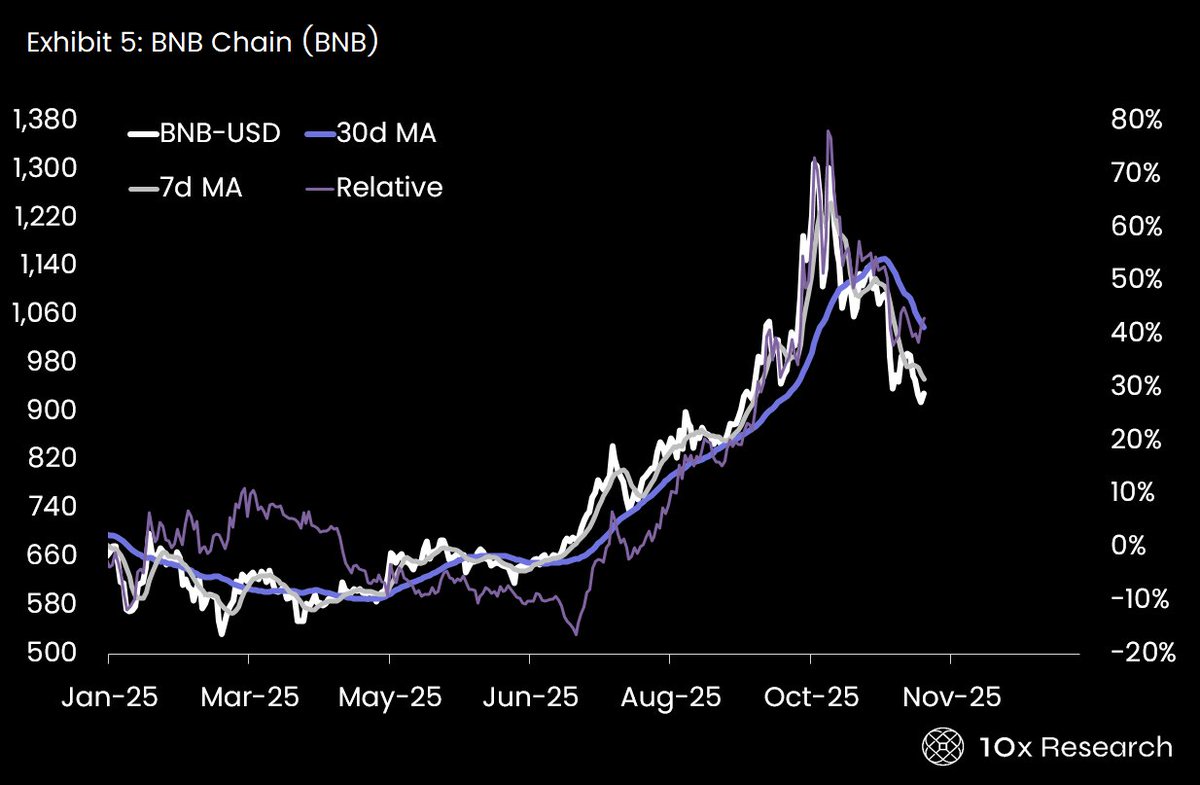

BNB is showing mounting weakness this week, with the token sliding beneath critical moving averages and lagging behind the broader crypto market. Fresh analysis from 10x Research and TradingView charts indicates that technical breakdowns, ecosystem changes, and shifting on-chain behavior are all weighing on short-term sentiment, despite upcoming upgrades that could strengthen BNB Chain over the medium term.

Developers’ Migration Triggered Short-Term Repositioning

BNB fell -6.1% over the past week, dropping below both its 7-day and 30-day moving averages—a combination that suggests sustained bearish momentum. According to 10x Research, the decline intensified after developers announced a mandatory migration for legacy multi-signature wallets on BNB Chain.

This infrastructure update prompted some users and institutions to temporarily reposition their assets, adding further selling pressure at a moment when BNB was already showing signs of technical fatigue.

BNB Underperforms the Crypto Market

On-chain indicators reveal that BNB’s performance has trailed the broader market over the past week. While large-cap assets like ETH and SOL have shown modest recovery attempts, BNB’s price action has remained comparatively muted.

This underperformance indicates a more cautious stance among BNB holders, especially as macro uncertainty and declining liquidity continue to pressure altcoins across the board.

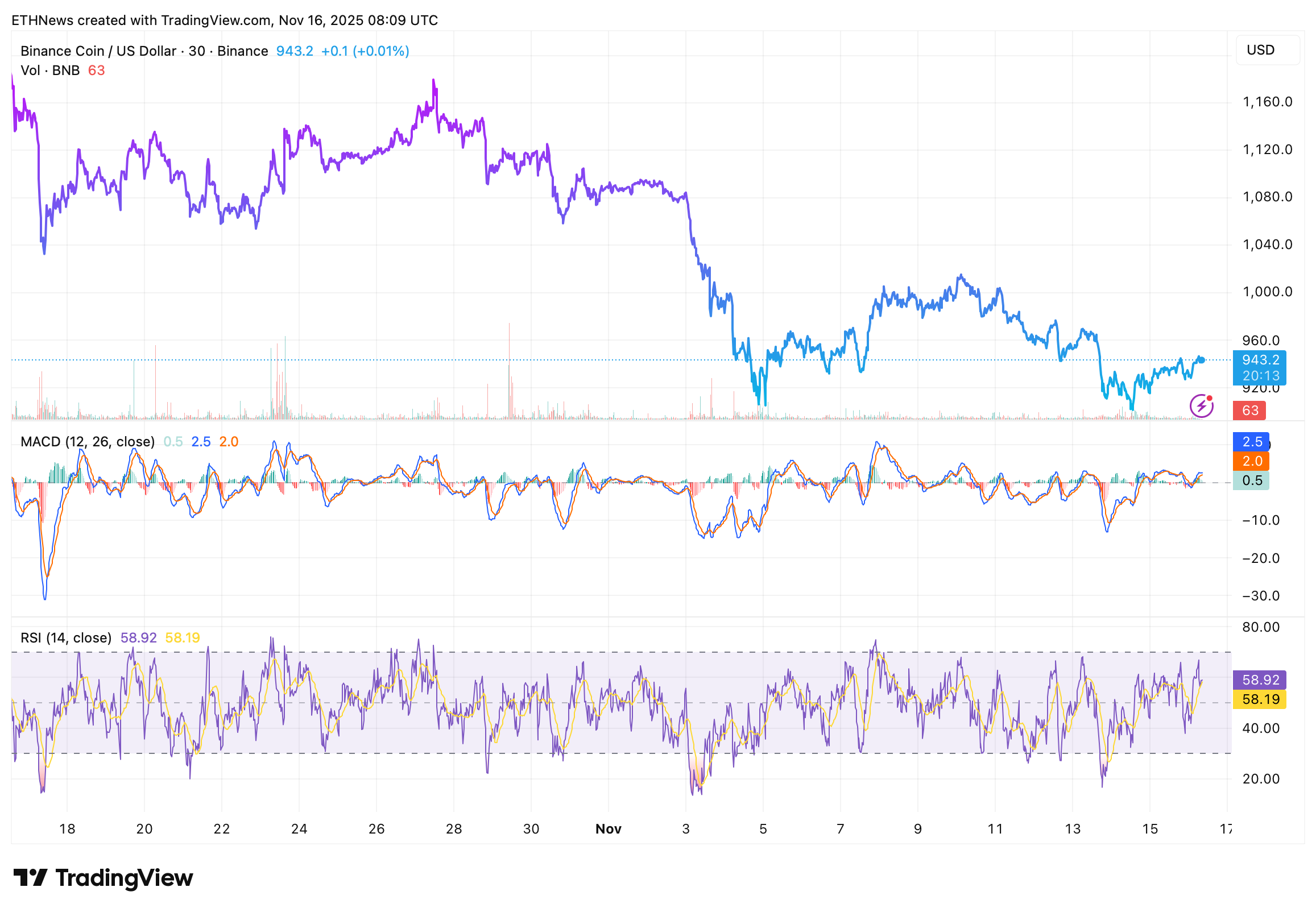

Technical Indicators Show Limited Momentum

Price Action:

- •BNB trades near $940, well off its early-November highs near $1,160.

- •The downtrend remains intact despite minor bounce attempts.

MACD:

- •Momentum oscillates around flat levels, showing no clear bullish crossover.

- •Recent histogram bars remain mixed, reflecting low conviction from buyers.

RSI:

- •The RSI fluctuates near 58, showing mild recovery but no breakout strength.

- •The indicator has spent most of the month in a sideways channel, echoing consolidation rather than reversal.

Volume:

- •Trading volume is extremely light, highlighting a lack of buyer urgency.

- •Only brief spikes during sell-offs suggest reactive, not proactive, trading behavior.

Medium-Term Tailwinds Still Exist, but Bulls Need Confirmation

Despite the recent weakness, BNB Chain’s upcoming “Yellow Season” upgrades continue to offer medium-term positives. These include:

- •AI agent integration,

- •Execution improvements, and

- •Gas-limit expansion plans.

These enhancements aim to position BNB Chain as a more efficient environment for high-volume applications and autonomous on-chain systems. However, price action has yet to reflect these potential catalysts.

Short-Term Outlook: Eyes on Key Support Levels

BNB’s next directional move hinges on whether bulls can stabilize price above the $920–$950 support region. Losing this area could expose a deeper decline toward the sub-$900 range, where stronger liquidity historically emerges.

To regain momentum, BNB would need to:

- •Reclaim the 30-day MA,

- •Show improving relative strength against the broader market, and

- •Attract renewed user flows following the multisig migration.

For now, BNB remains firmly in a corrective phase, with cautious sentiment and thinning liquidity keeping upward pressure limited. Traders will be watching closely to see if upcoming ecosystem upgrades can shift the narrative, or if further downside is still ahead.