As part of its 2025 federal budget, Canada introduced new stablecoin legislation that mirrors the U.S. GENIUS Act. With $309 billion already locked in stablecoins and a $2 trillion market forecast by 2028, Canada’s timing for regulatory clarity couldn’t be better.

While this regulatory clarity might boost investor confidence across the board, the biggest upside is currently being observed elsewhere in the market.

Investors are now shifting focus to presales, and DeepSnitch AI is leading the charge. With over $500K raised and real AI tools already in testing phases, DeepSnitch AI could potentially outperform even the boldest Bittensor TAO price predictions for 2025.

Canada to Regulate Stablecoins in 2025 Budget

Canada has unveiled new legislation in its 2025 federal budget, aiming to bring fiat-backed digital assets under tighter control. This move closely mirrors the United States’ GENIUS Act and signals growing alignment between major Western economies on cryptocurrency regulation.

Under the new plan, stablecoin issuers will be required to hold sufficient fiat reserves, implement clear redemption policies, and adopt robust risk management frameworks. These requirements will be enforced under the Retail Payment Activities Act, with the Bank of Canada allocating $10 million over two years to oversee compliance.

While a formal timeline for the law has not yet been set, the legislation is part of Canada’s broader push to modernize digital payments and strengthen financial security for its 41.7 million citizens.

The stablecoin market is experiencing significant growth, with its current capitalization exceeding $309 billion and projections pointing towards a $2 trillion market by 2028. Industry leaders such as Western Union and MoneyGram are already integrating stablecoin functionality into their systems, anticipating wider institutional adoption.

In Canada, Tetra Digital is emerging as a frontrunner in the stablecoin sector, having raised $10 million to develop a digital Canadian dollar. Meanwhile, the country has officially shelved plans for a central bank digital currency (CBDC), citing a lack of urgent demand.

Top Altcoins to Watch in 2026: DeepSnitch AI, Bittensor, and Hyperliquid

DeepSnitch AI Surges 42% as Investors Raise $500K Rapidly

The U.S. Federal Reserve’s October 29 rate cut, coupled with fresh rumors that the U.S. government shutdown might soon end, has sent risk appetite soaring. However, this time around, investors are not solely focused on Bitcoin or Ethereum. They are heavily investing in AI tokens, a trend that makes logical sense given the current market dynamics. The AI market is still considered massively undervalued, with projections indicating it could multiply its value by 25 times by 2033.

This trend is precisely why DeepSnitch AI is quickly becoming a prominent topic of discussion. The project is developing an AI-powered platform that many are describing as the essential "picks and shovels" during the current digital gold rush driven by the AI boom. With Gartner estimating $1.5 trillion in global AI spending for 2025, and DeepSnitch AI targeting Telegram's user base of over 1 billion, the potential for upside is substantial.

The most compelling aspect of DeepSnitch AI is its focus on solving real problems that traders frequently encounter. For instance, SnitchFeed acts as a personal trading assistant, scanning terabytes of on-chain data to identify high-reward, low-risk investment opportunities before they become widely known. This ability to generate alpha is valuable in both bull and bear markets, suggesting strong long-term potential.

Having undergone full audits by Coinsult and SolidProof, DeepSnitch AI is already being positioned as a top candidate for 100x returns in the cryptocurrency space. With the token currently priced at just $0.02157, many early investors are anticipating that a $1,000 investment today could grow to $100,000 by the time the project officially launches.

Bittensor TAO Price Prediction 2025: Analysts Remain Bullish Amidst Strong Fundamentals

TAO was trading around $400 on November 5, following a pullback from its peak of $550, but it is currently holding key support levels. The $450 mark has served as short-term support, $420 remains a significant breakout zone, and the 200-day moving average at $370 provides additional strength to the overall upward trend.

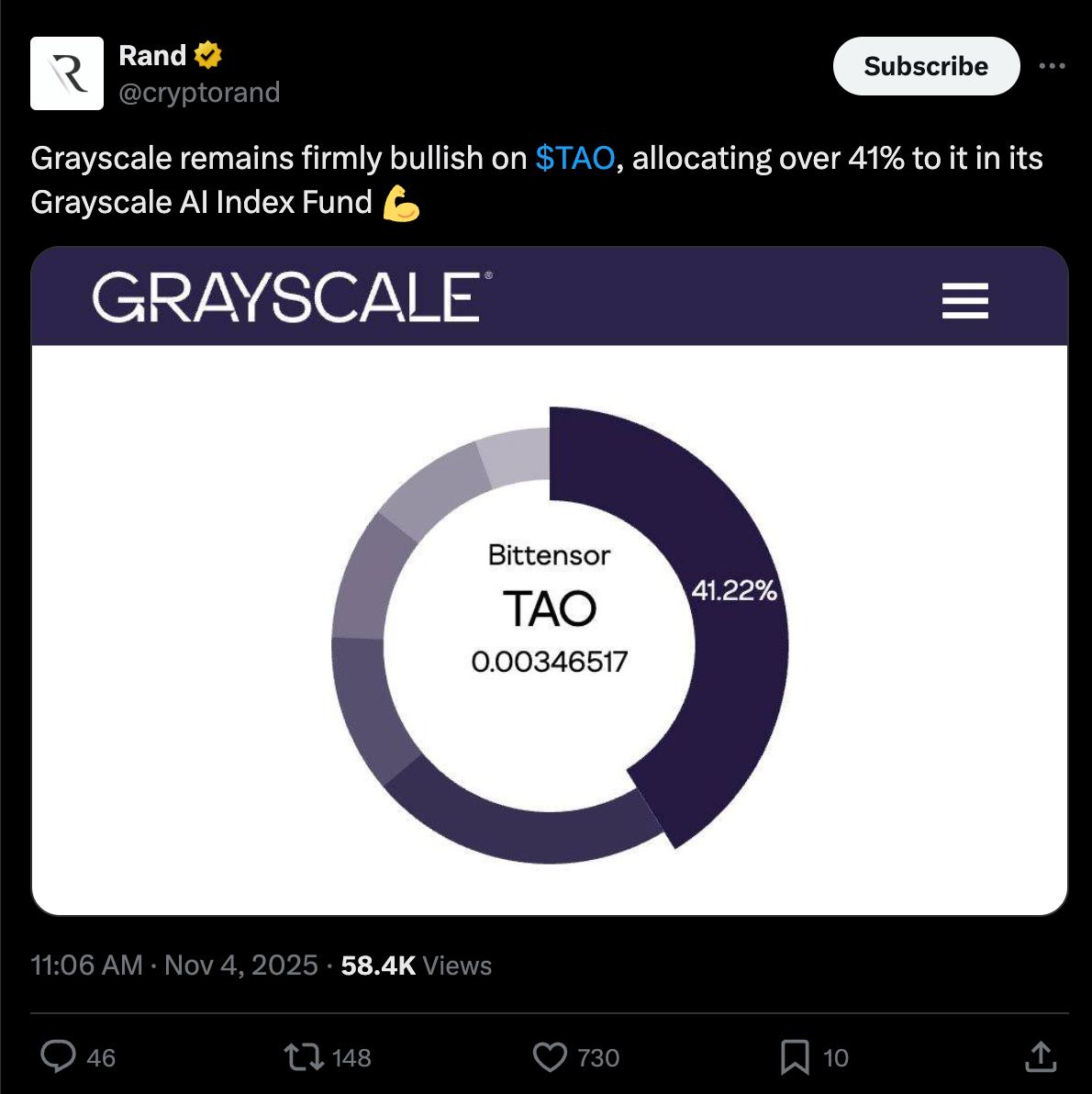

Grayscale has initiated a private placement for TAO, offering institutional investors access to the AI-driven Layer-0 network. This move is noteworthy for an altcoin and indicates growing confidence in its long-term value proposition.

On December 10, TAO's emissions are scheduled to decrease by 50%. This reduction will effectively halve miner sell pressure, which is expected to have a positive impact on the Bittensor TAO price prediction for 2025. If demand continues to remain strong, this could potentially lead to a supply shock.

The recent network upgrade is also a significant development. The introduction of Root Interest now allows holders to automatically earn yield from subnets, effectively transforming TAO into the foundational element of a comprehensive AI yield ecosystem. The adoption of this system is rapidly increasing.

Hyperliquid Maintains Strength Despite Selling Pressure

Hyperliquid is exhibiting early signs of a rebound following a sharp decline. The price found support at $36.5, coinciding with the 200-day exponential moving average and a historical trendline. On November 5, the asset was trading above $40. As long as this support level holds, a move back towards $51 appears possible.

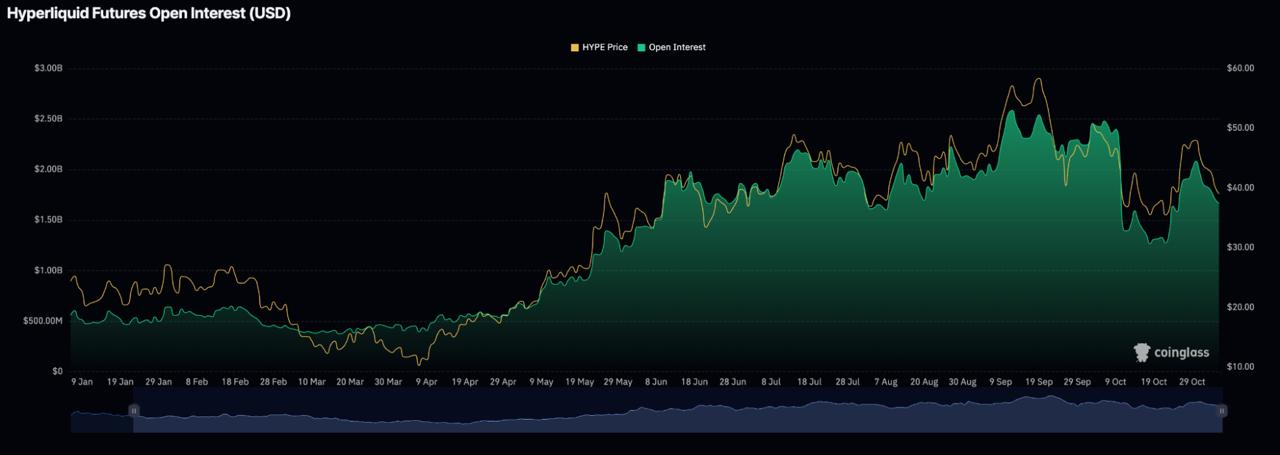

On-chain data from CryptoQuant and Coinglass indicates that whales are increasing their positions while retail investors remain relatively inactive. Funding rates have turned positive at +0.0090%, signaling an increase in the value of long positions. Open interest is also rising, but without excessive speculation, suggesting a healthier and more stable market setup.

After being rejected at $51.15 in late October and experiencing a 19% drop, HYPE successfully held the $36.51 zone and has begun to climb. The Relative Strength Index (RSI) is recovering from a reading of 45. If the RSI breaks above 50 and the price clears $45, a surge towards $51 and potentially $60 could follow.

Closing Thoughts

With only 7% of the global population currently invested in cryptocurrency, and with countries like Canada making stablecoins more accessible, the number of crypto traders is expected to grow significantly. Platforms like DeepSnitch AI are well-positioned to benefit substantially from this expansion.

This anticipated growth is why whales are making early investments, having raised over $500K in record time. Many believe that a $500 investment today could potentially grow to $50,000 upon the token's launch. If adoption continues to accelerate, this figure might even prove to be a conservative estimate.

Visit the official DeepSnitch AI website for the latest updates, join their Telegram community, and follow them on X (formerly Twitter) for ongoing developments.

FAQs

What is the Bittensor TAO forecast for 2025?

Most popular Bittensor TAO forecasts anticipate the token trading between $500 and $700 in 2025, assuming continued growth in network demand and AI adoption. The Bittensor TAO price prediction for 2025 is further bolstered by the scheduled December halving event.

Can Bittensor TAO reach $1,000 in 2026?

A $1,000 TAO price target for 2026 is achievable, contingent on two critical factors: sustained demand for decentralized AI networks and the successful development and adoption of subnets. If AI blockchain adoption accelerates and liquidity deepens through institutional products, Bittensor AI's potential becomes considerably stronger.

What makes Bittensor TAO different from other AI cryptocurrencies?

Unlike many traditional AI cryptocurrencies that focus on infrastructure or computing power, Bittensor establishes a decentralized marketplace for machine learning models. Developers and validators can earn TAO by contributing valuable AI outputs to the network.