 24 hours. Market observers suggest that a significant recovery for Cardano does not necessitate extraordinary assumptions.

If the Cardano price manages to reclaim the $0.70 to $0.75 price range and sustain its position above the 200-day moving average, a trajectory towards $1 would become a realistic prospect within a more robust market cycle. Looking ahead to 2026, analysts suggest that a movement into the $1.20 to $1.50 range would be more consistent with historical price patterns rather than being driven by speculative hype.