Securitize to Become Public Company Valued at $1.25 Billion

Securitize Inc. has entered into a merger agreement with Cantor Equity Partners II Inc., a special purpose acquisition company affiliated with Cantor Fitzgerald. This agreement is set to make Securitize a publicly traded company with an estimated valuation of $1.25 billion before the merger is completed. The move strategically positions Securitize within the burgeoning $19 trillion market for tokenizing real-world assets, representing a significant advancement for blockchain-based financial services.

The consolidated entity will operate under the name Securitize Corp. Its shares are slated to be listed on the Nasdaq stock exchange, trading under the ticker symbol SECZ. This transaction serves to bridge the gap between blockchain-enabled finance and traditional financial markets, thereby expanding accessibility to regulated digital currency products.

Following the merger's closing, Securitize plans to tokenize its own equity. This initiative marks a pioneering effort within the industry, aiming to showcase a novel method for issuing and trading shares of publicly listed companies on a blockchain.

Institutional Backing Fuels $469 Million Deal

The merger is supported by substantial investments from major financial institutions. Key investors, including BlackRock, ARK Invest, Blockchain Capital, Hamilton Lane, Jump Crypto, Morgan Stanley Investment Management, and Tradeweb Markets, have committed to rolling over their entire equity holdings into the new company.

The transaction is projected to generate approximately $469 million in total proceeds. This amount comprises $225 million from a fully committed PIPE (Private Investment in Public Equity) funded by investors such as Arche, Borderless Capital, Hanwha Investment & Securities, InterVest, and ParaFi Capital. An additional $244 million is anticipated to come from Cantor Equity Partners II’s trust account, contingent upon the level of investor redemptions.

Securitize has developed a robust and adaptable platform for the issuance and lifecycle management of digital assets. This platform leverages blockchain technology to connect issuers and investors while ensuring regulatory compliance. It integrates with 15 leading blockchains and interacts with decentralized finance (DeFi) protocols, stablecoins, and custodians to facilitate asset issuance and secondary market trading.

The company possesses a comprehensive suite of U.S. regulatory licenses. It is registered with the Securities and Exchange Commission (SEC) as a transfer agent, broker-dealer, alternative trading system, investment advisor, and fund administrator.

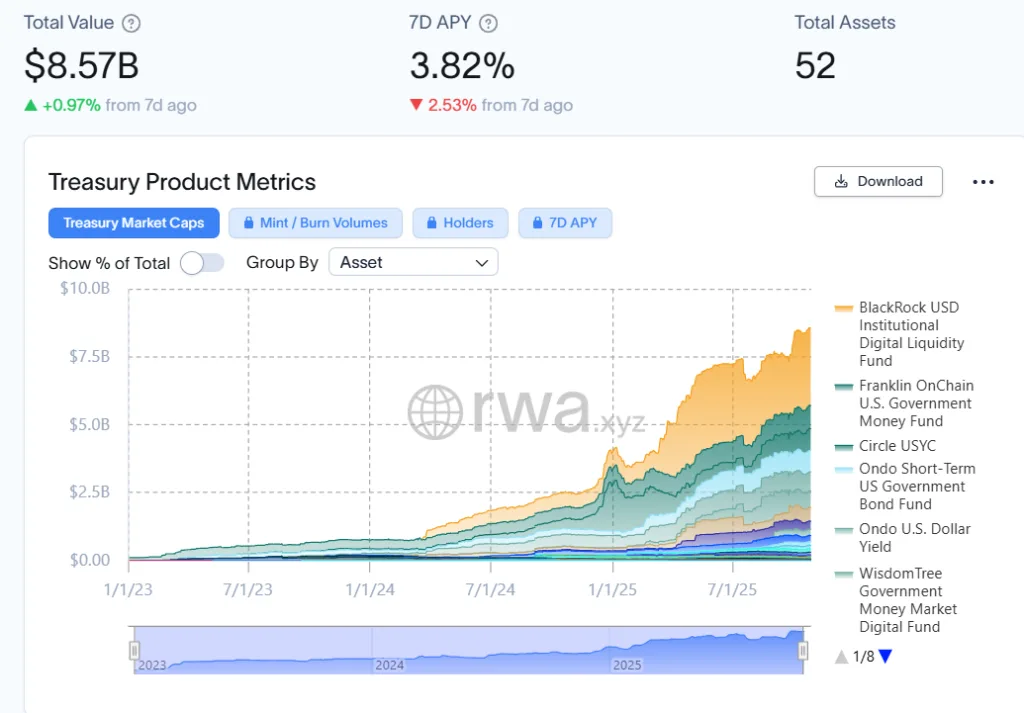

The market for tokenized real-world assets has experienced rapid expansion over the past year. Tokenized U.S. Treasurys alone have reached a combined value of $8.57 billion, reflecting a growth of over 200%, according to data from RWA.xyz. The broader tokenization market is currently valued at nearly $35 billion, having grown by 135% during the same period.

Citi analysts forecast that tokenized markets and assets could approach a value of nearly $4 trillion by 2030. The increasing institutional interest in blockchain investments bodes well for companies like Securitize.

Securitize Strengthens Growth Plans Ahead of Public Debut

Securitize intends to utilize the proceeds from the merger to enhance its balance sheet and support its growth initiatives. The firm plans to expand its platform capabilities, drive institutional adoption, and develop new financial products. Importantly, no current shareholders will be selling their stock or receiving cash in this transaction; it is structured to maintain ownership for long-term value creation.

The merger has received approval from the boards of directors of both companies and is anticipated to be finalized in the first half of 2026, pending regulatory approvals. Upon completion, this transaction will establish Securitize as one of the more prominent publicly traded companies in the digital asset sector.

This development follows a recent trend of cryptocurrency-related companies pursuing public offerings. Circle, for instance, became publicly listed on the New York Stock Exchange earlier this year, raising $1.1 billion. Cryptocurrency exchanges Gemini and Bullish have also made their public market entries this year. These listings signify a growing acceptance of blockchain infrastructure within traditional finance.

Securitize has secured strategic partnerships with leading asset managers, reinforcing its market leadership. In 2024, BlackRock launched its USD Institutional Digital Liquidity Fund, known as BUIDL, on the Ethereum network, collaborating with Securitize. This fund allows eligible investors to hold tokenized U.S. Treasurys and earn yield on-chain.

In collaboration with firms such as Apollo, Hamilton Lane, KKR, and VanEck BlackRock, Securitize has successfully tokenized over $4 billion in assets. These relationships highlight the firm's strong position to assist institutions in tokenizing traditional financial products on blockchain networks.