Bitcoin has now fallen more than 20% from its recent peak, marking one of the sharpest pullbacks of the 2024–2025 cycle. Traders are split between calling a bottom and bracing for deeper losses, but two major on-chain indicators from CryptoQuant help narrow the picture.

Short-Term Holder MVRV Hits Historical Buy Zone

One of the clearest signals comes from the Short-Term Holder MVRV, which has slid into the 1.0–1.15 band. That range has repeatedly acted as a reset zone during this cycle:

- •Short-term holders are now near breakeven or slightly underwater.

- •Historically, this level attracts fresh demand as weak hands exit.

- •Previous dips into this region lined up with local accumulation phases.

In other words, based on pure valuation, Bitcoin is entering territory that has previously produced rebounds, if macro conditions stop deteriorating.

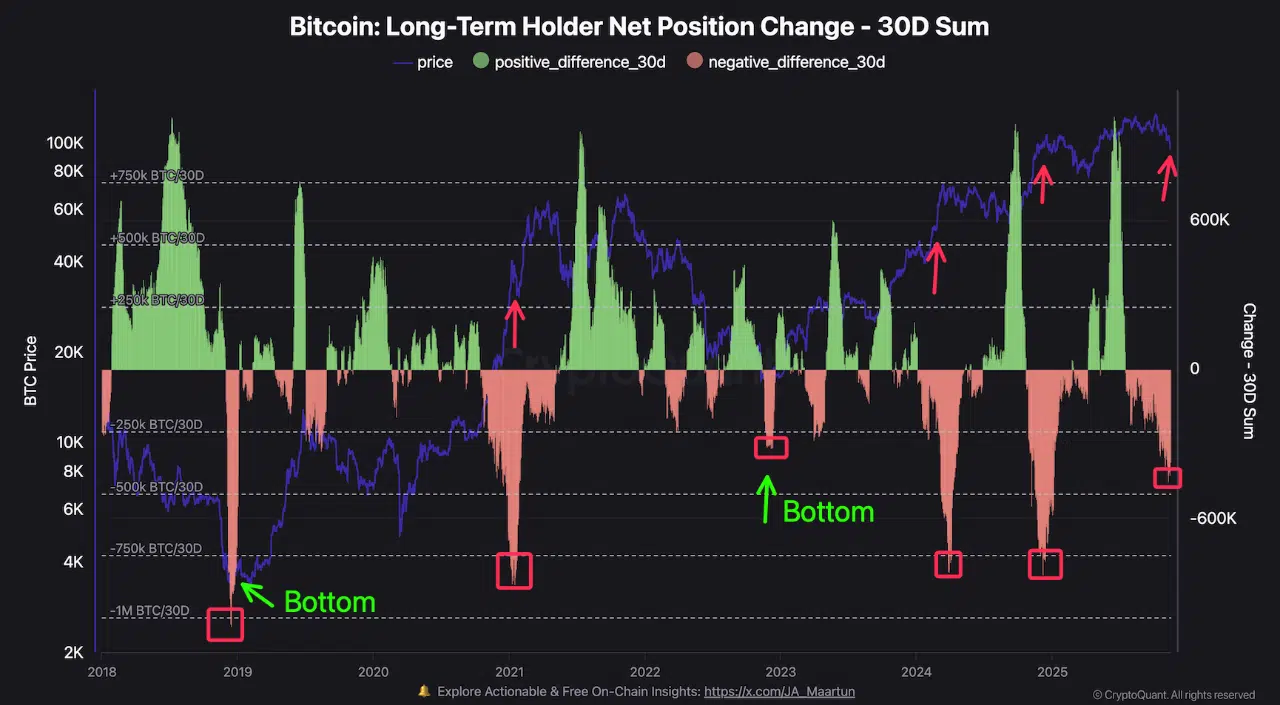

Long-Term Holders Are Distributing – A Warning Sign

The more complicated signal comes from long-term holders (LTHs). The LTH Net Position Change shows that this cohort has been net sellers over the past 30 days. That matters because:

- •LTHs usually distribute into strength, not weakness.

- •Heavy distribution tends to build supply pressure when demand is fading.

- •In previous cycles, extended LTH selling has prolonged corrective phases.

CryptoQuant highlights an important nuance: LTHs have sold even at past market bottoms, so their behavior isn’t perfect timing. They’re outliers, not always predictive. But consistent selling from this group still introduces extra downside risk.

The key signal traders want to see next: Long-term holders shifting back to accumulation. Until that happens, every bounce faces structural resistance from supply hitting the market.

A Market Split Between “Bottoming” and “More Pain Ahead”

The two indicators together paint a mixed, but useful, picture:

- •Valuation looks increasingly attractive (STH MVRV reset).

- •Supply pressure remains elevated (LTH distribution).

- •Momentum is still negative, but leverage has already been flushed.

This creates a narrow path. If Bitcoin holds current support zones and LTH selling slows, the market may be setting a foundation for the next leg higher. If long-term holders continue distributing aggressively, the market may need more consolidation, or even another major flush, before a durable reversal takes shape.

Cycles Only Reverse After Maximum Pain

One pattern remains constant across Bitcoin’s history: deep drawdowns always precede major expansions.

- •2018 capitulation → 2021 breakout

- •2022 collapse → 2024–2025 all-time highs

Whether this pullback becomes that kind of catalyst depends on supply dynamics in the coming weeks.