Bitget, the cryptocurrency trading exchange, has recorded a staggering 4,468% surge in futures trading volume during the recent earnings season.

As per the recently released analytics, spot trading volume for tokenized U.S. stocks grew 452% month-over-month (MoM) and futures trading volume jumped by 4,468% from mid-October to the end of November, marking the strongest period of activity since these products launched on Bitget.

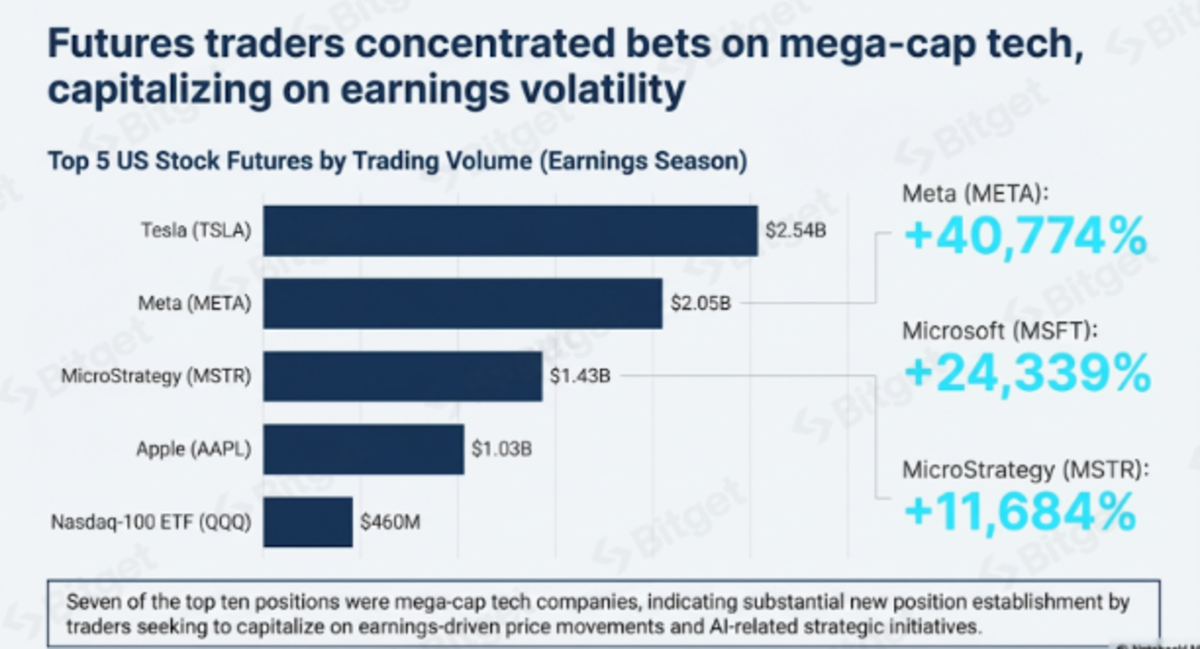

Futures markets reflected extraordinarily aggressive trading activity centered around mega-cap tech stocks, with Tesla (Nasdaq: TSLA), Meta (Nasdaq: META), Strategy (Nasdaq: MSTR), Apple (Nasdaq: AAPL), and the Nasdaq-100 ETF (QQQ) dominating activity.

- •META: 40,774% volume surge MoM

- •MSFT: 24,339% volume surge MoM

- •MSTR: 11,684% volume surge MoM

The top five US Stock Futures by trading volume turned out to be:

- •TSLA: $2.54 billion

- •META: $2.05 billion

- •MSTR: $1.43 billion

- •AAPL: $1.03 billion

- •QQQ: $460 million

Strategy’s high volume demonstrates sustained interest in crypto-related products, the report said.

Spot Trading Behavior Reflects Balanced Approach

The spot trading participation showed a more balanced and diversified allocation approach.

Nvidia (Nasdaq: NVDA) spot trading volume grew 1,888% MoM. Other bellwethers like Tesla (Nasdaq: TSLA), Amazon (Nasdaq: AMZN), and Apple (Nasdaq: AAPL) also secured top positions.

Traders invested in tokenized ETFs, including the Nasdaq-100 and the S&P 500, to gain broad market exposure while diversifying away from single-stock risk.

The long-term Treasury ETF saw its trading volume surge by 69,573% MoM, indicating a "sophisticated defensive positioning strategy" by infusing funds into a "safe-haven asset," the report said.

Asian Investors Take Advantage of 24-Hour Model

Bitget said its 5×24 trading model proved critical in enabling global investors, particularly those based in Asian countries, to leverage the continuous access to their strategic advantage.

The U.S. pre-market hours (08:00-10:00 UTC) recorded the highest-volume trading window outside of regular U.S. hours. The period is critical to Asian investors as it aligns with their local afternoon, the report said.

The Bitget report attributed the extraordinary growth in trade indicators to three structural drivers:

- •Nature of the assets being traded

- •Accessibility of 24-hour markets

- •Behavior of a diverse global user base.

“What we’re seeing is the emergence of a fully democratized global equity market,” said Bitget CEO Gracy Chen.

"Tokenized equities are no longer experimental. They are becoming a mainstream asset class shaped by global capital and global behavior."

“When investors across continents can participate in earnings season in real time—using USDT, with 24-hour access and without geographic barriers—the market becomes broader, more liquid, and fundamentally more sophisticated," she added.