A well-known commodity strategist at Bloomberg Intelligence has indicated a possibility of Bitcoin experiencing a substantial collapse, potentially falling 45% from its current position to its yearly pivot point.

Despite a recent bounce over the past week, the Bitcoin (BTC) market continues to exhibit signs of stress over a longer timeframe. The price has seen an approximate 9% climb in the last 7 days, trading around $92,400. However, it is still on track for a significant drop in November.

With the month currently showing a decline of roughly 15%, Bitcoin remains on a trajectory for its largest monthly loss since February 2025, unless buyers can establish stronger control soon.

Bitcoin Risks Dropping to $50,000

Mike McGlone, Bloomberg Intelligence senior commodity strategist, has cautioned that Bitcoin still faces the risk of sliding back towards its yearly pivot level, which is near $50,000.

McGlone shared this analysis in a post on X, accompanied by a chart tracking Bitcoin’s yearly performance from 2014 to 2025. The chart also includes data for the S&P 500 Index and its 120-day volatility. The data presented suggests that Bitcoin has a tendency to gravitate back towards the $50,000 mark, a level that has served as a significant midpoint for the market since 2021.

Bitcoin first surpassed the $50,000 level in March 2021 and has since shown a pattern of moving towards or away from this price point. Although it is currently trading approximately 84% higher than this level, historical behavior indicates that the leading cryptocurrency frequently returns to this central pivot during periods of global market tightening.

The chart further illustrates the close correlation between Bitcoin's price movements and the S&P 500. At the time of the analysis, the volatility reading was near 11%, representing one of the lowest year-end levels observed since 2017.

According to McGlone, this unusually low volatility could signal increasing pressure. Historically, when equity volatility drops to such low levels, markets often prepare for sharp movements. He believes that Bitcoin might react by drifting back towards the $50,000 level, a price point last seen in August 2024.

To provide perspective, a decline to $50,000 would represent a 45.8% drop from the current price. The last time BTC experienced a crash of this magnitude was between April and June 2022, when it fell by over 70% within a three-month period, exacerbated by the contagion from the Terra implosion.

Analysts Eyeing a Full Bitcoin Recovery

While McGlone has raised concerns about potential downside, several other analysts foresee a possibility of a full recovery if buyers can successfully break through key resistance levels. For instance, Michaël van de Poppe suggests that Bitcoin needs to surpass the $91,000 to $94,000 zone to shift momentum in an upward direction. If this area is cleared, he anticipates the market could move towards $100,000 and potentially higher.

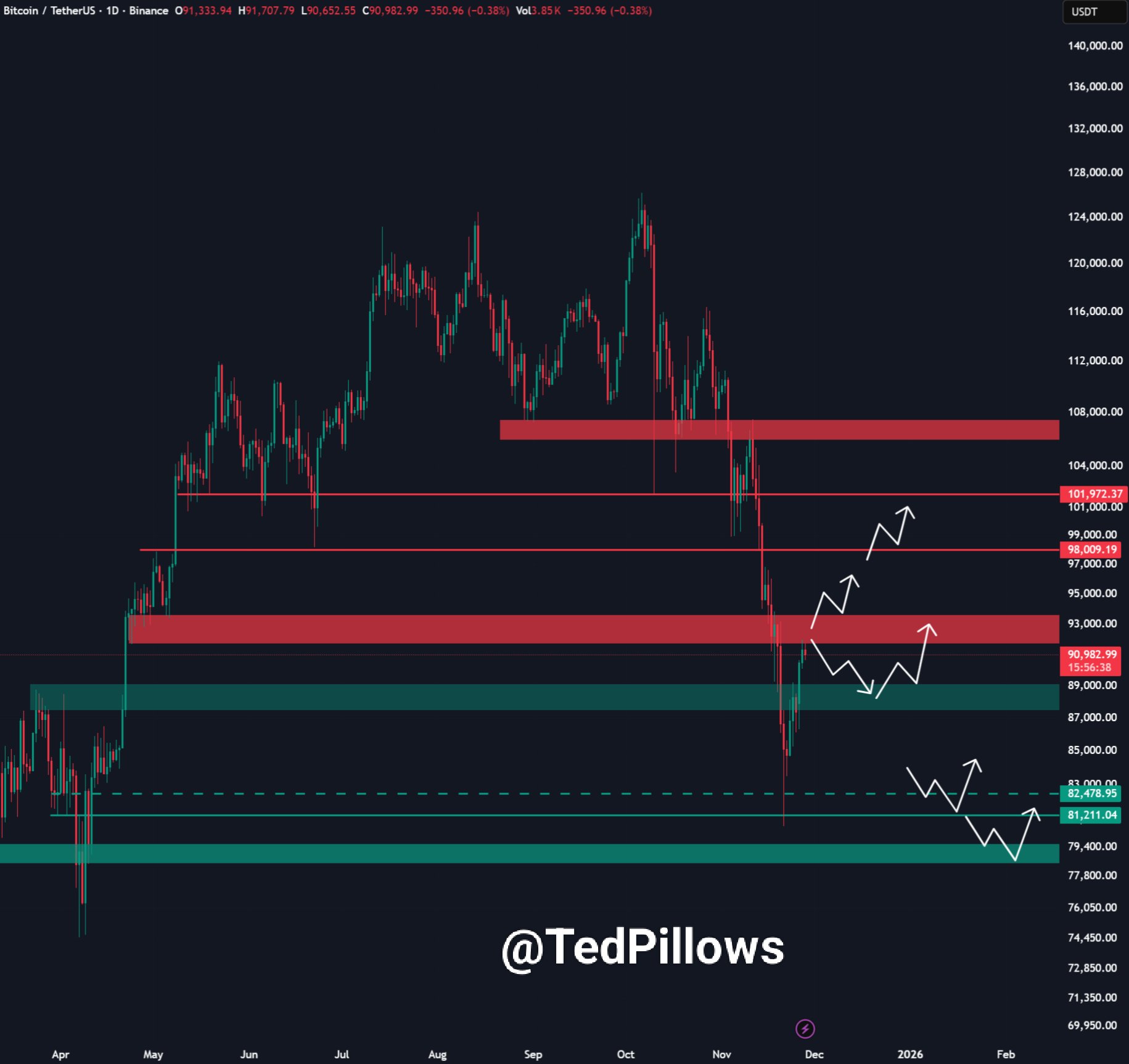

Analyst Ted Pillows presented a similar analysis, focusing on the resistance level between $92,000 and $93,000. He stated that Bitcoin must reclaim this region for buyers to target a run towards $98,000 to $100,000. Conversely, if the market fails to break through this resistance, he believes a drop back towards the $88,000 level could occur.

In the meantime, market analyst Killa noted that despite Bitcoin's 15% climb from recent lows within a mere 7 days, it has not yet formed a clear higher low. According to his assessment, Bitcoin is now approaching major resistance while trading on declining volume.

He elaborated that strong downtrends often reject the initial attempt to reclaim a major level, typically leading to a price pullback to retest demand zones before a true reversal can form. The analyst posits that BTC would likely rise from $80,000 to $92,000, then drop to $88,000, before recovering towards $96,000, rather than surging directly from $80,000 to $96,000.