Key Developments in XRP ETF Filing

Bitwise has updated its XRP ETF application for the fourth time with the Securities and Exchange Commission (SEC), incorporating details pertaining to the NYSE and establishing a management fee of 0.34%. This strategic amendment is viewed as a crucial step forward, potentially paving the way for SEC approval of the exchange-traded fund.

The ongoing SEC review process is anticipated to significantly influence XRP's market dynamics and its price trajectory. Investor sentiment and market behavior are expected to react to the regulatory decisions surrounding the XRP ETF.

XRP's Market Performance and ETF Impact

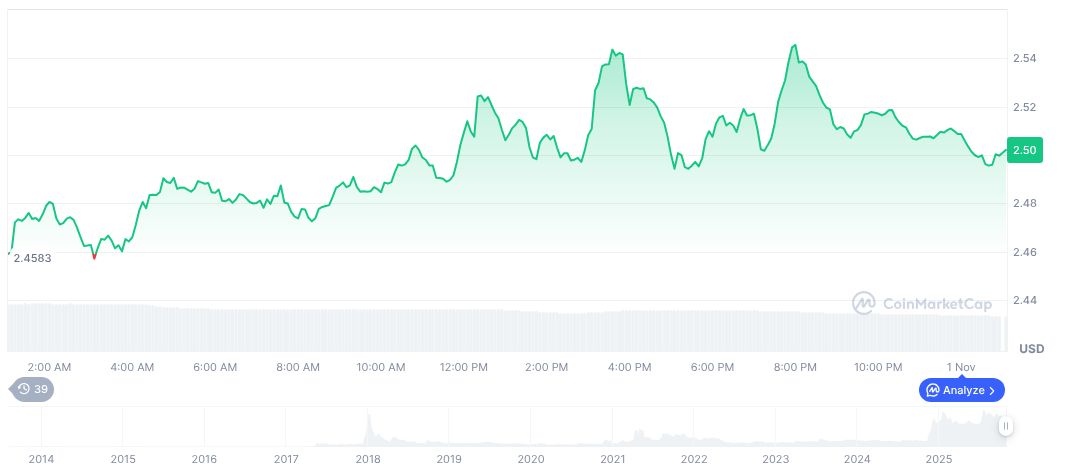

Currently, XRP is trading at $2.50, marking a 0.71% decrease over the last 24 hours. Its market capitalization stands at $150,523,696,450, representing 4.05% of the overall market share. Recent performance indicates a volatile trend, with losses of -17.35% over the past 30 days and -13.55% over the last 90 days. This volatility is occurring amidst the significant developments related to its ETF application.

The potential SEC approval of an XRP ETF could catalyze major shifts in the cryptocurrency market. Analysts suggest that such approval might lead to increased XRP prices and a greater influx of institutional investment. The timeframe for the SEC's review could also result in heightened trading volumes and a notable alteration in general market sentiment.

Bitwise's prior procedural updates for ETFs tracking Solana, Hedera, and Litecoin have established a precedent. These previously launched ETFs experienced substantial first-day funding and significant trading activity, offering a glimpse into the potential market impact that an XRP ETF could generate upon receiving launch clearance.

Market Data and Analysis

XRP's current trading price is $2.50, with a 0.71% decline in the past 24 hours. The cryptocurrency's market cap is $150,523,696,450, constituting 4.05% of the total market. Over the last 30 days, XRP has seen a -17.35% loss, and over 90 days, it has fallen by -13.55%, underscoring its inherent volatility during this period of ETF-related developments.