Bitcoin is facing renewed pressure as it trades below its 365-day moving average, a level historically linked to the start of bearish phases. Yet on-chain data from CryptoQuant suggests that traders’ realized losses are now nearing levels that have preceded major rebounds in the past two years.

Key Takeaways

- •Bitcoin has dropped below its 365-day moving average, a historically significant support level.

- •On-chain data shows realized losses at -11%, close to the -12% zone that has preceded rallies in previous cycles.

- •Analysts see contrasting signals: short-term weakness versus long-term accumulation opportunity.

Bitcoin Below Its 365-Day Moving Average

According to CryptoQuant’s head of research Julio Moreno, Bitcoin has now broken below its 365-day moving average (MA), a threshold that has often defined key market turning points. Moreno noted that during previous cycles, such breakdowns coincided with the onset of bear markets, such as in 2022, while recoveries were marked by sustained moves above this level.

In 2025, Bitcoin’s price, now hovering around $101,000, has struggled to maintain momentum amid macro uncertainty and ETF flow slowdowns. Moreno warned that continued trading below this red-line level could reinforce short-term bearish sentiment unless buyers regain control.

On-Chain Losses Signal Historical Rebound Zone

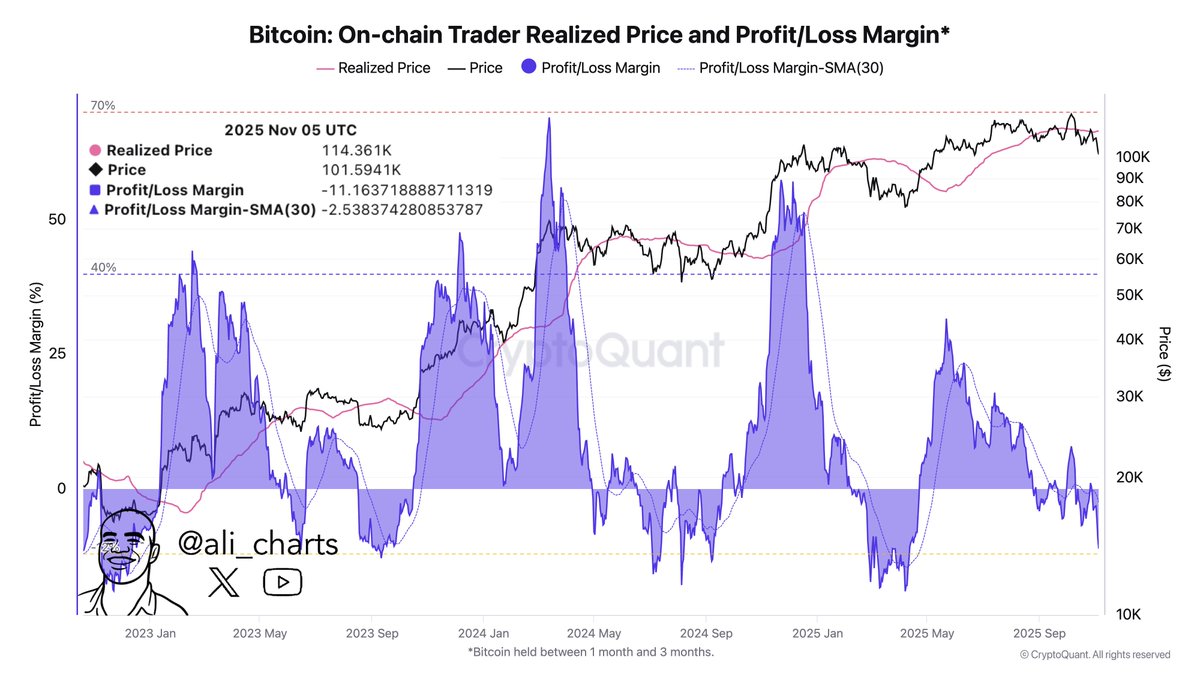

At the same time, on-chain data shared by analyst Ali paints a different picture. His CryptoQuant chart shows that Bitcoin’s realized losses currently stand at -11%, nearing the -12% threshold that has repeatedly marked market bottoms over the past two years.

“In every instance since 2023, Bitcoin has rebounded when traders’ realized losses fell below -12%,” Ali wrote, suggesting that current conditions could signal another inflection point. The metric measures the average profit or loss of recently spent coins, providing a real-time gauge of market capitulation or recovery potential.

Short-Term Volatility, Long-Term Opportunity

Despite the technical breach of key support, several market watchers believe the latest pullback reflects a typical mid-cycle correction rather than the start of a prolonged downturn. With institutional inflows into ETFs exceeding 2 million BTC in total holdings and on-chain accumulation metrics remaining strong, many see this phase as one of consolidation before potential upside.

CryptoQuant’s data aligns with that thesis: when realized losses cluster around double-digit negatives, it has typically coincided with whale accumulation and market reversals. Still, analysts caution that confirmation would require Bitcoin to reclaim the 365-day MA and stabilize above $105,000 in the days ahead.

Conclusion

Bitcoin’s current setup reflects a rare mix of technical weakness and on-chain strength. While the break below the 365-day MA raises short-term risks, the depth of realized losses historically points to an approaching rebound. Whether this dynamic repeats depends on whether long-term holders continue accumulating, or if the market’s patience finally gives way.