Market Overview

Bitcoin experienced a weekend retreat as a resurgence of risk-off momentum took hold, influenced by rising geopolitical tensions and softer-than-expected economic data from Europe and China. This pullback followed a failed attempt to reclaim the $98,000 level, prompting traders to re-evaluate the balance between speculative leverage and hedging strategies. The situation was further complicated by renewed outflows from Bitcoin ETFs and strengthening traditional safe-haven assets, underscoring the significant impact of macro-economic dynamics on cryptocurrency demand, even as Bitcoin traded in the upper-$90,000s during periods.

Key Market Indicators and Takeaways

- •The Bitcoin futures premium remained near 5%, indicating that demand for leverage was still resilient following the unsuccessful attempt to break past $98,000.

- •Bitcoin ETFs recorded outflows totaling $395 million, coinciding with gold reaching fresh record highs, which diminished Bitcoin's appeal as a hedge and led traders to price in downside risk.

- •Over the weekend, Bitcoin saw a correction of approximately 3.4%, as investors reduced their risk exposure in response to geopolitical uncertainties and data suggesting slower growth in China.

- •The 30-day options delta skew for Bitcoin increased to 8%, signaling that put options were trading at a premium and reflecting a cautious sentiment among major holders.

Derivatives Market Signals Weakening Interest and Hedge Appeal

During a holiday pause in markets, investors gravitated towards safer assets, leading to a flight towards cash and precious metals. The Euronext 100 index saw a decline, while gold continued its ascent to new record levels. This trend reinforced the perception of Bitcoin as a risk-on asset rather than a dependable hedge during times of stress or uncertainty. Despite Bitcoin briefly trading back above the $93,000 mark, traders remained cautious, suggesting that hedging demand had not fully recovered even with the price rebound.

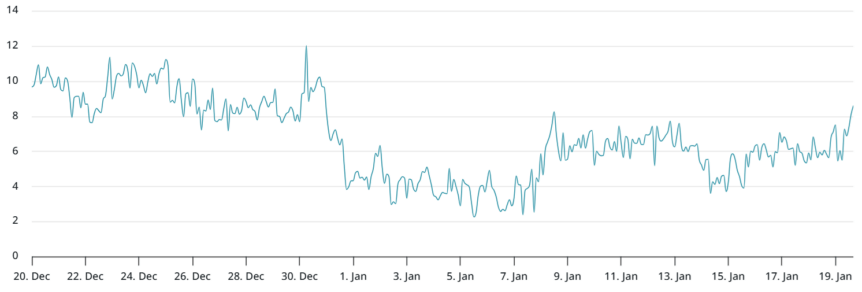

The annualized premium on Bitcoin futures, commonly known as the basis rate, stabilized around a neutral-to-bearish 5%. This suggests that the demand for leveraged long positions remained intact, even after Bitcoin's failed attempt to retake the $98,000 level. However, a cautious sentiment persisted within the derivatives market, hinting at a potential decline in institutional enthusiasm and a preference for hedges that protect against potential losses rather than chasing further upside gains.

Concurrently, Bitcoin spot exchange-traded funds experienced significant outflows, amounting to approximately $395 million on the preceding Friday. This occurred as gold and silver prices surged to new highs. This market dynamic negatively impacts Bitcoin's attractiveness as a hedging instrument and reinforces the view that traders are increasingly seeking downside protection amidst persistent macro-economic headwinds. The perceived fragility in the hedging setup may also indicate a broader diversification of risk, as investors adjust their exposure across various assets previously considered uncorrelated or alternative hedges.

Derivative market signals further underscored a cautious mood among investors. The Deribit delta skew, which measures the premium on put options relative to call options, increased to approximately 8%. In typically balanced markets, the delta skew usually fluctuates between -6% and +6%. The movement above 6% indicates that investors are willing to pay a premium to hedge against potential downside risks. This aligns with a sentiment of reduced conviction in a sustained rally beyond the $100,000 mark and a preference for hedging strategies in the face of macro-economic uncertainty.

Global Economic and Geopolitical Influences

Industry experts have commented on the global economic landscape. Deutsche Bank's head of FX research highlighted the significant exposure of European markets to U.S. assets, suggesting that Europe might be hesitant to support the U.S. dollar if the Western alliance faces strain. This observation emphasizes how international capital flows and geopolitical risks can directly influence cryptocurrency markets, where liquidity and hedging demand can shift rapidly in response to policy announcements and currency movements.

Economic data from China released in late 2025 presented a mixed outlook. The quarterly growth rate stood at 4.5% year-over-year, and exports remained robust, partly due to strong global demand. However, analysts cautioned that stimulus measures might be scaled back, potentially dampening domestic economic momentum and reducing global demand for risk assets, including Bitcoin. In this context, macro-economic catalysts continue to be the primary drivers of trader risk appetite, reinforcing the notion that crypto markets remain highly sensitive to broader economic conditions rather than solely isolated narrative trends.

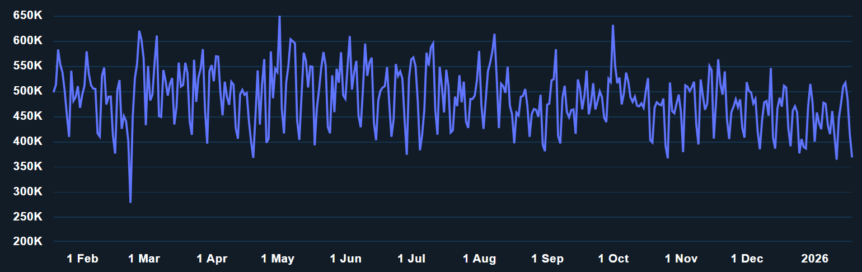

On-chain activity data suggests a cooling demand for network participation. According to Nansen, daily active addresses have decreased to around 370,800, representing an approximate 13% drop from two weeks prior. This decline is significant because sustained on-chain activity serves as a proxy for miner revenue and overall network health, both of which are foundational to the long-term investment case for Bitcoin. In the short term, reduced network activity, coupled with elevated regulatory or macro-economic risks, could limit upside momentum, particularly if institutional investors reassess risk premiums following a broader market pullback.

Outlook and Market Positioning

With multiple macro-economic factors at play—ranging from global trade tensions to policy decisions concerning Greenland and ongoing geopolitical hotspots—the trajectory for Bitcoin remains complex. The absence of strong bullish momentum in the derivatives market, combined with outflows from ETFs and declining on-chain activity, indicates that traders are adopting a cautious approach. The $92,000 level, which was previously a key point for a potential breakout, now faces increased resistance as market sentiment remains closely tied to evolving global developments rather than purely crypto-specific catalysts.