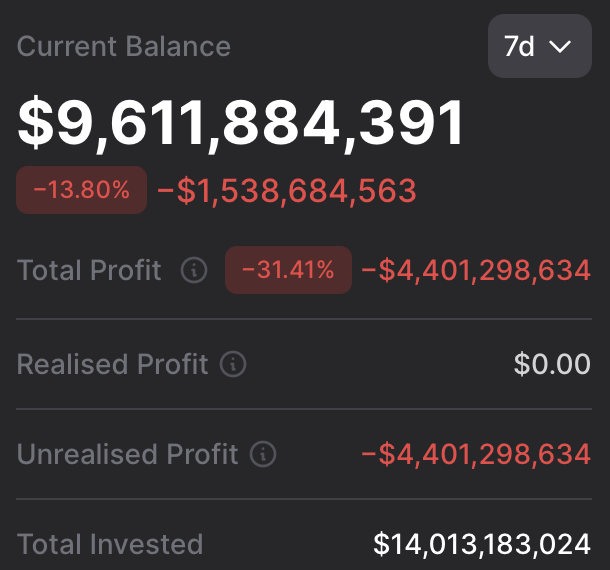

BitMine Immersion (BMNR), the largest Ethereum-focused digital asset treasury, is now facing over $4.4 billion in unrealized losses as ETH has dropped 45% from its August peak. The steep decline has erased the firm’s once-significant net asset value premium and triggered an 84% plunge in BMNR’s stock price since July.

According to Markus Thielen of 10x Research, the losses highlight deeper structural vulnerabilities across Digital Asset Treasury (DAT) companies. He warned that BMNR’s layered corporate setup, spanning asset managers, external advisors, and high-compensation leadership, adds heavy recurring costs that eat into returns. Thielen estimated that BitMine’s executive and advisory compensation packages could extract $157 million annually for a decade, even as shareholder value deteriorates.

Thielen also noted that Ether’s current 2.9% staking yield offers little relief. Once operational expenses and intermediary fees are deducted, he argued, shareholders receive a far lower effective yield, one that “no serious institutional allocator will accept,” especially when paired with Ether’s volatility and the declining value of the underlying collateral.

With the NAV premium gone and losses mounting, Thielen cautioned that many investors may be effectively stuck. DAT structures can “trap shareholders,” he said, making exits painful and costly, a “true Hotel California scenario” as unrealized losses continue to balloon.