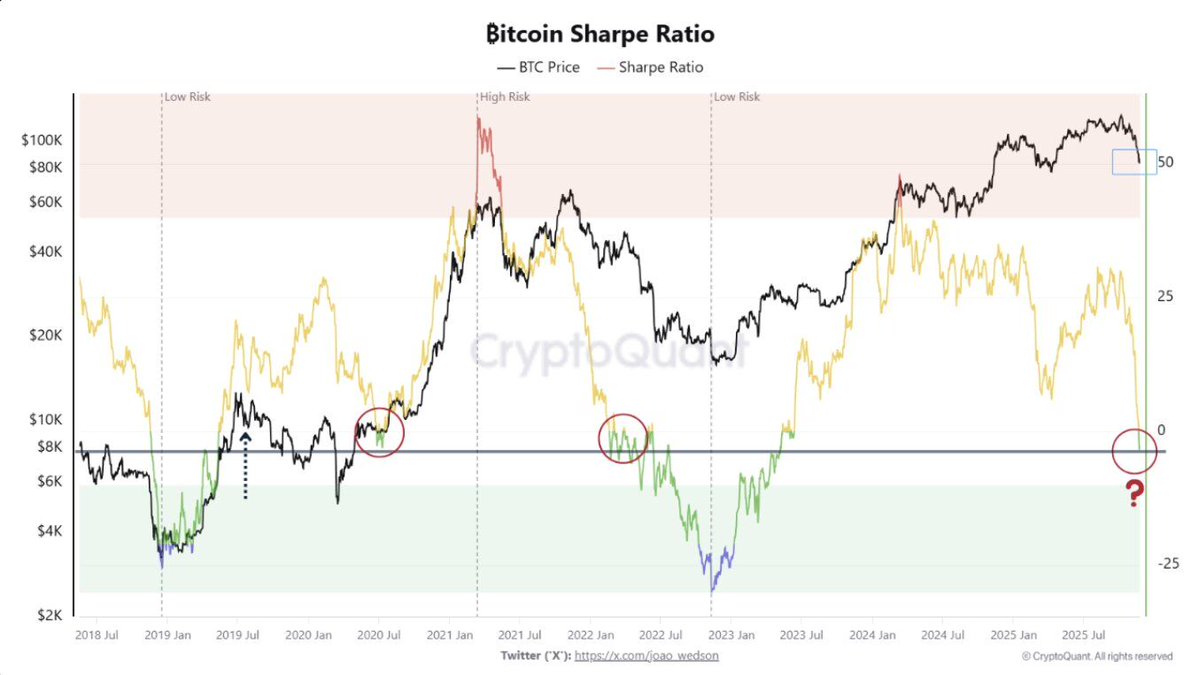

The Bitcoin Sharpe Ratio has plunged back toward zero, according to data from CryptoQuant, marking one of the most significant resets in recent years.

This metric, which measures Bitcoin’s risk-adjusted returns, tends to fall to these levels only during periods of extreme uncertainty and early-stage market repricing. Historically, moments like this have preceded strong long-term recoveries as market volatility cools and forward returns become more attractive.

A Familiar Pattern From Past Market Bottoms

The chart illustrates that Bitcoin’s Sharpe Ratio has now reached the same zone seen during several major turning points. The first instance occurred in March 2020 during the COVID crash, when fear and volatility overwhelmed the market before an explosive multi-year bull run. The second appeared in mid-2022 after the Luna and Three Arrows Capital collapses, a moment marked by panic selling and widespread liquidation risk. In each of these cycles, the Sharpe Ratio’s collapse aligned with deep market stress, but also with conditions that later produced strong upside.

The current drop mirrors those earlier resets. Bitcoin’s price (shown in black on the chart) remains structurally higher than in past downturns, but the Sharpe Ratio (shown in yellow) has sharply reverted downward, indicating that volatility has surged while returns have temporarily compressed. This combination suggests markets are aggressively recalibrating risk premiums, an environment that typically rewards patient accumulation once volatility begins to stabilize.

Why This Reset Matters

A Sharpe Ratio near zero generally means the market is demanding much higher compensation for taking on risk. When returns stop outpacing volatility, sentiment often shifts to the extreme side of caution, exactly the kind of conditions associated with late-stage corrections rather than new downtrends. CryptoQuant’s interpretation is consistent with this historical pattern: when the Sharpe Ratio touches these levels, forward-looking returns tend to improve significantly as uncertainty subsides.

Although near-term turbulence may continue, the underlying message is clear. Bitcoin is moving through a classic risk-reset phase, similar to the lead-up periods that have previously marked key cyclical inflection points. Once the Sharpe Ratio begins to recover, the data suggests that the market often transitions into stronger, more sustainable trends.