New Bitcoin whales are currently facing unrealized losses totaling approximately $6.95 billion. This situation represents the highest amount of paper losses for this group since October of the previous year. Bitcoin is trading near $110,000, which is about 13% below its recent all-time high of $126,000.

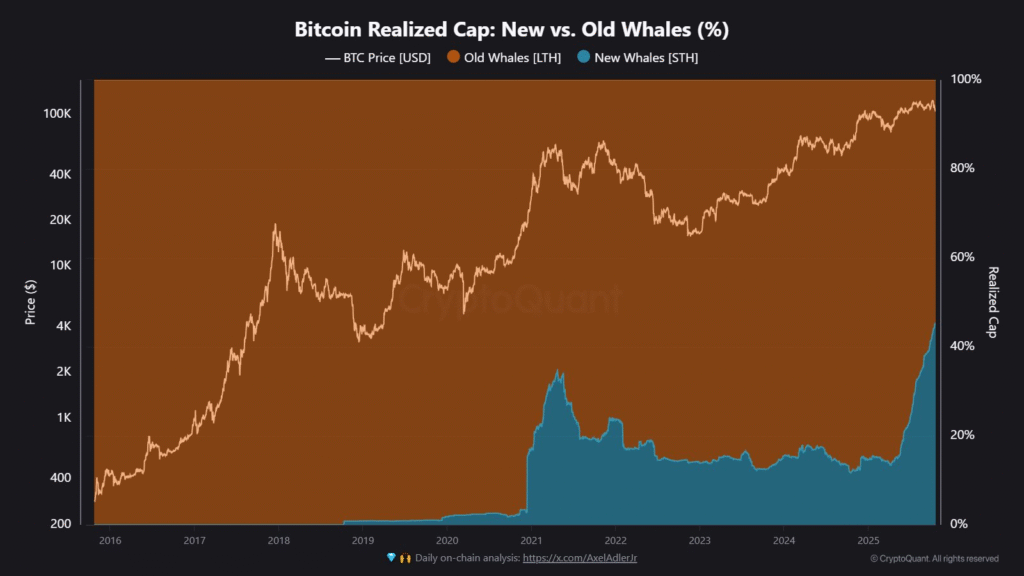

These new whales now collectively hold 45% of the total whale realized cap, a significant increase from under 20% recorded earlier in the year. This indicates that a substantial portion of the market's large holders entered their positions during recent price surges.

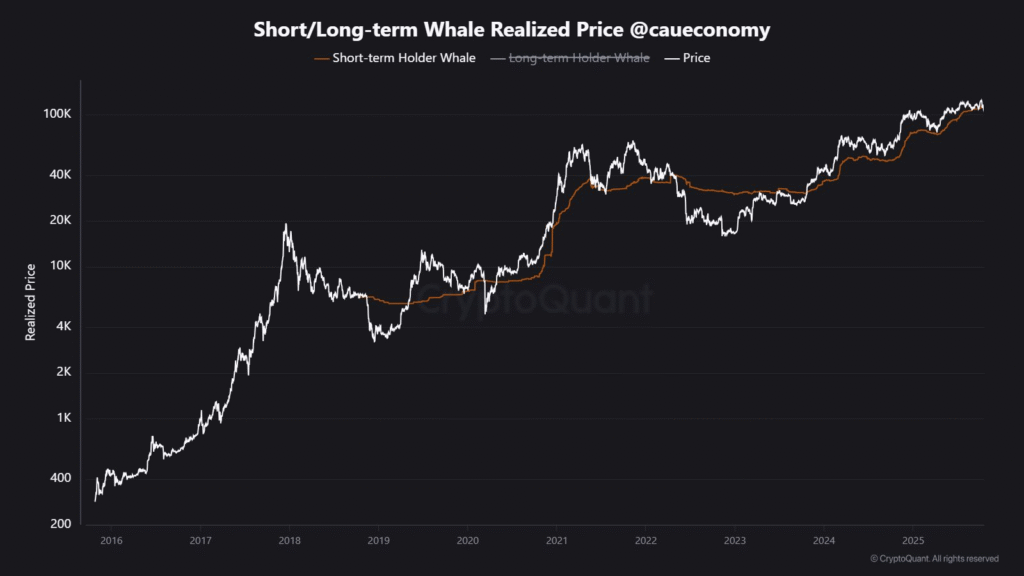

CryptoQuant reported that these wallets accumulated Bitcoin at elevated price levels, which has now resulted in them being underwater as the market corrected. The data confirms that this is the first time since November 2024 that these short-term whales have experienced unrealized losses.

Whale Holdings and Accumulation Trends

According to CryptoQuant, the new whale cohort currently accounts for approximately 45% of the total whale realized cap. This is a notable increase from a figure below 20% that was observed earlier in the year. This trend suggests that a significant portion of the market's major holders acquired their Bitcoin during recent price peaks.

Despite the current paper losses, several market analysts have observed ongoing accumulation by whales. Market expert Crypto Patel noted that more than 26,500 BTC were recently transferred into whale wallets.

Whales are loading up.

— Crypto Patel (@CryptoPatel) October 19, 2025

Over 26,500 #BTC just flowed into whale accumulation wallets, that’s not traders, that’s big money moving off exchanges.

Historically, every spike like this has happened when fear is high… and whales are quietly buying. pic.twitter.com/JiXWlBfJrZ

Patel explained that this type of accumulation activity frequently occurs during periods of high market fear, suggesting that large investors are quietly building their positions.

Market Analysts Observe Broader Stability

Analyst Merlijn the Trader commented that the current market cycle appears to differ from previous bull markets. He stated that inflows from Bitcoin ETFs are now exerting a greater influence on the market than retail sentiment. According to his assessment, large investors are strategically positioning themselves during this period of relative stability.

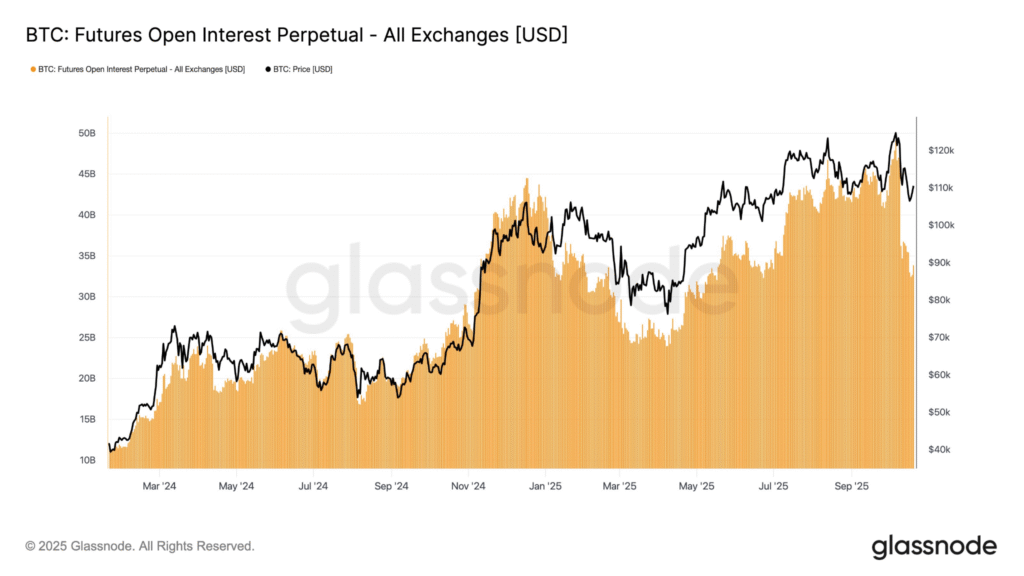

Data from Glassnode indicates a 30% decrease in open interest, which suggests a significant reduction in leveraged trading activity. Funding rates have also moved closer to neutral levels, contributing to a more balanced market environment.

Analyst Ted Pillows observed that Bitcoin is currently testing support levels between $107,000 and $108,000. He suggested that maintaining this support range could facilitate a price rebound. Conversely, a break below this level might lead to the asset approaching the $100,000 mark.