Key Takeaways

- •New voter analysis indicates Bitcoin appeals across US political parties, enhancing its policy influence.

- •Improved political sentiment for Bitcoin can direct capital towards scaled infrastructure, making $BTC more usable for everyday financial transactions.

- •A significant buyer invested over $500,000 in $HYPER during a presale that has raised more than $27.5 million, demonstrating conviction as liquidity builds.

- •Bitcoin Hyper's Layer-2 solution aims to combine Solana-like transaction speeds with Bitcoin settlement, enabling faster $BTC payments and DeFi applications.

Bitcoin's political identity in the United States is more adaptable than commonly portrayed. Recent analysis from the BTC Policy Institute suggests that voters across the political spectrum respond favorably to Bitcoin when it is presented in alignment with their core values.

For audiences leaning Democratic, the narrative focuses on financial inclusion, enhanced access to financial services, and consumer choice.

For Republicans, Bitcoin resonates through themes of energy innovation, the protection of property rights, and resilience against censorship. The core asset remains the same, but the messaging adapts; this flexibility is a key strength. Bitcoin's brand has the capacity to broaden its appeal.

This adaptability is significant because the 2025-26 period is poised to be a crucial phase for digital asset policy. Narratives that connect with common concerns, such as reducing the cost of cross-border payments, improving grid economics, and offering better savings tools, are instrumental in shaping regulatory frameworks and capital flows.

When Bitcoin can effectively communicate its benefits in a way that resonates with voters' existing priorities, it gains greater traction in Washington D.C. and stronger momentum in financial markets. The survey's release coincides with a period of macroeconomic uncertainty, which often prompts investors to seek assets perceived as both scarce and adaptable.

This environment fuels a common reaction in the crypto space: the development of projects adjacent to the most robust assets available.

Bitcoin Hyper ($HYPER) – Bringing Bitcoin-Grade Settlement to High Throughput

Amidst growing positive sentiment for Bitcoin's utility across different political affiliations, a substantial investor, often referred to as a whale, recently invested over $500,000 into $HYPER during a period of intense presale activity.

The momentum is evident. The Bitcoin Hyper ($HYPER) presale has now exceeded $27.5 million in funding. Tokens are being offered at $0.013275, with advertised staking rewards of 42%. For those seeking exposure to Bitcoin's renewed political and market relevance, this convergence of narratives is particularly noteworthy.

The fundamental challenge Bitcoin faces is straightforward, even for those not deeply technical: while Bitcoin is highly secure and dependable, its transaction speed and cost can become prohibitive during periods of high network usage. This limitation is acceptable for its function as a store of value, often called "digital gold," but it is less suitable for real-time applications.

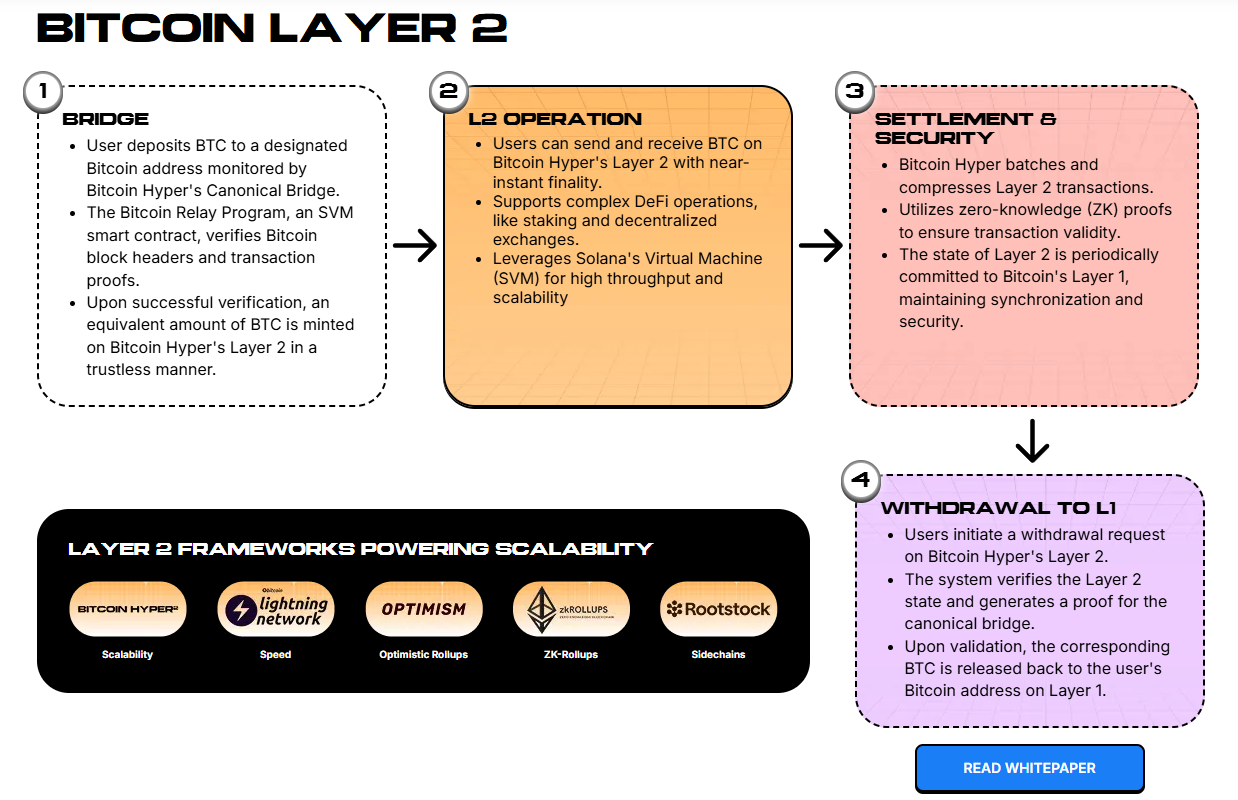

Bitcoin Hyper aims to bridge this gap with a Layer-2 solution that utilizes an SVM-based execution environment. This design allows for scalable computation while ensuring finality is anchored to the Bitcoin blockchain. The architectural concept is clear: a canonical bridge facilitates the transfer of $BTC from the Layer-1 (Bitcoin) to the Layer-2. On the Layer-2, transactions are executed rapidly and at a low cost. Subsequently, the updated state is batched and returned to Bitcoin for final settlement.

For end-users, this architecture translates to near-instantaneous $BTC transfers, the ability to engage in decentralized finance (DeFi) functions, and on-chain trading, all while benefiting from the robust security model of Bitcoin.

Utility is paramount because it transforms narrative into tangible use. If Bitcoin is to be a significant part of discussions surrounding financial inclusion and energy innovation, it requires infrastructure capable of supporting everyday financial activities, not solely long-term asset storage.

$HYPER's objective is to make $BTC a viable option for transactions where speed and cost are critical factors.

The token's stated utility encompasses gas fees, staking, and governance, directly linking the asset's value to network activity rather than purely speculative trading. If the network achieves its projected throughput and fee levels, developers will have a predictable platform, and users will experience faster $BTC transactions without compromising the base asset's inherent trust guarantees.

In an era where policy discussions are gaining prominence, the proposition of scaling Bitcoin's utility without diluting its core principles is resonating strongly.

Significant whale activity serves as a validator for presale projects; the recent $500,000 purchase of $HYPER is part of a recurring pattern of large allocations. Previous substantial buys include a $379,000 purchase and a $274,000 acquisition. These large investments have contributed to increased momentum and broader social media discussion.

Every Layer-2 solution faces execution risks, including the design of bridges, the incentives for validators, the availability of developer tools, and ensuring sufficient liquidity at launch.

However, the underlying premise is sound. As Bitcoin's political reception improves due to its perceived alignment with diverse values, capital tends to flow towards Bitcoin-adjacent infrastructure. This is precisely the space where $HYPER aims to establish itself.

The combination of significant whale participation and a narrative that leverages Bitcoin's bipartisan appeal presents an attractive opportunity for presale investors looking for asymmetric bets when Bitcoin is leading the market.

Participate in the $HYPER presale, with tokens currently priced at $0.013275.