BlockDAG: Leadership Transparency and Tangible Progress

The market continues to debate the SUI price outlook and the Chainlink (LINK) price outlook, yet one truth is clear: real growth begins with real trust. In the search for top crypto picks, leadership transparency and tangible progress are now the ultimate benchmarks. In an industry often masked by anonymity, one question dominates investor discussions: Who is behind BlockDAG?

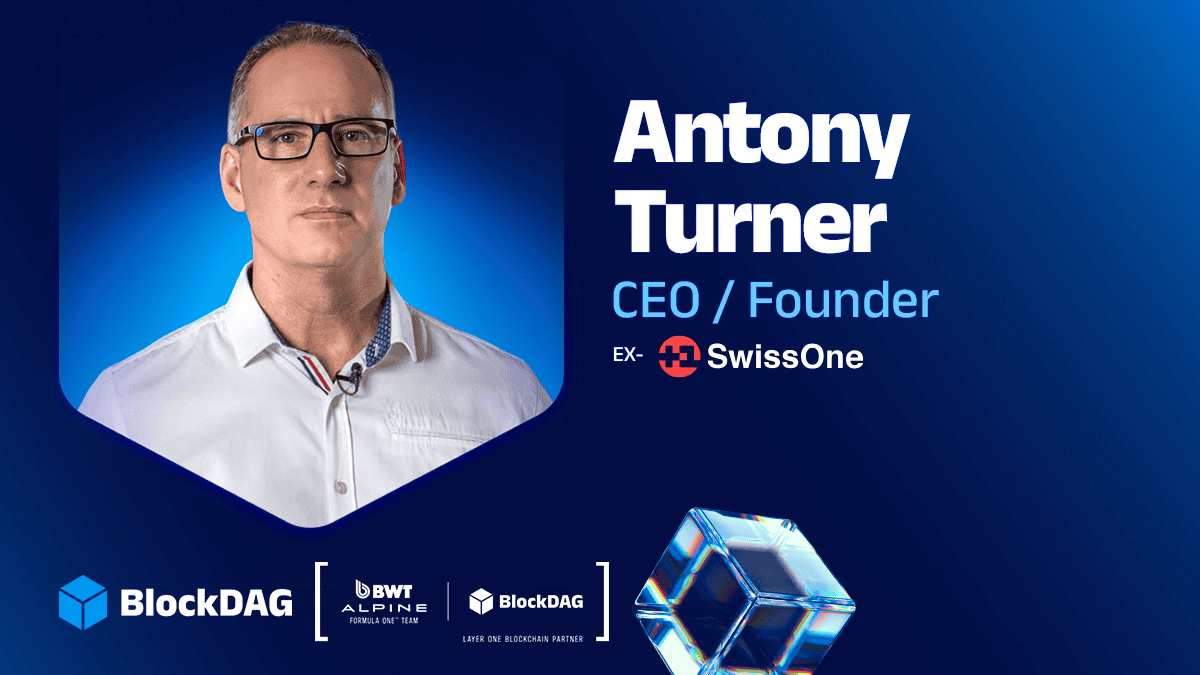

BlockDAG (BDAG) has given that answer plainly. Its CEO, Antony Turner, leads the project publicly, placing his own name and reputation at the forefront. This visible accountability is reinforced by the sale of 20,000 X-series miners worldwide, showing that the project’s foundation is not theoretical but fully operational. The network’s flagship X100 rig, which mines up to 2,000 BDAG daily, highlights the blend of technology and transparency driving BlockDAG’s ambition for a 1000x return potential.

How Transparency & Technology Power BlockDAG’s 1000x Vision

BlockDAG’s extraordinary rise within the crypto landscape is no accident; it’s the product of a transparency-first philosophy that few projects can match. Under the leadership of CEO Antony Turner, the company has redefined what accountability means in blockchain development, transforming open communication and public visibility into a powerful force of investor confidence.

This trust has directly translated into results: over 20,000 miners sold, 312,000+ holders worldwide, and a presale that has already amassed over $435 million in funding, making BlockDAG one of the most successful crypto launches in history.

Yet the project’s success is not measured by numbers alone. BlockDAG’s presale model is carefully structured for sustainable long-term growth, with Batch 32 priced at $0.005 and a confirmed launch price of $0.05 set for February 10, 2026, and a clear roadmap designed to deliver predictable ROI for early participants. With 4.56 billion coins still available and a hybrid ecosystem combining Proof-of-Work security with DAG scalability, BlockDAG is building the kind of technical and economic framework most projects only achieve post-mainnet.

At the heart of this ecosystem lies the X-series miners, especially the X100 rig, which powers a decentralized mining economy. Each device not only mines BDAG daily, generating passive income, but also strengthens the network’s core security. This fusion of hardware utility, verifiable leadership, and cutting-edge scalability positions BlockDAG as a project with genuine 1000x potential, engineered for both trust and long-term growth.

SUI Price Outlook: On-Chain Growth Reflects Expanding Demand

The SUI price outlook remains supported by strong network fundamentals. The Layer-1 blockchain’s Total Value Locked (TVL) has surged to an all-time high of $2.6 billion, backed by record DEX trading volume of $20.33 billion in October 2025. Analysts note this growth stems from organic demand, reinforcing confidence in SUI’s technology.

Adding to its progress, the value of stablecoins circulating on SUI has climbed to $1.15 billion, proving increasing adoption in real-world utility. On the technical chart, SUI is consolidating between $2.50 and $2.71, forming a symmetrical triangle, a classic setup before a major breakout.

A push above the $3.60 resistance could unlock a sharp rally, potentially driving prices toward $9.00. With these indicators aligning, the SUI price outlook continues to project bullish potential based on its expanding use case and network activity.

Chainlink (LINK) Price Outlook: Institutional Interest Strengthens Position

A bullish Chainlink (LINK) price outlook is taking shape as institutional adoption intensifies. As the leading oracle provider for tokenized finance, Chainlink’s relevance grows daily. In October 2025, the Chainlink Foundation repurchased over 63,481 LINK, signaling confidence in long-term value. Meanwhile, a decreasing Exchange Supply Ratio shows accumulation by long-term holders.

Technically, LINK’s price sits between $17.95 and $18.50, a range analysts call an “accumulation zone.” Its 30-day MVRV ratio entering negative territory supports this stance, indicating the token could be undervalued. Additionally, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) continues to expand, recently integrating with S&P Global for real-time on-chain data validation.

If LINK breaks through the $25 resistance, analysts forecast a rapid climb toward $46, confirming a robust, long-term bullish scenario. With its growing enterprise utility, the Chainlink (LINK) price outlook remains a key watch point for traders tracking institutional blockchain integration.

The New Trust Benchmark in Crypto Growth

While the SUI price outlook highlights steady network expansion and the Chainlink (LINK) price outlook signals institutional strength, neither offers the full package of transparency, infrastructure, and leadership accountability that BlockDAG delivers.

Under Antony Turner’s direction, BlockDAG has turned credibility into capital, raising over $435 million while building a functional mining economy. The 20,000 X-series miners already distributed worldwide, led by the X100 rig mining 2,000 BDAG daily, prove that this project’s foundation is real.

In a market crowded with speculation, BlockDAG represents the next phase of crypto maturity: a system where verifiable leadership meets scalable technology. This combination of transparency, performance, and tangible results positions BlockDAG as one of the most authentic top crypto picks in today’s market, embodying the balance of trust and innovation required for true 1000x potential.