Bitcoin has pulled back nearly 20% from recent highs, but analysts see it as a bullish mid-cycle reset. On-chain data shows historic whale activity, yet long-term holders continue to accumulate. Technical setups suggest Bitcoin could enter an explosive breakout phase similar to previous 80–180% rallies.

Analysts Say Pullback Is Setting Up the Next Rally

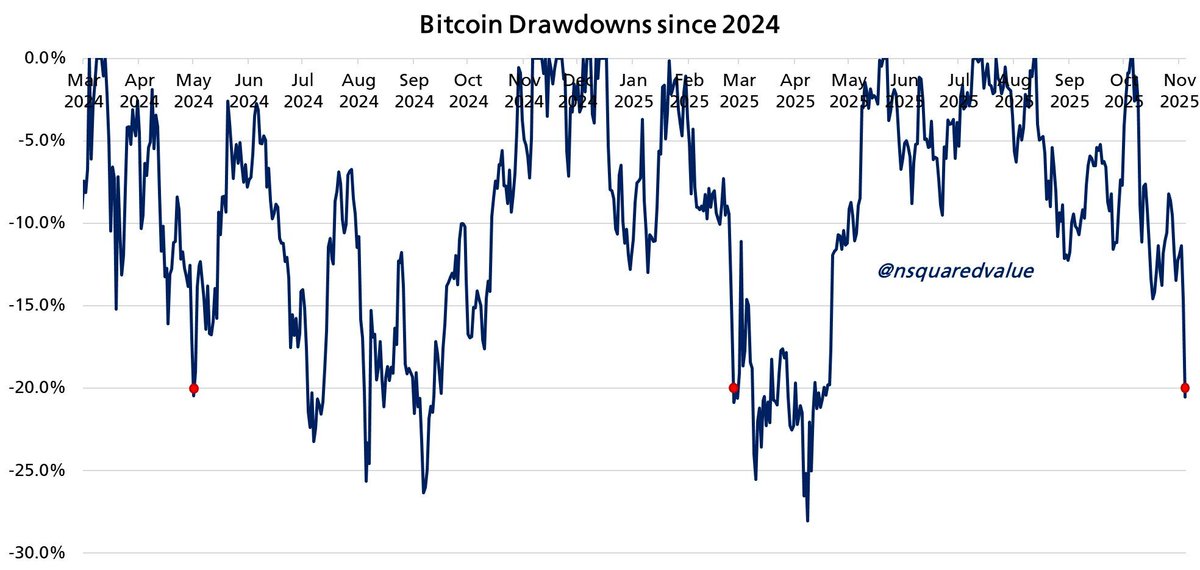

Bitcoin’s recent 20% decline has sparked debate, but analysts argue the market is merely recharging for another leg higher. Data from @nsquaredvalue shows that similar drawdowns in past cycles preceded major rallies within 2 to 6 months.

Historically, such retracements marked mid-cycle consolidations, not macro tops. On-chain signals reinforce this view, realized profits, MVRV ratios, and active address growth all remain within neutral zones, suggesting the bull cycle remains structurally intact.

Whales Are Active But the Market Is Absorbing It

According to Glassnode, OG whales (long-term holders moving coins worth over $100M) have been unusually active in 2025. The chart shared by Crypto Rover highlights dense clusters of whale transactions not seen since Bitcoin’s 2021 bull run.

🚨 THIS YEAR, OG WHALES ARE MOVING BITCOIN LIKE NEVER BEFORE! pic.twitter.com/pBPyF87Bip

— Crypto Rover (@cryptorover) November 8, 2025

While this typically signals profit-taking, it hasn’t resulted in major price breakdowns, a sign of strong institutional absorption. Bitcoin has maintained support near $100,000, despite significant on-chain movements.

This shift underscores the maturity of the market: large holders can now take profits without destabilizing price action, thanks to ETF inflows and corporate treasuries providing liquidity buffers.

“Coiling Like a Spring”: Technicals Point to Tightest Range in History

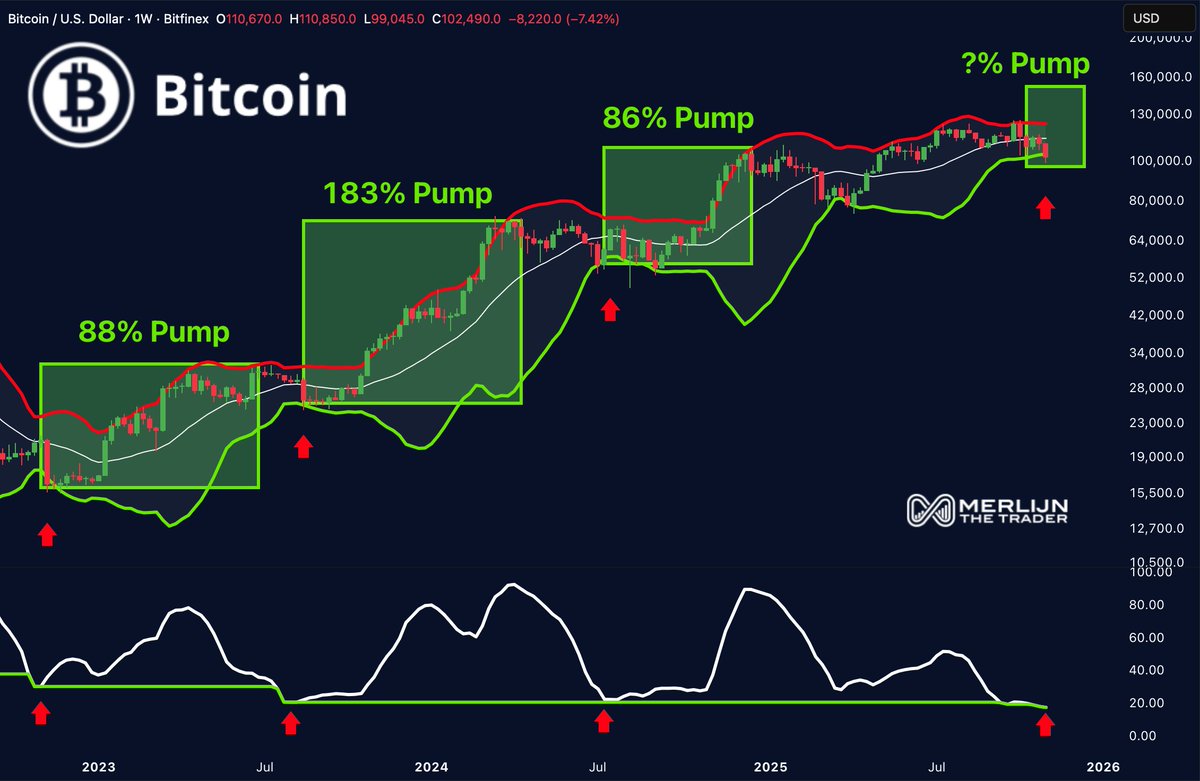

Trader Merlijn The Trader noted that Bitcoin’s Bollinger Bands are now the tightest they’ve ever been, a condition that has historically preceded massive upside breakouts.

Each previous instance of similar compression led to rapid expansions:

- •2023: +88% rally

- •2024: +183% surge

- •2025 (mid-year): +86% gain

Now, volatility has reset to multi-year lows once again, suggesting Bitcoin is coiling for its next move. “Every time this happened, the market faked down, then exploded up,” Merlijn explained.

What’s Next: Patience Before Liftoff

Most cycle indicators remain untriggered, supporting the idea that Bitcoin is in a mid-cycle consolidation phase rather than topping out. Analysts expect a recovery window of 2–6 months, aligning with prior pre-breakout accumulation periods.

If the pattern repeats, Bitcoin could retest its highs by early Q2 2026, potentially launching the next parabolic phase.

As Merlijn concluded:

“The stage is set. The trap is baited. Only one question matters – are you ready for liftoff?”