Key Market Indicators Suggest Stabilizing Conditions

Bitcoin is approaching a low-risk environment, which presents a prime opportunity for dip buyers. As of late November, Bitcoin's price is hovering around $91,000. Several key market indicators are suggesting that conditions are stabilizing, offering potential buying opportunities for cautious investors.

In Brief

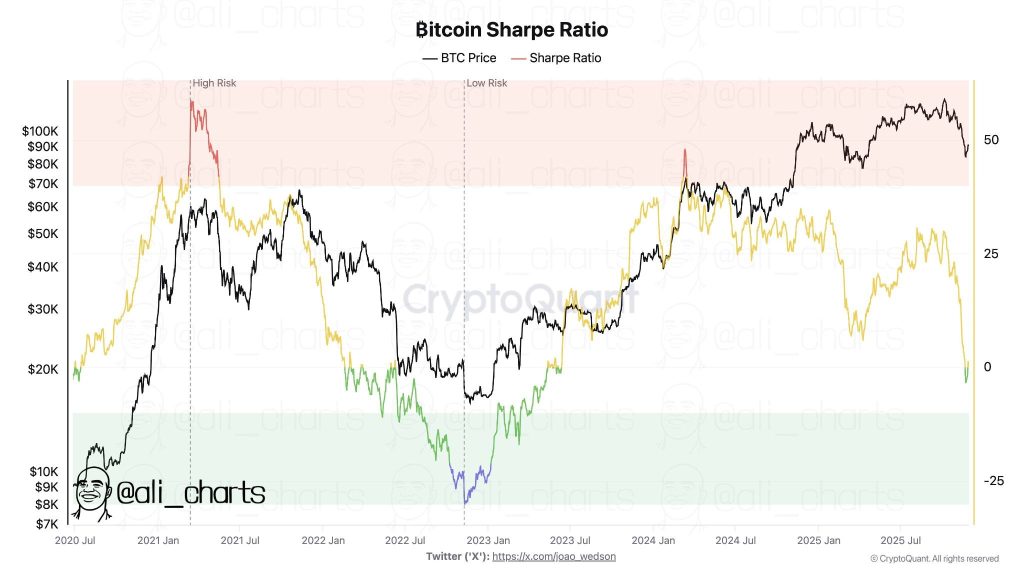

- •Bitcoin's Sharpe Ratio indicates lower market volatility and reduced risk.

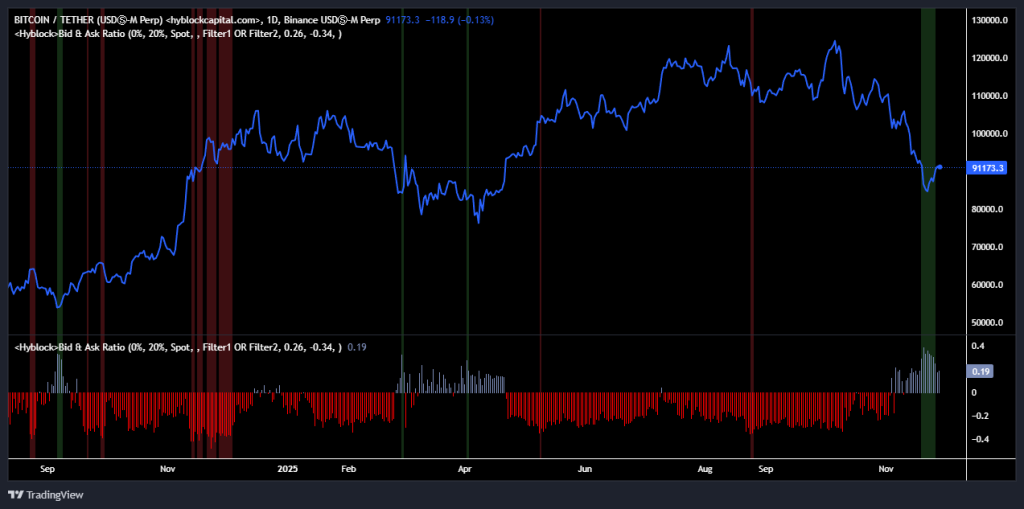

- •A decline in the Bid-Ask Ratio suggests weakening demand near current price levels.

- •The Coinbase premium flipping positive signals bullish short-term sentiment.

Sharpe Ratio Signals Lower-Risk Environment for Bitcoin

The Sharpe Ratio, a crucial measure of risk-adjusted returns, is currently signaling a lower-risk environment for Bitcoin. This ratio has been steadily declining since early 2023, which suggests reduced volatility in the market. This trend is important because it indicates less risk for investors who wish to accumulate Bitcoin during price dips. As the Sharpe Ratio approaches its lowest point in months, it signifies a more stable market, creating favorable conditions for those looking to buy without significant exposure to risk.

Demand Weakens as Bid-Ask Ratio Declines

In conjunction with the Sharpe Ratio, Bitcoin's Bid-Ask Ratio is also showing signs of weakening demand. Currently, the Bid-Ask Ratio stands at 0.19, which indicates that demand near Bitcoin's current spot price is declining. This decline suggests that the "easy buy-ins" at current levels may be over, and the market could be moving into more challenging buying conditions. As the ratio decreases, supply becomes more dominant, signaling the potential for consolidation or a market correction.

Coinbase Premium Index Flips Bullish

Furthermore, the Coinbase Bitcoin Premium Index has flipped green, signaling increased demand on Coinbase. The premium rate is now at 0.10%, indicating that buyers are willing to pay more for Bitcoin on Coinbase. This suggests a bullish signal for short-term market sentiment.

Key Liquidity Zones Identified

Bitcoin recently tested liquidity at $93,000, with significant trading activity observed. The next key liquidity zone is located at $90,000, where a large cluster of buy orders could provide support. This zone may be instrumental in determining whether Bitcoin will experience a reversal or continue to consolidate at lower levels.