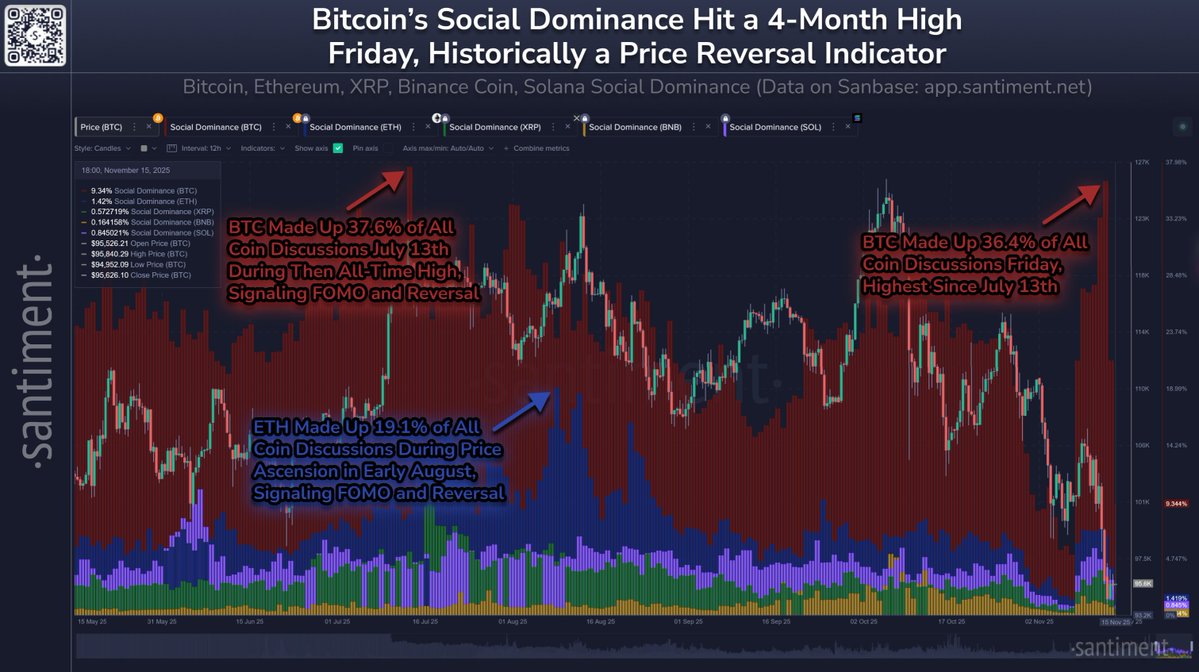

Bitcoin’s social dominance has surged to levels not seen in four months, according to fresh data from Santiment, a pattern that has historically aligned with market reversals following periods of heavy fear, capitulation, or extreme volatility. The latest spike occurred during Friday’s sharp dip below $95,000, when retail discussion around Bitcoin jumped aggressively, overtaking broader altcoin chatter and signaling heightened panic and uncertainty across the market.

Social dominance measures the percentage of total crypto discussions focused on Bitcoin, and elevated readings tend to appear at emotional extremes. When traders abandon discussions about speculative altcoins and concentrate almost entirely on Bitcoin, it often reflects capitulation-driven sentiment, a setup that has repeatedly preceded price recoveries throughout past cycles. Santiment notes that Friday’s rate marked the highest level since July 13, a day that previously coincided with a local bottom and swift upside reversal.

This shift comes after weeks of heightened volatility, rising liquidations, and thinning liquidity across major exchanges. As risk appetite weakened, Bitcoin once again became the central topic of crypto conversations, with discussion rate dominance climbing to over 36% during the sell-off. Similar patterns played out earlier this year, including the early-August correction when Ethereum temporarily dominated sentiment before a rebound.

While not a guaranteed bottom indicator, surging social dominance often aligns with fear-driven market behavior, the very environment in which Bitcoin historically stabilizes before attempting a rebound. With macro uncertainty still elevated and traders rotating defensively, sentiment indicators like this become increasingly relevant.

As markets digest the recent pullback, traders will be watching whether Bitcoin’s social dominance cools back to normal levels or continues climbing, a sign that fear remains in control and volatility may not be finished just yet.