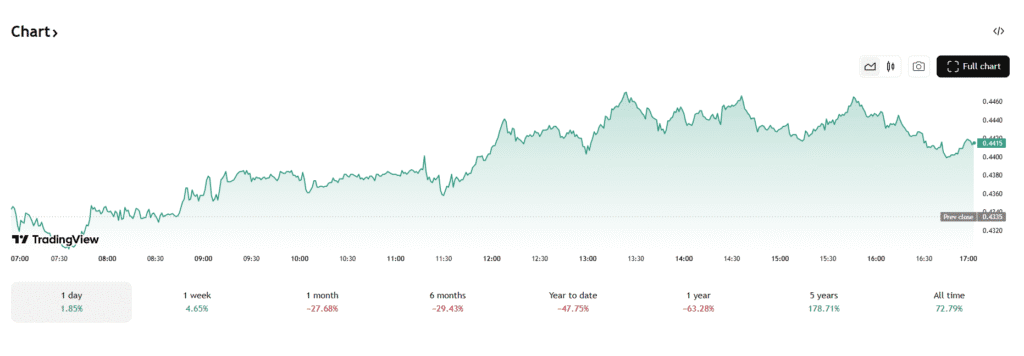

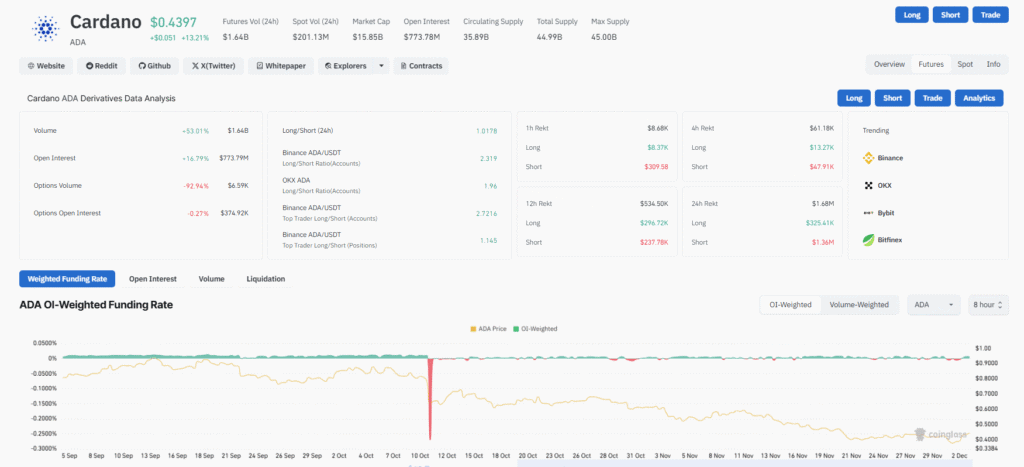

Cardano (ADA) is currently trading within the $0.43–0.44 range. Derivatives data indicate a neutral market structure, based on current readings of Open Interest and volume.

| Key Highlights: - ADA trades around $0.43-0.44, maintaining stability within a neutral consolidation phase. - Open Interest (OI) ranges between $760–780 million, while futures volume stands around $1.64 billion. - The spot volume is approximately 200 million, reflecting healthy liquidity that is not indicative of an imminent breakout. - Resistance levels are identified at $0.50–0.52, and support is found at $0.40–0.42. - A breakout above $0.52 could target the $0.55–0.60 range, while a breakdown risks a drop to $0.38–0.36. - The circulating supply, close to 35.9 billion ADA, necessitates robust demand for sustainable upside movement. |

ADA is currently trading in the $0.43–0.44 range, with recent sessions exhibiting relatively stable price behavior. The market capitalization is close to $15.82 billion, and spot trading volume is around 200 million, confirming the presence of market participants despite subdued volatility.

The circulating supply, nearing 35.9 billion ADA, continues to influence ADA's price dynamics, as a large supply requires significant inflows to fuel trend expansion. Nevertheless, ADA maintains consistent liquidity conditions compared to many assets in its market category, based on current trading activity.

Despite stable activity, spot volume remains below levels typically seen before a breakout, keeping ADA within a controlled sideways range until derivatives flows or broader market sentiment provide a more decisive signal.

Technical Analysis Points to Key Breakout Zone

Recent chart data indicates that ADA is trading within a defined price range. Key levels for support are identified around $0.40–0.42, with resistance at $0.50–0.52. A confirmed close above $0.52 on the 4-hour or 1-day chart would strengthen bullish momentum and potentially lead to a move toward $0.55–0.60.

Historically, ADA has faced challenges in sustaining upward momentum around this resistance cluster, making it an important psychological and technical barrier. The recent pattern shows tighter consolidation and higher lows, according to observable chart behavior.

If bullish momentum falters, ADA could retract toward $0.40–0.42, which has remained a strong structural demand zone. A failure to hold this support level could lead to a decline to $0.38–0.36, levels historically associated with deeper liquidity and corrective retests.

Price Projections and Market Sentiment

Short-term chart observations suggest that the $0.52 level remains a key reference point, as evidenced by previous price reactions when this area was tested. ADA has previously shown price reactions near upper range boundaries such as the $0.55–0.60 zone, which has been characteristic of range expansion behavior observed in the past.

If ADA faces rejection from resistance, a 5–10% pullback to $0.40–0.42 is likely, which remains the nearest actionable support. Sentiment would only weaken further if broader market conditions deteriorate.

Derivative metrics indeed confirm a neutral market profile, indicating that ADA does not exhibit excessive leverage. Consequently, price action is driven more by structural demand rather than speculative behavior. This contrasts with altcoins that frequently experience higher volatility due to leverage-driven moves.

On-Chain and Derivatives Metrics Support Neutral Market Structure

According to CoinGlass, ADA's Open Interest is near $760–780 million, with futures volume in the $1.64 billion range and spot volume around $200 million. This reflects steady participation across both derivatives and spot markets. Current derivatives data suggests consistent participation without signs of unusually high leverage.

Compared to altcoins with heavy leverage, ADA maintains a moderate derivatives profile, which reduces the possibility of liquidation cascades. This aligns ADA's price action more closely with actual market demand, rather than volatility induced by margin unwinds.

The large circulating supply, close to 35.9 billion ADA, continues to act as a boundary on the speed at which momentum can build. Coupled with balanced derivatives metrics, the ADA market is currently in equilibrium, awaiting a catalyst or a stronger liquidity shift to define its direction.