Key Developments for TAO

- •TAO has experienced a rally of over 50%, breaking through resistance levels and now trading above $530 with significant upward momentum.

- •Technical indicators suggest a bullish trend, highlighted by a bullish engulfing pattern on the monthly chart and a daily breakout above critical price levels.

- •Institutional engagement is on the rise, evidenced by a daily spot trading volume that has reached $1 billion and the recent launch of a TAO Exchange Traded Product (ETP) in Europe.

Bittensor (TAO) has demonstrated robust price performance throughout November, fueled by technical breakouts and increasing institutional interest. On the monthly chart, TAO has formed a bullish engulfing candle, a pattern that typically signals a potential trend reversal. The token's value has increased by 5% this month, trading around $505, after reaching a peak of $539 and a low of $480. Concurrently, daily gains have reached 6.82% as the TAO/USDT pair successfully broke above the $480 mark, transforming this former resistance into new support.

Analyst TedPillows identified the initial breakout occurring near the $354 level, and since his original analysis, TAO has appreciated by more than 50%. This recovery has been further strengthened by confirmation on the daily timeframe, indicating sustained bullish pressure should the current momentum persist. In parallel, the TAO/BTC pair has seen a significant increase of 36.17% this week, reaching 0.004815 BTC, its highest point in almost a year, according to TradingView data. Michaël van de Poppe observed that this breakout follows a period of several months of consolidation, with the uptrend now confirmed above short-term moving averages.

While the current rally suggests an improvement in sentiment across the broader altcoin market, the pace of this growth might moderate if profit-taking activities increase. Nevertheless, the combination of strong technical indicators and renewed trading volume provides potential support for continued short-term upside movement.

Institutional Adoption and Trading Volume Milestones

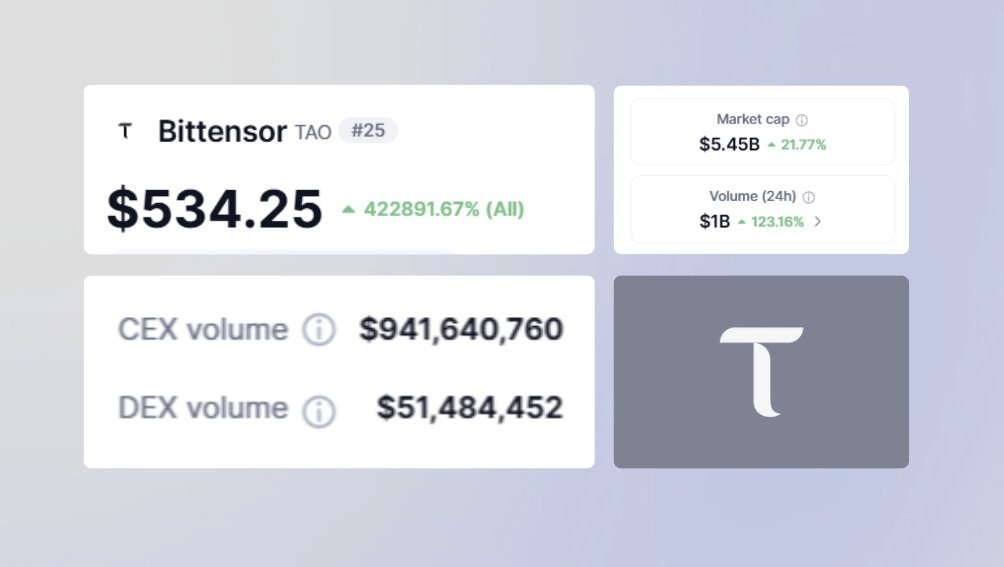

TAO achieved a significant milestone by surpassing $1 billion in daily trading volume for the first time on November 1. Centralized exchanges accounted for over $940 million of this volume, while decentralized platforms contributed $51.5 million, reflecting a substantial increase in demand.

In a notable development for institutional access, Safello and Deutsche Digital Assets introduced Europe's first physically backed TAO ETP, offering a 10% annual yield through staking mechanisms. BitGo is responsible for holding the underlying tokens in cold storage, thereby establishing a compliant pathway for institutional capital to enter the market. Following this launch, spot trading volume surged by 109% to $950 million, and the derivatives open interest increased by 64.8% to $446 million. However, the net flow of tokens decreased from $18 million to $7 million, which may indicate some level of profit-taking subsequent to the ETP listing.

With the network's halving event scheduled for December 10, daily TAO emissions are set to decrease from 7,200 to 3,600 tokens. This reduction in supply is expected to create upward price pressure. Although this model is similar to Bitcoin's halving mechanism, the ultimate impact on TAO's price may vary depending on miner behavior and the sustained growth of demand.