Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released its latest Crypto Derivatives Analytics Report in collaboration with Block Scholes. The report reveals cautiously optimistic signals in cryptocurrency markets following a volatile start to December.

The analysis examines market dynamics following December 1st’s sharp selloff, which was triggered by hawkish signals from the Bank of Japan. Despite positive developments, such as Vanguard’s decision to open crypto ETF trading, derivatives data suggests traders remain cautious, as major cryptocurrencies are still trading well below their all-time highs.

“Cryptocurrencies have been buffeted by multiple crosswinds, from shifting expectations surrounding major central bank policies, to mounting concerns over the viability of DATs,” said Han Tan, Chief Market Analyst, Bybit Learn. “Major crypto prices are likely to remain beholden to macro forces over the immediate term, especially with the pivotal Fed rate decision looming, even as the crypto world attempts to shake off the ghosts of the Oct 10 liquidation event,” he added.

Key Highlights from the Report

- •Market Recovery Underway: Bitcoin (BTC) has recovered to a two-week high above $93,000, while Ethereum (ETH) reclaimed the psychological $3,000 level. This rebound followed a sharp early-December selloff triggered by hawkish signals from the Bank of Japan. Positive catalysts, including Vanguard’s decision to open its platform for crypto ETF and mutual fund trading, have supported this recovery.

- •Subdued Downside Fear: Options traders have significantly reduced their bearish positioning. Put-call skew premiums have declined sharply from 10-13 percentage points at the start of the month to just 2-4 percentage points currently. This indicates that traders are pricing crash protection with far less premium than just one week ago.

- •Muted Leverage Activity: Open interest in perpetual futures has increased modestly during the recovery, though it remains well below pre-October 10, 2025 levels. The data suggests lower participation rates in leveraged positions, with recent selloffs showing no signs of liquidation cascades that typically characterize over-leveraged markets.

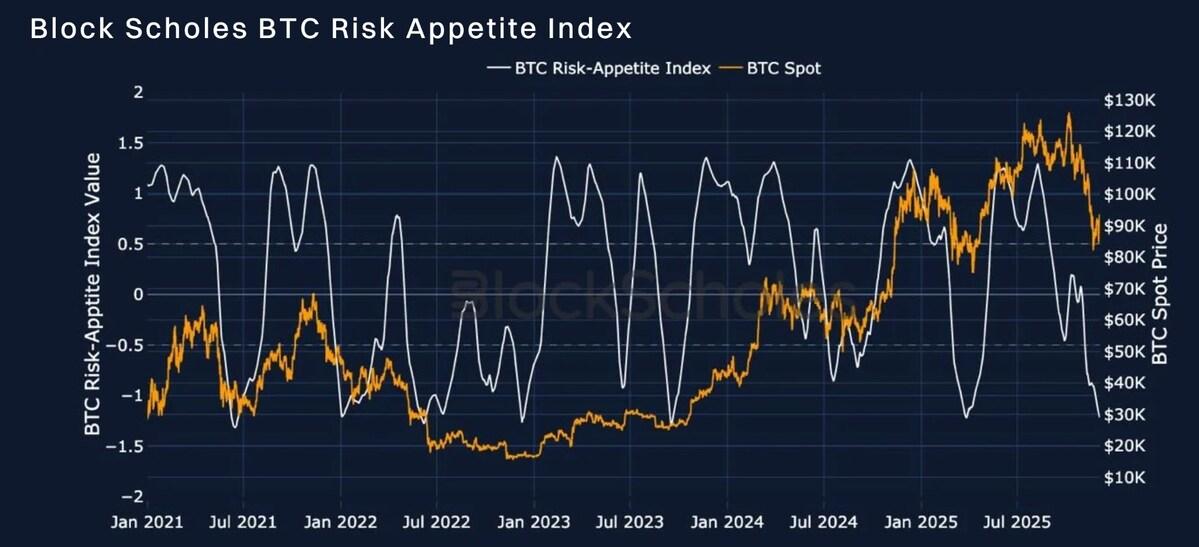

- •The Fading Bear: Block Scholes’ proprietary Risk Appetite Index indicates that while sentiment is shifting in a positive direction, market participants have not yet turned bullish. This cautious stance is unsurprising given that both BTC and ETH continue to trade significantly below their all-time high levels.

Basic Attention Token (BAT) Performance

The report also spotlights Basic Attention Token (BAT), which has surged over 100% since October 11th to around $0.27. This performance significantly outpaces the broader altcoin recovery. The Ethereum-based token, which powers Brave browser’s privacy-focused advertising ecosystem serving over 100 million monthly users, has helped make social tokens the second-best performing sector over the past month, trailing only privacy coins.

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3.