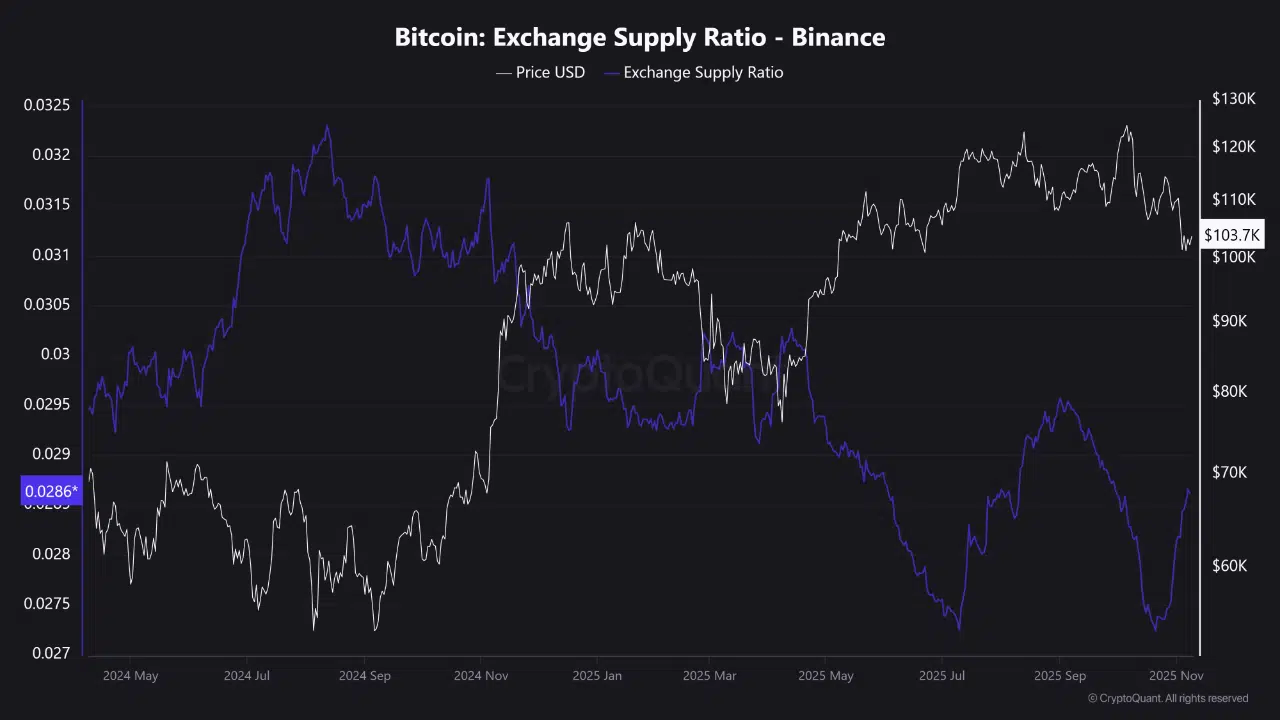

According to a CryptoQuant report, Bitcoin’s Exchange Supply Ratio (ESR), which tracks the amount of Bitcoin held on exchanges relative to total supply, has been steadily climbing since mid-October. The latest data shows the ESR rising from 0.0272 to 0.0286, marking its highest level since September.

At the same time, Bitcoin remains stable near $103,000, indicating that the increase in exchange balances is not linked to panic selling, but rather to a restructuring of liquidity within major trading platforms. This development points to a maturing market phase where institutions are positioning capital more strategically.

Liquidity Rebuilding, Not Selling Pressure

Historically, a rising ESR can signal potential selling when retail traders deposit coins to exchanges. However, CryptoQuant analysts highlight a different dynamic this time: the data suggests liquidity reinforcement rather than distribution.

Despite the larger Bitcoin reserves, price stability has persisted, implying that these funds are likely being allocated toward derivatives markets and hedging operations instead of outright spot sales. This is consistent with previous institutional accumulation phases observed on Binance, where a rise in reserves after heavy withdrawals preceded renewed buying strength.

Institutional Accumulation Phase May Be Underway

CryptoQuant’s analysis indicates that Binance’s liquidity depth is recovering after months of net outflows. The exchange’s rising Bitcoin holdings and balanced market structure suggest that large portfolios are redeploying assets in anticipation of future strategic moves.

If this pattern continues, with Bitcoin holding comfortably above the $100,000 threshold, it would mark the start of a healthy rebalancing phase, typically followed by renewed price momentum driven by whale accumulation and institutional liquidity inflows.