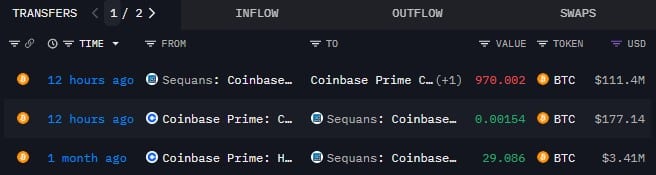

Sequans, a company that holds Bitcoin as part of its treasury strategy, has transferred 970 BTC, valued at approximately $111 million, to Coinbase. This transaction marks the first significant outbound transfer since the company adopted its Bitcoin treasury approach.

The substantial transfer immediately captured the attention of market participants, as large movements of funds to exchanges often prompt speculation about potential selling or asset reallocation strategies.

On-chain data confirmed a major transaction between Sequans and Coinbase, one of the prominent cryptocurrency exchanges operating in the United States. This event represents the largest outbound Bitcoin transfer from Sequans since it began accumulating the digital asset.

Following this transfer, Sequans continues to hold approximately 2,264 BTC, with an estimated value of $255.75 million. This significant reserve ensures the company remains substantially exposed to the price fluctuations of Bitcoin.

Significance of the Transaction

Large Bitcoin transactions executed by corporate treasuries frequently trigger discussions regarding potential sales or asset restructuring. In the absence of an official statement from Sequans, the precise motivations behind this move remain open to speculation.

It is common practice for institutions to utilize Over-the-counter (OTC) desks for the sale of large volumes of cryptocurrency to mitigate slippage. Coinbase Prime offers custody and treasury management services, suggesting that this relocation might be primarily for storage purposes rather than immediate selling.

Market Context

As of this report, the broader market has not shown any significant adverse reactions to the transfer. Analysis of exchange reserve data and inflow metrics in the coming days will likely provide further clarity on the market's response.

At the time of writing, Bitcoin is trading at $112,571, with a 24-hour trading volume of $6.6 billion. The cryptocurrency has experienced a 1.12% decrease in the last 24 hours, maintaining a live market capitalization of $2.24 trillion.

Sequans' recent action underscores the ongoing evolution of corporate Bitcoin treasuries. Similar to other major companies, Sequans is contributing to the trend of adopting Bitcoin as a long-term store of value.