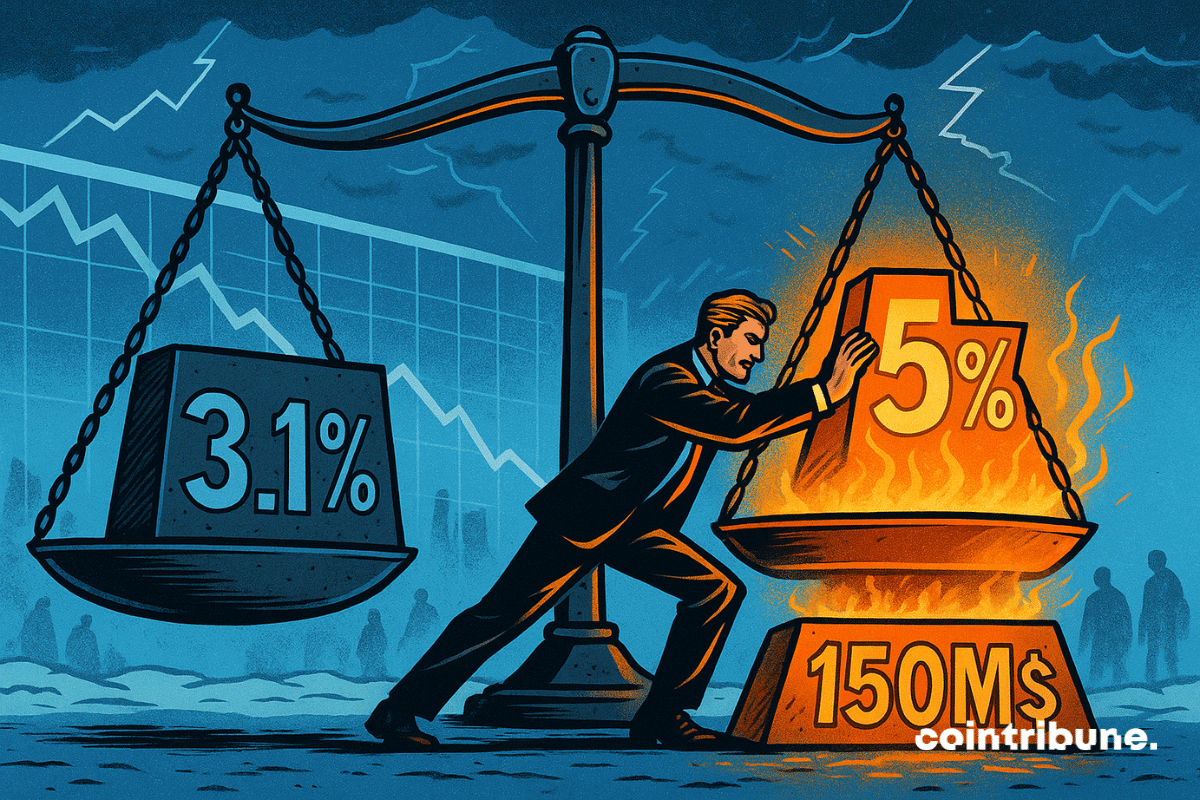

Market corrections often elicit different responses depending on an investor's disposition. For the risk-averse, it signifies an opportune moment to exit the market. Conversely, for major players, it presents a chance to increase their holdings. BitMine, under the leadership of Tom Lee, strategically leveraged the recent market downturn to acquire an additional $150 million worth of Ethereum (ETH). This accumulation strategy is generating considerable attention and is driven by an ambitious objective: to hold 5% of all existing Ethereum.

In brief

- •BitMine executed a purchase of $150 million in ether through Kraken and BitGo this past week.

- •The company's current holdings represent over 3% of the total Ethereum supply available on the market.

- •The company's strategy is contingent on the successful implementation of the Fusaka update and a supportive macroeconomic environment.

- •BMNR stock experienced a 15% surge, attributed to the rise in ether's price and BitMine's substantial purchases.

Ethereum: The Pursuit of 5% is Underway

BitMine has made a significant move, following a previous purchase of $70 million. In a single week, the company added 96,798 ETH to its reserves. This substantial acquisition was facilitated through Kraken and BitGo, according to data from Arkham. Consequently, BitMine now possesses more than 3% of the total ether supply, with a clear objective to reach the 5% mark.

While many may perceive this as a simple speculative bet, Tom Lee views it as an investment in infrastructure. He stated, "We have increased our weekly ETH purchases by 39%." Lee believes that Ethereum is currently in a position analogous to Bitcoin in 2017: facing skepticism but poised for significant growth.

In contrast to other crypto treasuries that are reducing their acquisition rates—an 81% decrease in purchases since August—BitMine is charting a distinct course. This strategic decision is not merely a public relations tactic. With Chi Tsang at the helm of the company and the addition of three new independent directors, the governance structure is being fortified to support long-term ambitions.

The Winning Combination: Fusaka, Fed, and FOMO

BitMine's decision is not solely based on ideology; it is also a calculated move timed effectively. Firstly, the recent deployment of the Fusaka update is a critical development for Ethereum. This significant technical enhancement is designed to improve the network's capacity for processing transactions while maintaining a high level of security.

Secondly, there are indications of a shift in policy from the Federal Reserve. Several senior officials, including Waller, Daly, and Williams, have suggested the possibility of an interest rate cut, potentially by December 10. Such macroeconomic shifts often provide a boost to riskier assets, including Ethereum.

The crypto market has found its bearings... We are now more than seven weeks from the liquidation shock of October 10.

Tom Lee

This statement from Tom Lee helps to explain BitMine's intensified interest, evidenced by the 39% increase in its weekly ETH purchases.

Adding to this positive momentum, Ethereum-related ETFs experienced inflows of $140 million in a single day, according to DeFiLlama. In contrast, Bitcoin ETFs saw outflows of $15 million during the same period. This suggests a growing investor preference for Ethereum-based products.

BMNR: The Ethereum Stock Proxy Gaining Wall Street's Attention

The impact of BitMine's strategy has also been felt in the stock market. BMNR, the stock ticker for BitMine, experienced a significant surge of 15% in December. This rise is largely attributed to its role as a proxy for Ethereum's performance. The correlation between BMNR and ETH has strengthened, reaching 0.50, indicating that BMNR tends to follow, and even amplify, Ethereum's price movements.

Technical indicators further support this outlook. The Chaikin Money Flow (CMF), which tracks the flow of funds from large investors, is showing an upward trend despite stagnant prices. Similarly, the On-Balance Volume (OBV) is also climbing, suggesting discreet accumulation by significant market participants.

A potential inverted head-and-shoulders pattern is currently forming on the chart, which could indicate bullish potential, with a target price of $52.70, representing a 55% increase from the current price of $33.59. However, a failure to break through this resistance could lead to a decline, with $24.31 serving as a critical support level.

Key Figures to Note

- •$3,203: The price of Ethereum at the time of this report.

- •5%: BitMine's target share of the total ETH supply.

- •$140 million: Inflows into Ethereum ETFs in a single day.

- •+15%: The percentage growth of BMNR stock in December.

- •81%: The reduction in ETH purchases by other treasuries since August.

Despite BitMine's considerable efforts and investment, some analysts remain skeptical. They point to a perceived erosion of institutional interest in Ethereum, noting that ETH has been experiencing a decline in institutional portfolios. These analysts argue that the actions of a single, albeit aggressive, player may not be sufficient to fundamentally alter this trend.