Bitcoin’s recent market behavior appears increasingly shaped by structural forces rather than localized political events.

The material shared highlights how geopolitical developments, derivatives positioning, and supply concentration interact, offering a layered view of what is influencing sentiment beneath the surface. Rather than pointing to a single catalyst, the data frames Bitcoin as responding to global capital dynamics and positioning shifts.

Japan’s Political Shift and Its Limited Global Reach

According to reports shared by CryptoQuant, the dissolution of Japan’s House of Representatives has raised questions about potential spillover effects into crypto markets. From an on-chain perspective, however, Japan’s influence on global Bitcoin price formation remains structurally limited.

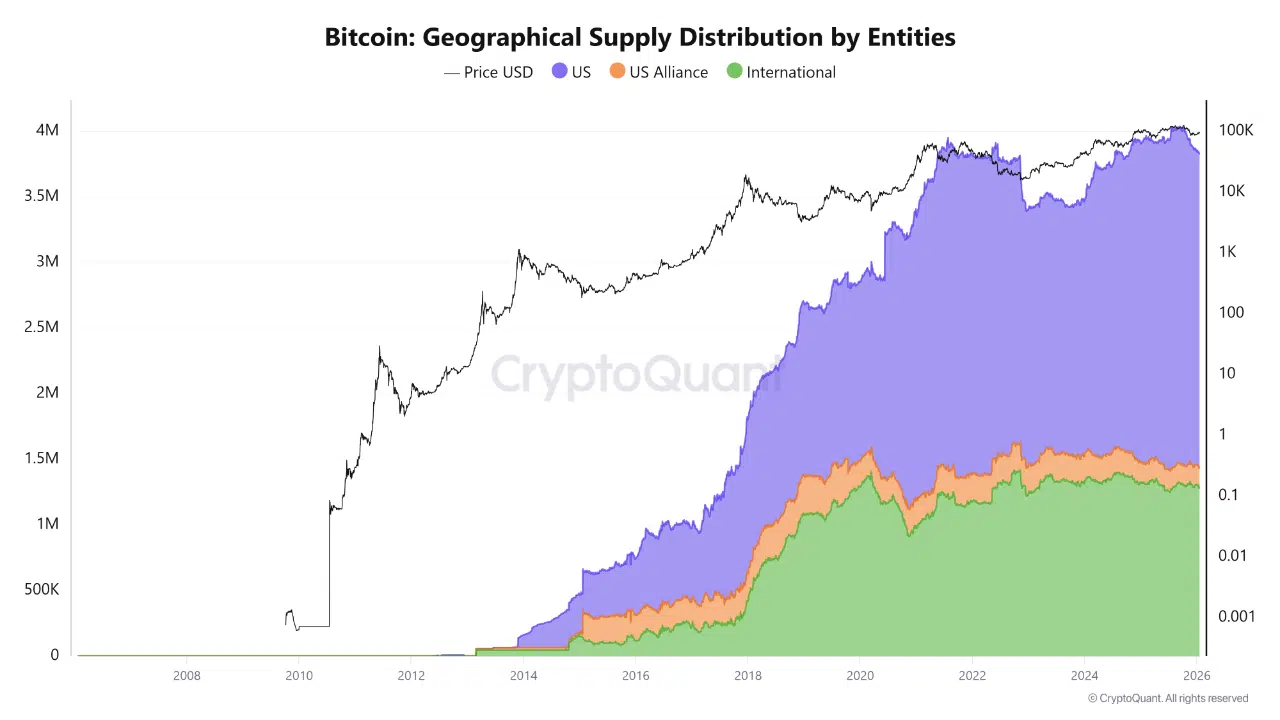

Geographical supply distribution data shows Bitcoin holdings are heavily concentrated in the United States and allied regions, while Japan’s share is too small to register independently. This suggests that broader price dynamics continue to be driven primarily by U.S. monetary conditions, ETF-related flows, and institutional demand rather than domestic Japanese politics.

Currency Effects and Short-Term Perception Gaps

While global impact appears muted, the data acknowledges that political uncertainty in Japan can still influence local market perception. Expectations of expansionary fiscal policy tend to weaken the yen, which can lift yen-denominated Bitcoin prices even if the USD price remains unchanged.

This creates a localized sense of strength within Japan that does not necessarily reflect a shift in global demand, highlighting how currency dynamics can temporarily distort regional sentiment.

Derivatives Flows and Rising Risk Appetite

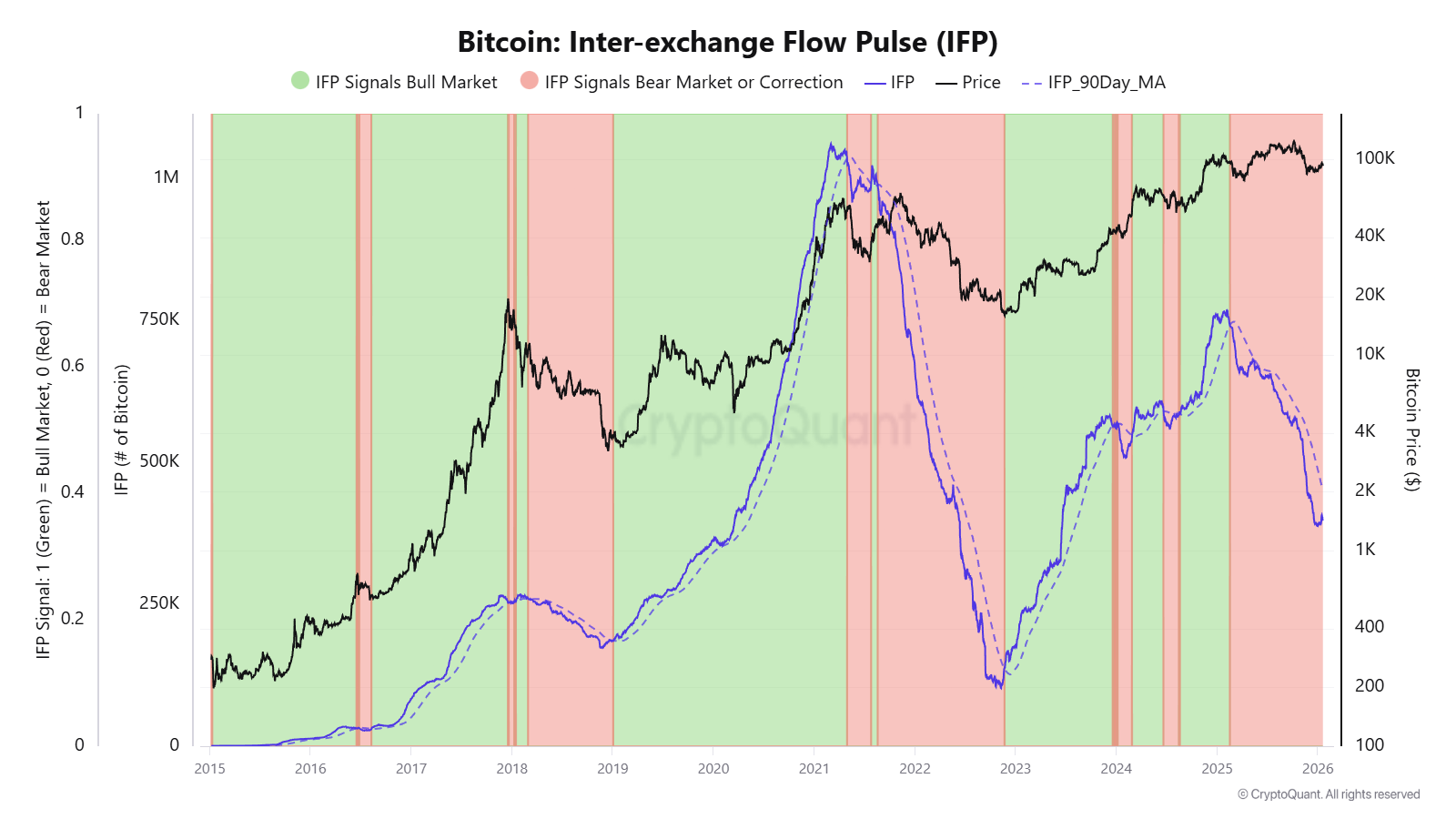

Separately, CryptoQuant data shows Bitcoin inflows to derivatives exchanges are increasing. The Inter-Exchange Flow Pulse (IFP) indicator has bottomed and is now rising, signaling a shift in market sentiment. Historically, growing BTC flows into derivatives venues have coincided with bullish phases, as traders increase leverage and directional exposure.

The chart also shows the IFP line moving closer to its 90-day moving average, a configuration that has previously aligned with improving risk appetite.

Structural Signals Over Political Noise

Taken together, the charts emphasize that Bitcoin’s broader trajectory is shaped less by isolated political events and more by structural positioning and capital flows.

Japan’s political developments may influence domestic market growth and regulatory continuity, but global price behavior continues to reflect where supply is concentrated and how traders are positioning through derivatives markets. The data points toward sentiment improvement driven by participation and positioning, rather than a direct response to regional political change.