Market Dynamics and Price Action

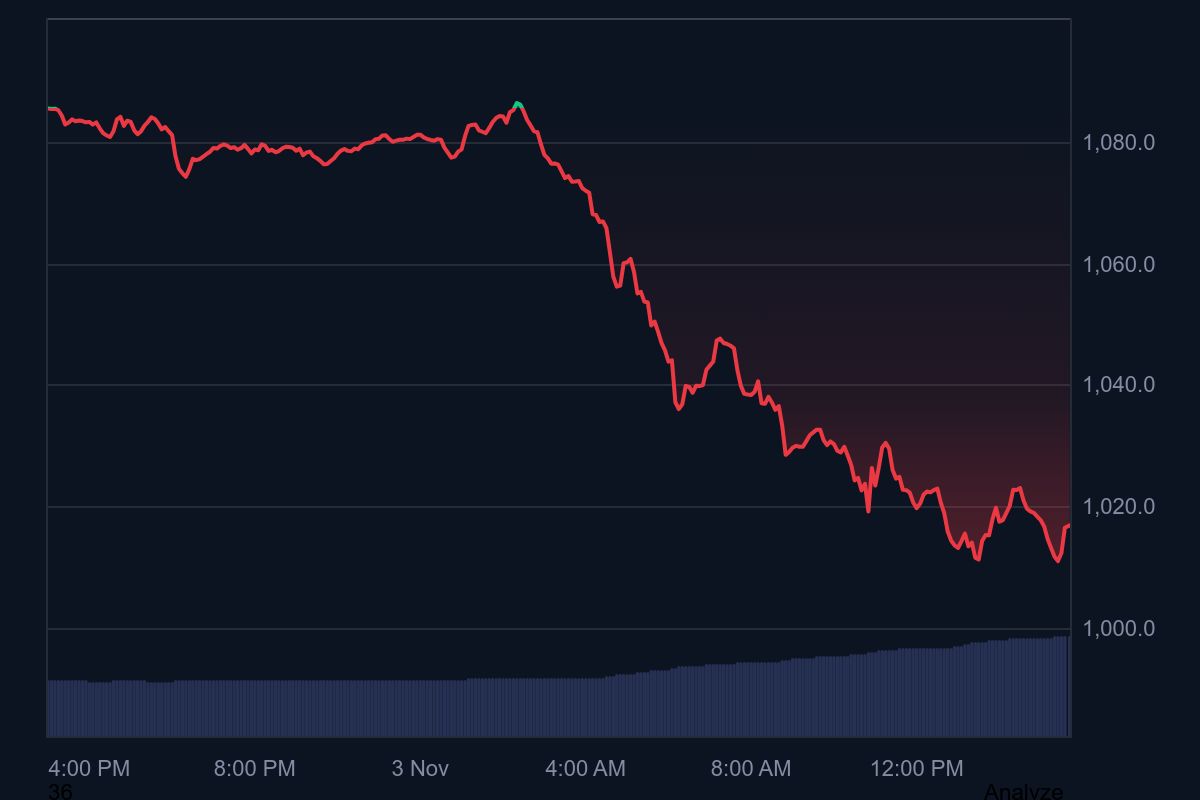

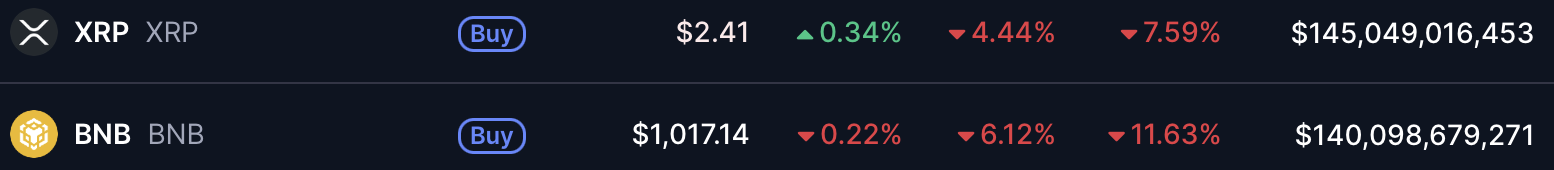

BNB (Binance Coin) experienced a decline of 6.09% over the past 24 hours, trading at $1,017 at the time of writing. This downturn extends its short-term downtrend as traders redirect their focus towards XRP and broader altcoin rotations reshape market flows. Despite this recent dip, analysts suggest that ongoing institutional accumulation and the continuous growth of the BNB Chain ecosystem provide a strong foundation for long-term investor confidence.

Shift in Focus to XRP

The recent sell-off in BNB follows a significant 11% surge in XRP on November 2, which temporarily elevated XRP's market capitalization above BNB's for the first time in several weeks. Data from CoinMarketCap indicates that this shift in market ranking, driven by capital rotation, led to profit-taking activities among short-term traders who closely monitor asset rankings for speculative opportunities. Consequently, BNB's market capitalization decreased to $140.1 billion, while its trading volume saw a substantial increase of nearly 79%, reaching $3.53 billion as traders exited their positions.

Technical Indicators and Support Levels

From a technical analysis standpoint, BNB's recent drop below its 7-day and 30-day Simple Moving Averages (SMAs) has confirmed a short-term bearish sentiment in the market. Analysts have identified the 23.6% Fibonacci retracement level at $1,274 as a key resistance point, while the 78.6% retracement level, situated near $1,049, is now acting as a crucial support zone.

BNB has briefly tested the $1,010 price range, a critical juncture where further downward movement could occur if the asset fails to reclaim the 7-day SMA, currently positioned at $1,107. Market observers note that the market is exhibiting signs of fatigue after multiple attempts to surpass the $1,100 resistance level. The upcoming trading sessions will be pivotal in determining whether buyers can successfully regain upward momentum.

Sustained Institutional Interest

Notwithstanding the current technical weakness, institutional investors have been steadily increasing their accumulation of BNB. A growing number of hedge funds and corporate entities, including several publicly traded firms on the Nasdaq, have expanded their exposure to BNB. This trend is often compared to MicroStrategy's strategy with Bitcoin, where BNB is viewed as a high-beta digital asset closely linked to the growth of blockchain infrastructure.

Furthermore, market participants are closely monitoring the progress of a pending BNB Exchange-Traded Fund (ETF) filing by VanEck. Should this ETF receive approval, it is anticipated to attract significant institutional inflows into the asset. A fund strategist commented that BNB stands out as one of the few non-stablecoin cryptocurrencies possessing sufficient network demand and liquidity depth to support ETF-level investment products.

Ecosystem Development and Partnerships

The development ecosystem of the BNB Chain continues to demonstrate resilience. Recent strategic partnerships, such as the collaboration with Better Payment Network (BPN), are designed to expand decentralized payment solutions and enhance real-world utility. However, analysts caution that while these developments strengthen the underlying fundamentals of the network, they have not yet had a significant impact on short-term price movements, which remain influenced by broader market volatility.

Price Outlook and Analyst Projections

Current market sentiment, as measured by Changelly’s Fear & Greed Index, is neutral. Analysts from Coinpedia and LiteFinance have provided forecasts for potential recovery zones for BNB in November. Coinpedia’s outlook suggests an average price of around $1,350 for BNB in November, with the possibility of reaching $1,620 if buying momentum intensifies.

In the immediate term, traders are focused on whether BNB can maintain its hold above the crucial $1,000 psychological level amidst ongoing competitive sector rotations. Despite short-term price pressures driven by volatility, the mid-term outlook for BNB remains constructive, supported by expanding institutional participation and deepening network utility.