Bitcoin is trading back above $87,000, but what’s happening under the surface is drawing even more attention. New on-chain data shows that BTC has slipped into a zone it almost never touches outside of major market resets, the short-term holder MVRV deep-value band.

This metric, which tracks the unrealized profit/loss of recent buyers, rarely dips into capitulation territory. When it does, two conditions typically appear: sentiment becomes exhausted, and sellers begin running out of ammunition. That’s exactly what the chart now indicates, a level historically associated with early-stage accumulation, not late-cycle weakness.

What the MVRV Chart Is Signaling Now

The chart shared by Frank A. Fetter shows Bitcoin dropping out of its long-respected price bands, falling briefly to the negative side of the short-term holder MVRV range. Past instances show similar dynamics:

- •In mid-2024, BTC dipped into deep value around $49k, then rallied strongly.

- •In early 2025, another touch near $74k preceded a sharp upward continuation.

- •Now, the marker around $82k–$89k is flashing the same overshoot pattern.

BITCOIN IS NOW IN THE DEEP VALUE ZONE$BTC just dipped below the short-term holder MVRV bands – something it almost never does outside of major reset periods. When this metric rolls into “deep value,” it usually means two things: sentiment is washed out, and sellers are running… pic.twitter.com/m6fAUcDZ9C

— CryptosRus (@CryptosR_Us) November 23, 2025

This doesn’t promise an immediate reversal, but these zones have aged well historically; they tend to mark periods where long-term buyers quietly load up rather than exit the market.

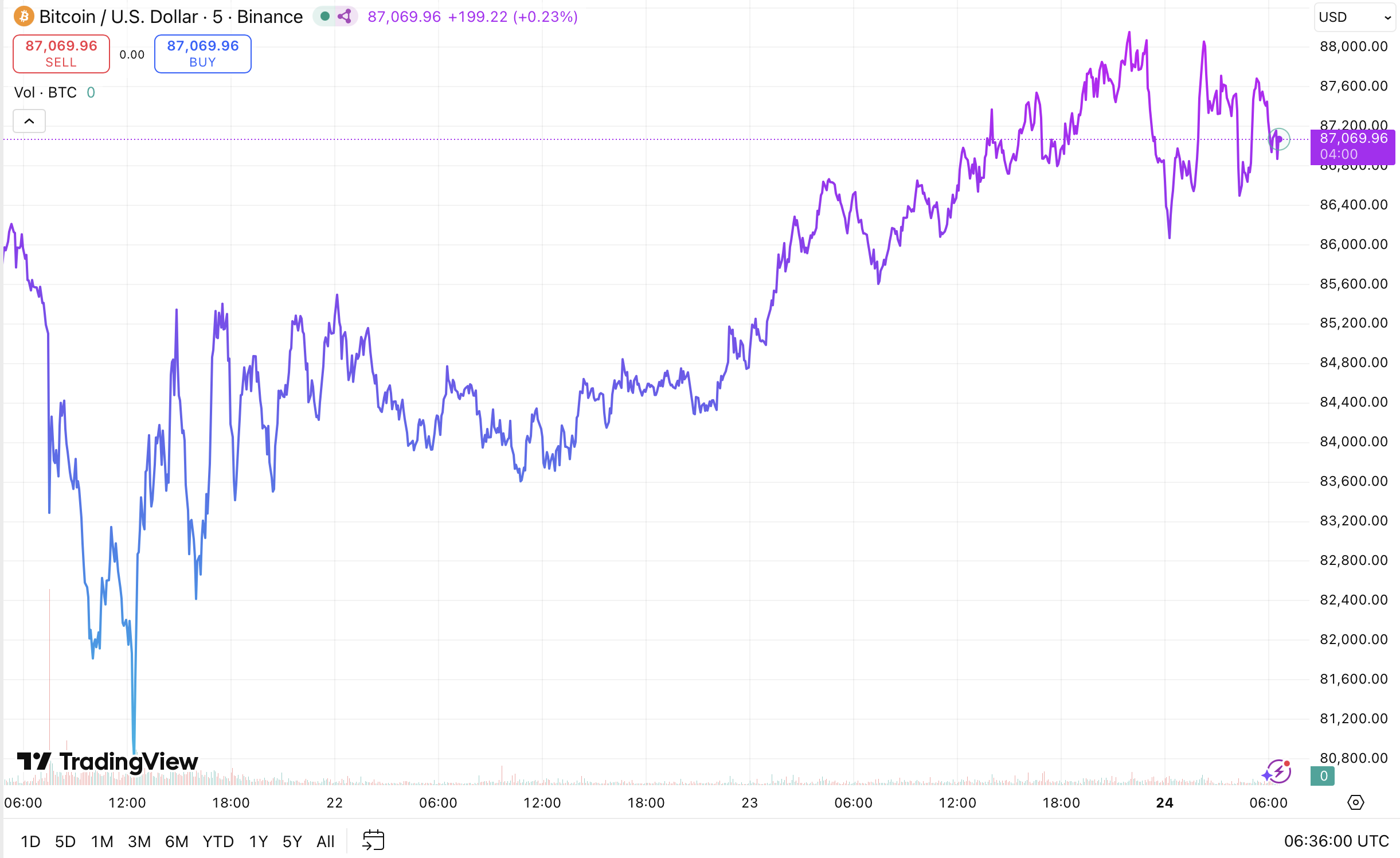

Price Action Shows Stabilization

Across the short-term chart, Bitcoin’s price has clawed back losses, rising from a week-long downtrend and holding above $87,000. The TradingView chart reflects a gradual recovery structure: deep volatility, repeated retests near $85k, and finally a breakout into higher consolidation during the latest session.

Momentum is still fragile, and intraday swings remain wide, but the structure is shifting from panic-driven selling toward more balanced two-way trading.

Market Conditions Suggest the Sell-Off Is Exhausting

Across key indicators, conditions are still tense:

- •RSI sits at 22.65 – heavily oversold, a level rarely sustained in strong markets.

- •Fear & Greed Index at 13 shows extreme fear, matching the on-chain signal that sentiment is washed out.

- •BTC still trades well below both the 50-day ($107,482) and 200-day ($105,108) SMAs, which means upside recovery would require momentum at scale.

Volatility at 8.62% remains high, consistent with an environment where liquidity is thin and reactions are amplified.

The Bigger Picture

Pullbacks that push Bitcoin into deep-value MVRV territory have historically become springboards for longer-term rallies. This doesn’t guarantee a bottom, but the combination of oversold RSI, extreme fear, and on-chain capitulation typically marks the part of the cycle where smart money enters, not exits.

For now, Bitcoin reclaiming $87,000 is an early sign that buyers are stepping back in. Whether this forms the next major base depends on how BTC behaves around the $85k–$88k support pocket, but the underlying metrics suggest the market may be closer to exhaustion than escalation.

If the pattern of past cycles repeats, this period of fear may age far better than it feels in real time.