Key Developments

Ethereum treasury firm BitMine announced it holds 3.48% of Ethereum's supply, totaling 4.203 million ETH, as disclosed on January 20, 2026.

This increase signifies BitMine's growing influence in the cryptocurrency market and reflects investor confidence in Ethereum's long-term utility and potential development in blockchain technology.

BitMine's Strategic Acquisitions and Shareholder Support

BitMine, a prominent Ethereum treasury company, recently increased its Ethereum holdings to 3.48% of the total supply as of January 19, 2026. With this strategic acquisition, their assets have reached an estimated value of $14.5 billion. This includes about 4.203 million ETH, 193 BTC, and certain Eightco Holdings shares worth $22 million.

The company's shareholder meeting on January 15th successfully passed four proposals, with an 81% majority favoring increased authorized shares. This indicates significant stockholder support for BitMine's approach to growing its Ethereum treasury, further evidenced by the recent acquisition of 35,268 ETH. BitMine's staking strategy continues to expand, with the total Ethereum staked now at 1,838,003, an increase of 581,920 from the previous week.

Tom Lee, Chairman of Bitmine Immersion Technologies, commented, "We view the fact that 81% of votes cast favored increasing authorized shares, Proposal 2, is a message from Bitmine stockholders that they understand our accretive ETH accumulation strategy."

Meanwhile, the crypto community watches closely as such concentration of assets might influence Ethereum market dynamics and price movements.

Ethereum Market Dynamics and BitMine's Influence

BitMine's growing Ethereum treasury places it on par with top cryptocurrency holders, following only MicroStrategy's massive Bitcoin reserves.

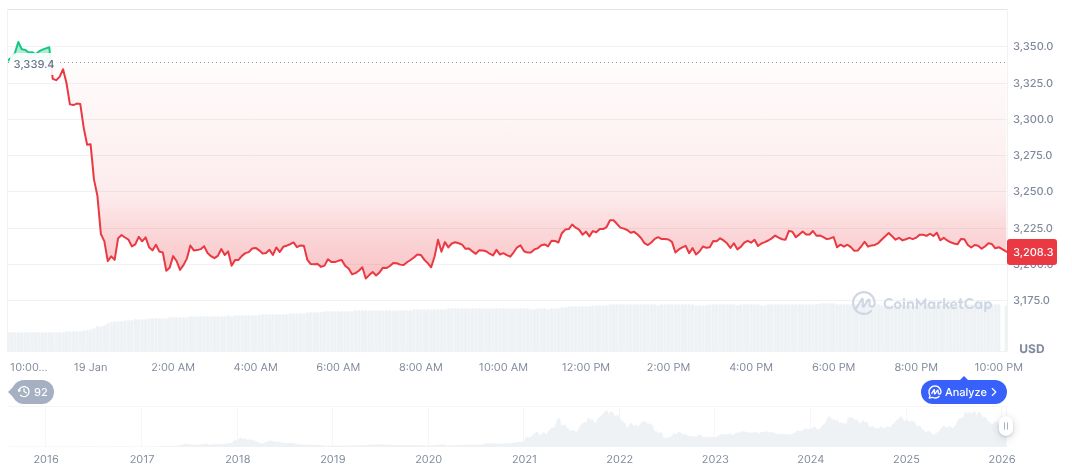

CoinMarketCap data, as of January 20, 2026, shows Ethereum (ETH) priced at $3,087.04, with a 24-hour trading volume of approximately $22.23 billion, reflecting a 22.76% decrease. Ethereum's market cap stands at $372.59 billion, with a 24-hour price change of -4.00%.

The Coincu research team highlights that BitMine's aggressive accumulation could influence Ethereum's supply-demand dynamics, impacting price volatility. Moreover, the broader market anticipates Ethereum's continued adoption in tokenization and other applications developed by Wall Street, as noted by BitMine's Chairman Tom Lee.