A mysterious crypto whale has sent buzz across the crypto market with shorting a staggering $420 million worth of BTC on Hyperliquid. The timing for the short trade aligns with BTC witnessing a huge selling pressure as it recently hit a new all‑time high of $126,198 on October 6, 2025.

As noted by Arkham, a blockchain data platform, the whale executed the trade with a $80 million USDC in margin and using a 6× leverage to size up the trade. The whale also transferred $50 million to Binance, potentially following a similar activity or hedging the trade.

THIS GUY JUST SHORTED $420M OF BITCOIN ON HYPERLIQUID

— Arkham (@arkham) October 9, 2025

He deposited $80M of USDC and leveraged it over 5x to short BTC. He also sent $50M to Binance, where he is likely doing the same activity.

This whale is betting on a massive DUMP. pic.twitter.com/te1wrnzIAv

Lookonchain, another on‑chain data tracking platform, noted that the same whale sold 3,000 BTC for $363.87 million two days ago. Now this mammoth short position suggests that whale is expecting a huge downside in BTC price over coming days.

After selling 3,000 $BTC($363.87M) 2 days ago, the #BitcoinOG just deposited 80M $USDC into #Hyperliquid to open a 6x short on 3,477 $BTC($419M), with a liquidation price of $140,660.

— Lookonchain (@lookonchain) October 9, 2025

He also deposited 50M $USDC into #Binance.https://t.co/GY2k5pRwcehttps://t.co/SYkEUe1Z5dpic.twitter.com/fBmMHXpOYo

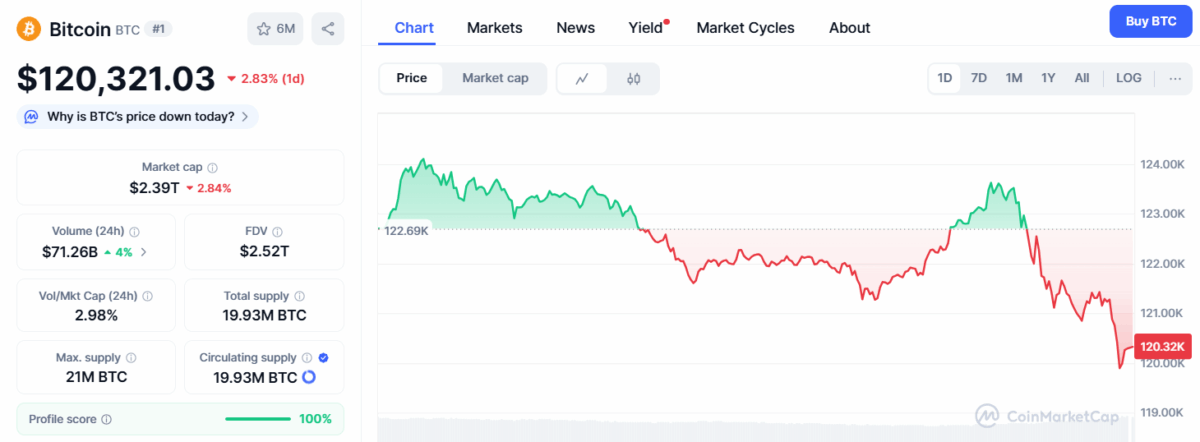

BTC price slumps below $120K

Following the public revealing of the trade, Bitcoin price took a hit and fell below $120K, losing daily high $123,614, as per CoinMarketCap data. It is currently trading at $120,300 with a 24‑hour trading volume of $71.26 billion.

Data from Hypurrscan, an on‑chain data and trade explorer for Hyperliquid, shows that the whale is currently $660K in profit and their liquidation price sits at $140,660 per BTC.

The crypto community is abuzz, with reactions ranging from awe to skepticism, as some question whether the whale might be balancing positions across multiple accounts. Crypto traders are currently closely monitoring the market’s response. While some users are predicting a lesson for the whale if the bet fails, others, such as suggest that the strategy might be more complex than it appears.

The trade underscores the growing influence of large players in crypto markets and could prompt closer scrutiny from regulators. As of now, the market holds its breath, awaiting Bitcoin’s next move in this high‑leverage showdown.