Whales Take Profits After Massive Accumulation

Bitcoin’s recent consolidation phase is sparking renewed activity across the crypto market, with whales trimming positions, altcoins showing resilience, and dominance levels retesting key technical zones, according to new on-chain and market data shared by Santiment, Cointelegraph, and trader DaanCrypto.

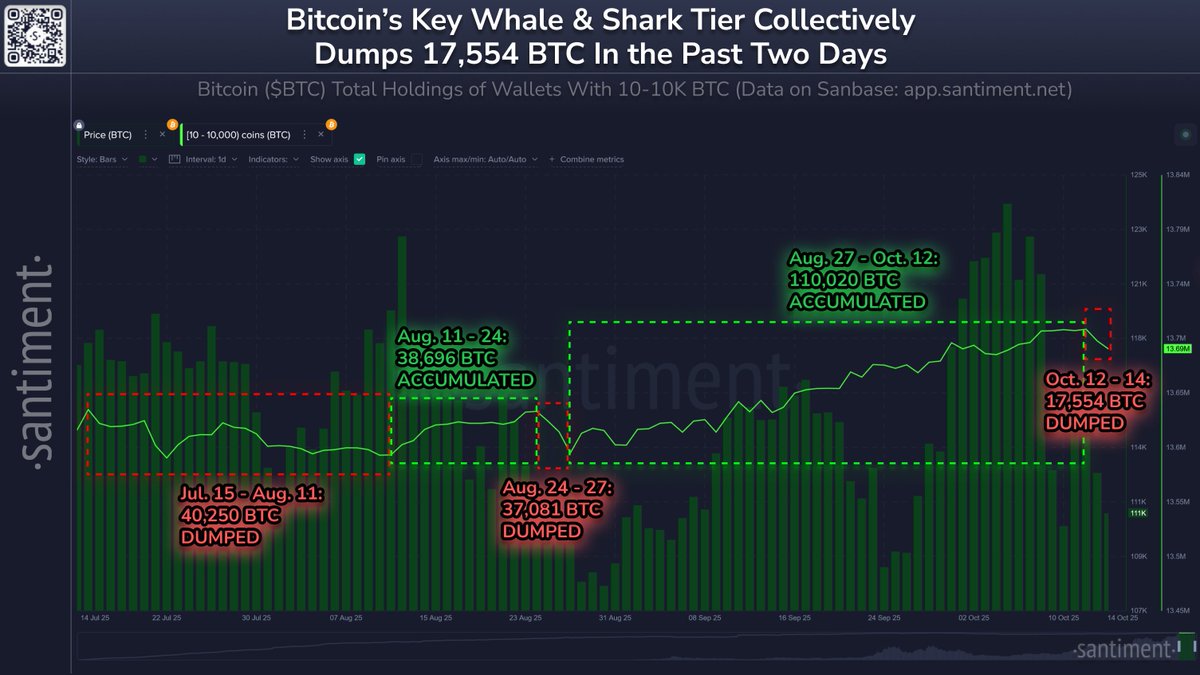

Data from Santiment reveals that wallets holding between 10 and 10,000 BTC, which collectively own about 68.7% of Bitcoin’s circulating supply, have offloaded 17,554 BTC in the past two days.

Despite this round of profit-taking, these large holders have accumulated over 318,000 BTC since January, indicating that the latest move may reflect short-term repositioning rather than sustained distribution.

Historically, whale activity of this size often coincides with minor local tops or mid-cycle rebalancing periods, particularly when funding rates and leverage across derivatives markets are elevated.

Bitcoin Dominance Retests Key Level as Alts Recover

Analyst DaanCrypto noted that Bitcoin dominance ($BTC.D), the metric tracking Bitcoin’s share of total crypto market capitalization, is currently undergoing a “big retest” after a sharp flush lower.

He described the setup as “technically looking pretty good for alts relative to BTC,” adding that altcoins are immediately reclaiming market share and could continue outperforming if sentiment stabilizes.

Many altcoins remain well below mid-cycle averages, suggesting potential upside on any market bounce. However, DaanCrypto cautioned that Bitcoin could “take back the spotlight” if dominance grinds toward its previous highs above 66%.

Market Correlations Remain Strong

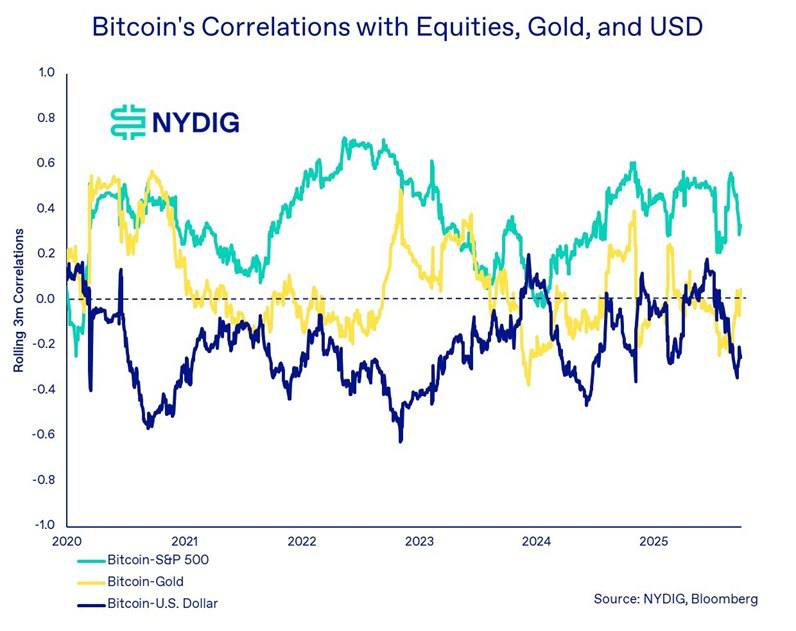

Meanwhile, data shared by Cointelegraph, citing NYDIG and Bloomberg, shows that Bitcoin’s 90-day correlation with U.S. equities remains elevated at 0.33, underscoring how tightly the asset still moves with risk markets.

Correlations with gold and the U.S. dollar, however, remain weak, reinforcing Bitcoin’s positioning as a risk-on asset rather than a traditional hedge in the current macro environment.

Outlook

With whales securing profits, altcoins rebounding, and macro ties still intact, the crypto market appears to be entering a rotation phase rather than a full-fledged correction.

If dominance continues to ease and equity sentiment stays firm, altcoins could extend their relative outperformance, while Bitcoin consolidates before its next directional move.