Bitcoin Faces Critical Year-End Countdown

Bitcoin is approaching a crucial two-month period that could significantly alter market sentiment for the asset, according to crypto analyst Will Clemente. If Bitcoin does not catch up to gold and stocks on a risk-adjusted basis by the end of the year, its case as more than just a diversifier may weaken going forward.

While Bitcoin's returns have outpaced gold and stocks since 2010, Clemente noted that there are no longer base effects to consider. Gold's market capitalization recently reached a record $30 trillion, surging over 54% this year to a new all-time high of $4,357 per ounce. This milestone makes gold 14.5 times larger than Bitcoin's market capitalization, which stands around $2.17 trillion.

Michal van de Poppe, founder of MN Trading Capital, suggested that capital from the gold market needs to rotate back into Bitcoin to help it break through its crucial resistance zone. This shift could occur either through a direct rotation of money or a broader move from risk-off to risk-on sentiment.

JPMorgan analysts have indicated that Bitcoin could still be undervalued by as much as 40% when compared to gold on a volatility-adjusted basis. At the time of publication, Bitcoin was trading at $111,190. A 40% increase would place its price around $156,000.

Analysts Anticipate Short-Term Price Bump for Bitcoin

Despite a recent price dip, sentiment across Bitcoin, Ethereum, and Solana suggests an anticipated recovery rather than further declines. Crypto Tristan expressed expectations of a significant bounce soon, while trader Jelle predicted a period of sideways movement followed by a sharp rebound after increased fear sets in.

Kevin Lee, chief business officer at crypto exchange Gates, believes Bitcoin is likely to regain momentum and stabilize between $120,000 and $125,000 in the near future. Economist Timothy Peterson, however, offers a more conservative outlook, suggesting a cooling-off period of three to four weeks before Bitcoin resumes its rally, potentially at a slower pace.

Both BitMines Tom Lee and BitMEX founder Arthur Hayes remain confident in their predictions that Bitcoin will reach $250,000 by the end of the year.

Ethereum's Potential Price Surge Underestimated, Analysts Say

Subtle signals emerging on Ethereum's price chart indicate that a significant price move is on the horizon. Crypto analyst Titan of Crypto suggests a bullish divergence may be playing out, an indicator that bears are losing momentum as the price hits a low while the oscillator does not.

Ethereum has seen an 11.10% decrease over the past 30 days, trading at $4,039.70 at the time of publication. Analyst SinaOsivand noted that Ethereum is quietly stabilizing with calm funding rates, and its structure appears ready for an upward movement, potentially targeting around $4,300 before the next altcoin season. He added that Ethereum is beginning to move on its own path, independent of Bitcoin.

Trader Mister Crypto stated that Ethereum is on the verge of entering a distribution phase that most observers will not anticipate. Technical analyst Crypto Caesar highlighted the $4,500 to $4,800 range on the ETH price chart, emphasizing the need to return to this zone as soon as possible. The last time Ether traded within this range was on October 10, prior to US President Donald Trump's tariff announcement on China, which impacted the crypto market.

Solana Poised for a Significant Breakout, Analysts Suggest

Solana's price may have found its local bottom, mirroring Ethereum's trend, according to John Bollinger, creator of the Bollinger Bands indicator. Bollinger suggested that it will soon be time to pay close attention, as the asset may have reached potential W bottoms, a bullish reversal signal indicating possible upward price movement.

Solana is currently trading at $189.87. Crypto trader Yimin X observed that Solana's supply is being absorbed around this price level and that the asset is coiling within a tight ascending channel. Yimin X believes Solana could be the next major breakout story, noting that each retest of the lower trendline has found buyers more quickly. If this pattern represents accumulation, the next upward move could be 50% higher, potentially bringing Solana back towards its January all-time high near $290.

Trader Alex Clay drew parallels between Solana's current setup and the recent rally of Binance Coin (BNB), which saw a 33% surge in 13 days earlier this month, reaching new highs of $1,293. Clay predicts that SOL will replicate the BNB scenario, suggesting that a breakout is imminent.

XRP Sees Increased Bullish Sentiment Amid Ripple Labs Interest and ETF Decisions

Crypto traders have become notably more optimistic about XRP in recent weeks, influenced by Ripple Labs' signaling of plans to purchase $1 billion worth of the token and the proximity of key ETF deadlines.

DustyBC Crypto informed his followers that the market is currently seeing some positive signs, indicating that bulls are re-entering the fight. He also pointed out that upcoming decisions on US-based XRP ETFs, expected before October 25, could significantly impact the token's price.

Currently, seven spot XRP ETF filings are under review by the US Securities and Exchange Commission. Additionally, Ripple Labs is reportedly planning to raise approximately $1 billion through XRP sales to establish its own digital-asset treasury, combining newly acquired tokens with a portion of its existing holdings.

XRP is trading at $2.53 at the time of publication, showing a 4.29% decrease over the past seven days. Traders anticipate that the $2.30 level will hold to some extent, as nearly $150 million in long positions face liquidation if XRP drops to that point, according to CoinGlass.

Options Traders Brace for Extended Volatility

Options traders are preparing for a period of sustained turbulence, according to Dr. Sean Dawson, head of research at onchain options protocol Derive. He expressed concerns that crypto market sentiment could deteriorate further in the coming weeks.

Dawson noted that volatility is increasing for both Bitcoin and Ether as markets grapple with fears of a renewed US-China trade war and a potential AI bubble burst. He pointed out that the 30-day implied volatility for Bitcoin has risen to 45% from 30% a month ago, while Ethereum's has climbed from 57% to 72% in the same period.

Dawson stated that traders are increasingly bracing for sustained turbulence, as the significant price swings observed earlier in October, coupled with growing macroeconomic uncertainty, have shaken confidence across the broader crypto market. Despite Bitcoin's steady price performance, traders are actively hedging against the risk of deeper drawdowns.

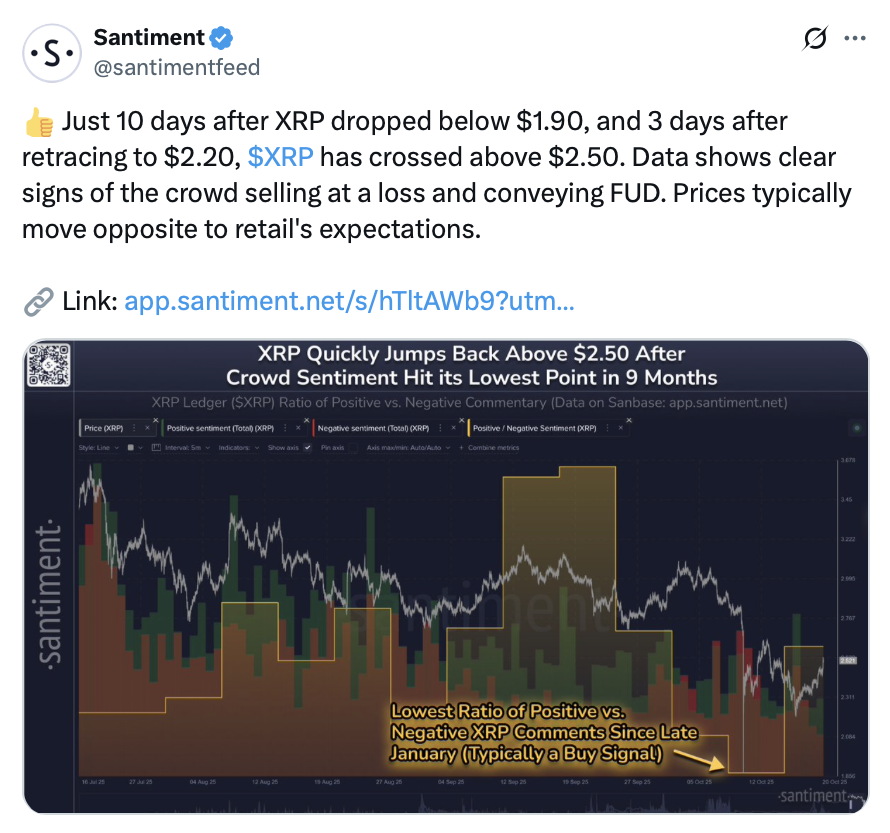

Santiment: Bullish Sentiment Emerges After Tariff-Induced Panic

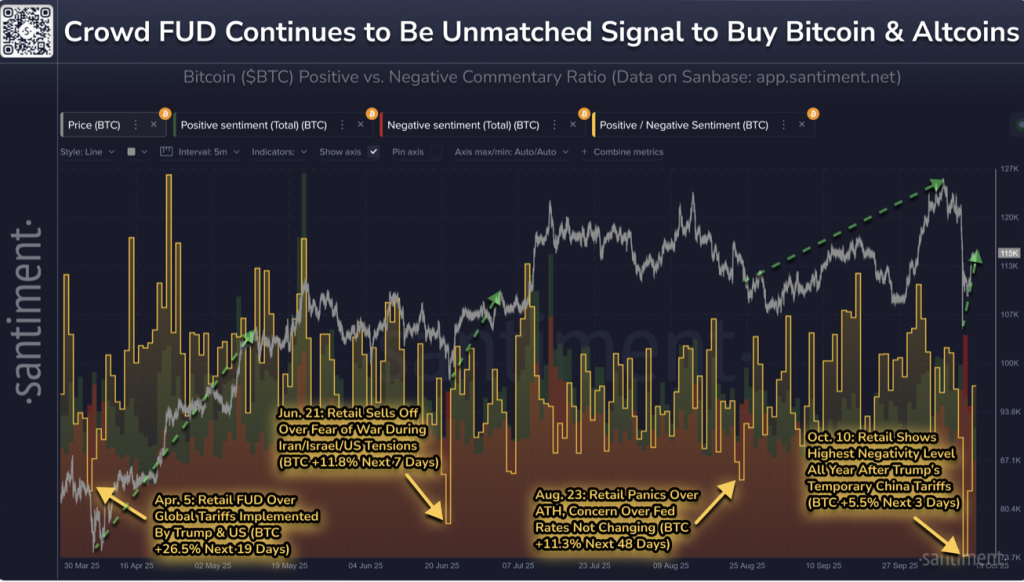

Retail traders experienced widespread panic following US President Donald Trump's announcement of a 100% tariff on Chinese imports on October 10, according to sentiment platform Santiment. The platform reported that crypto market fear reached its highest level of the year on the day after the tariff announcement.

However, Santiment suggests that these moments of panic have historically signaled strong buying opportunities for Bitcoin. The data indicates only three other days this year with comparable levels of fear, the first occurring in April, also triggered by Trump's global tariff comments.

Following a period of volatility, Bitcoin's price rebounded 26.5% in just 19 days. Santiment commented that in each of these instances, fear dominated due to global events that, in hindsight, were overreacted to from a market perspective. They added that retail emotions often lead to the opposite price movements for Bitcoin and altcoins, with smart traders capitalizing on crowd panic.

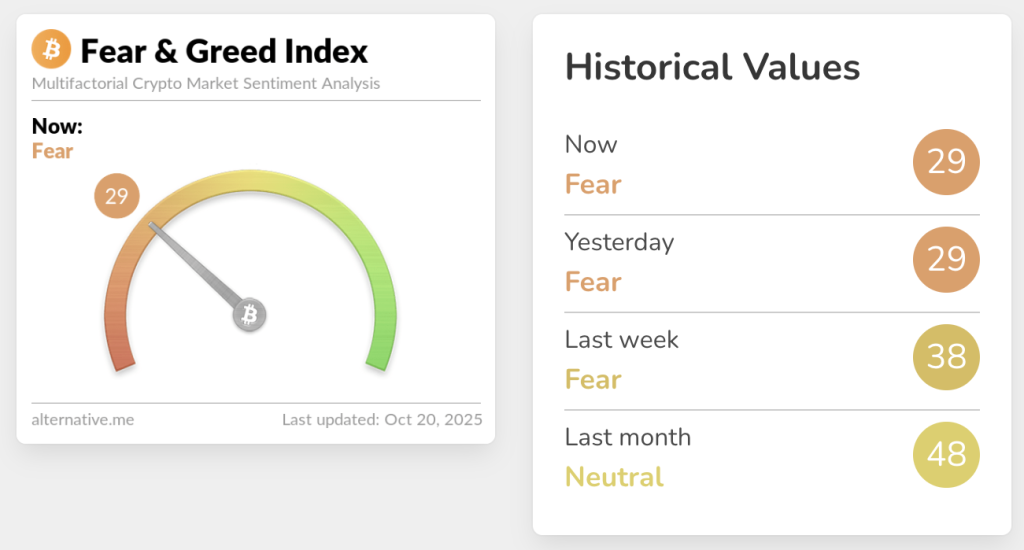

Other sentiment indicators reveal that crypto traders have not fully regained confidence since the tariff announcement impacted the market.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, has fallen significantly since Trump announced the tariffs on October 10. At that time, it registered a "Greed" score of 70, but it has since dropped to a "Fear" score of 29.

Retail investors are maintaining a cautious approach, as indicated by CoinMarketCap's Altcoin Season Index. The index currently shows a Bitcoin Season score of 26, a decrease from the Altcoin Season score of 51 recorded on October 9.