BlackRock may have delivered another blow to cryptocurrency bulls, dampening recovery hopes. The company has reportedly executed another tranche of selloffs for both its Bitcoin and Ethereum ETFs.

BlackRock reportedly sold 6,735 BTC worth over $616 million in the last 24 hours. This selloff has raised concerns of more downside risk, even after its recent sharp decline.

In a Bitcoin news update, the company reportedly channeled the recent outflows into Coinbase Prime. BlackRock was among the ETFs aggressively accumulating BTC through its fund a few months ago.

While its demand previously aided the bulls, this latest wave of selloffs may put further downward pressure on Bitcoin and Ethereum.

Although BlackRock sold a substantial amount of BTC, it represented only about 0.85% of the company’s total holdings, which were over 788,000 BTC. In other words, BlackRock maintained supremacy in terms of BTC holdings.

Nevertheless, BlackRock's outflows represented the latest wave of bearish Bitcoin news and reflected the current state of the market, characterized by crushed demand.

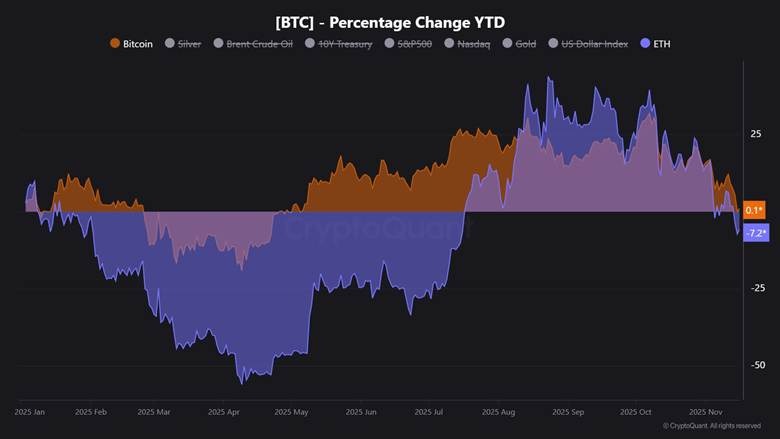

Bitcoin (BTC USD) Chart Erases its 12-Month Gains

If you had bought Bitcoin approximately 12 months ago, your holdings would be worth roughly the same today. This is despite the fact that Bitcoin experienced new all-time highs earlier this year.

Bitcoin’s 12-month chart was down by almost 2% in the last 24 hours, attributed to its sharp retracement in the past 7 days. Ethereum's price was down by over 7% during the same timeframe.

The chart above revealed that Bitcoin's price at press time was further away from its all-time high than it was at its lowest point in the last 12 months.

This also underscored the rapid pace of sell pressure that has taken place, considering that it achieved its all-time high less than two months ago.

This latest downside also validated the long-term holder outflows observed over the past few months.

Those outflows, combined with increasing sell pressure from entities like BlackRock, paint a clear picture of the intense sell pressure in the market.

Moreover, BTC price recently dipped into oversold territory, and demand has been largely non-existent.

The last time Bitcoin price dipped below its 12-month breakeven price level, it hovered below that point for a period.

Surprisingly, BTC demand remained relatively weak, contrary to expectations. This outcome is mostly synonymous with Bitcoin price characteristics observed during a bear market.

Retail Panic Selling Perpetuates the Bitcoin Bear Reign

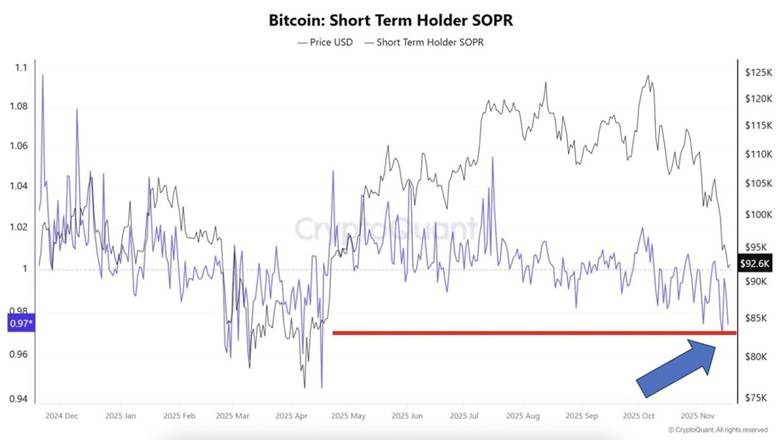

The Bitcoin short-term holder SOPR indicator confirmed that short-term holders have been aggressively offloading their coins.

Furthermore, the indicator recently dropped to 0.97%, meaning most short-term holders have been selling at a loss.

The last time this same ratio was below 1% was between February and May. In short, the latest bearish wave has been shaking out weak hands from the market.

A short-term holder ratio below 11 historically signals that the bottom of the trend may be nearby. In this case, BTC price may be facing sell pressure, but it could be nearing a local bottom.

Weak or absent demand at recent levels suggests a high probability that Bitcoin could extend its downside below $90,000.

Such an outcome would push the cryptocurrency deeper into oversold territory, where investors should be on the lookout for demand resurgence.