Key Points

- •Brazil is examining the taxation of international cryptocurrency and stablecoin payments.

- •Proposed reforms could introduce a 17.5% tax rate on digital assets.

- •The crypto community has expressed significant concern over potential investor flight due to these changes.

Proposed Tax Reforms and Industry Reaction

Brazil's Ministry of Finance is actively considering the inclusion of international cryptocurrency and stablecoin payments within the scope of the Financial Transaction Tax (IOF). This initiative aims to address existing loopholes in foreign exchange transactions. Officials are working to close taxation gaps that affect cross-border payments involving digital assets.

Currently, cryptocurrency transactions are exempt from the IOF. However, under the proposed reforms, they may soon be subject to a unified tax rate of 17.5%. This potential change could significantly alter the landscape for stablecoins, particularly those used in cross-border transfers, leading to increased costs for both investors and companies operating within the digital asset space.

"Increased income tax and financial operations tax on stablecoins generates a backlash in the crypto sector and could drive away investors... The cryptoasset sector reacted negatively to the possibility of applying a standardized 17.5% tax rate to cryptocurrency transactions and the creation of a Financial Transactions Tax (IOF) on stablecoins, proposals currently being discussed by the federal government."

Potential Impact on Exchanges and Investor Behavior

The proposed regulatory changes have raised concerns within the industry that Brazilian exchanges might be compelled to seek more competitive international markets. Historical patterns suggest that such regulatory shifts can lead to greater engagement with decentralized finance (DeFi) solutions as users attempt to bypass traditional regulatory frameworks.

Insights from Coincu research indicate that these regulatory adjustments could indeed drive Brazilian exchanges to explore international markets offering more favorable conditions. The crypto community has voiced apprehension about the potential for capital flight and an overall increased tax burden, which could negatively impact investor behavior and the clarity of regulations for digital asset transactions within Brazil.

Market Context and Bitcoin Performance

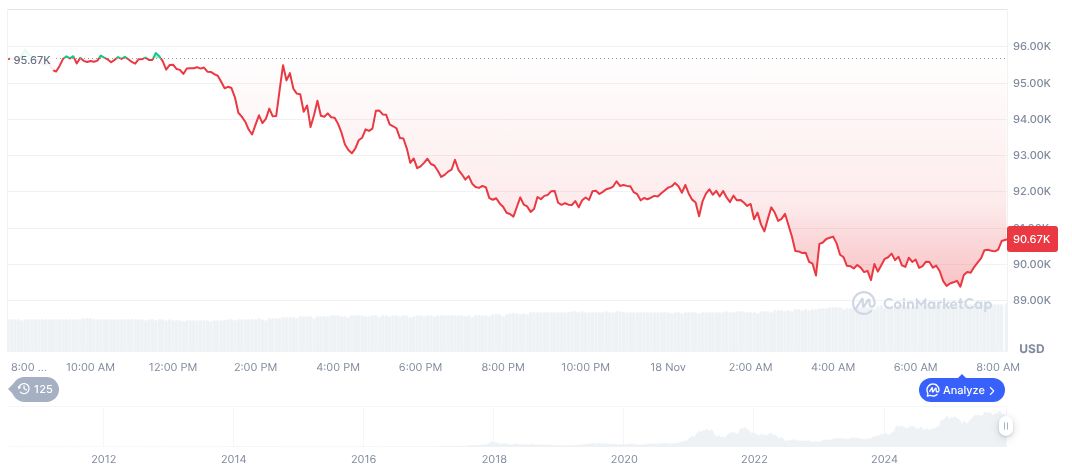

As of November 18, 2025, Bitcoin (BTC) continues to hold a dominant position in the cryptocurrency market. It boasts a market capitalization of $1.82 trillion and a circulating supply of approximately 19.95 million BTC, according to data from CoinMarketCap. Recent market performance shows a 4.29% decrease in its 24-hour price, highlighting the inherent volatility of the cryptocurrency market.