Market Overview and Key Indicators

Bitcoin's price experienced a substantial decline of nearly 30% in November, following its October high. However, recent on-chain data and exchange activity suggest a stabilization is occurring, with positive USDT net flows indicating easing pressures and increased buying interest.

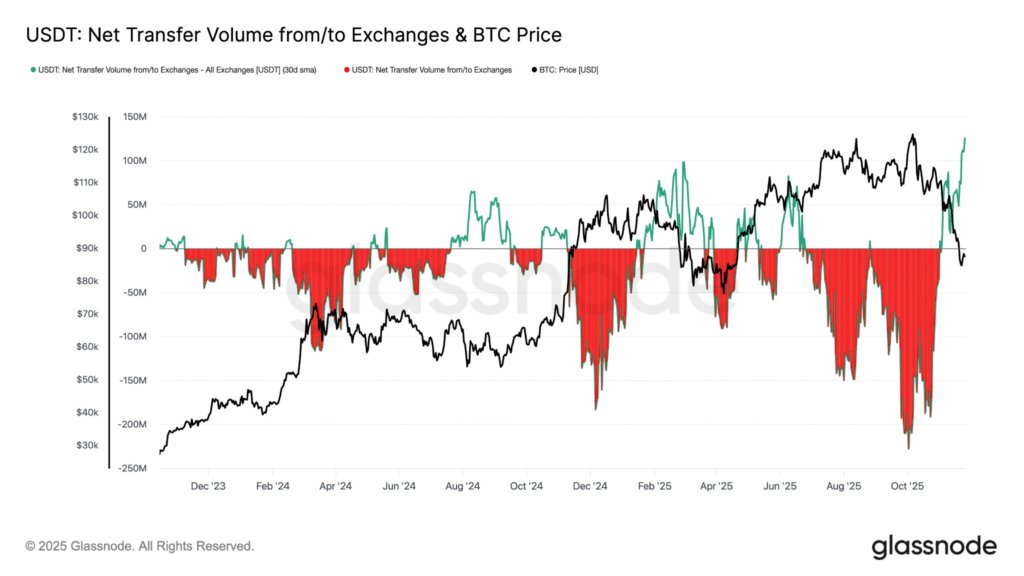

USDT Flows Shift to Support Bitcoin Stability

Analysis of USDT transfers to exchanges over the past two years, as examined by Glassnode, reveals a negative correlation between these flows and Bitcoin's price movements. During periods of high market excitement, large outflows often signify traders cashing out gains. At Bitcoin's recent peak of $126,000, daily USDT outflows exceeded $220 million, a pattern consistent with profit-taking at market highs. As prices subsequently fell, these outflows diminished, and net flows have now turned positive for the first time in weeks.

This shift indicates that less USDT is being moved off exchanges for immediate sales. The increased stablecoin liquidity remaining on trading platforms can bolster buying power. Glassnode's report highlights that such transitions in USDT flows frequently occur as market exuberance subsides and trading activity normalizes after periods of intense hype.

Bullish Divergence Points to Underlying Market Strength

An analysis by crypto analyst Misterrcrypto identified a hidden bullish divergence on Bitcoin's price chart. This pattern, characterized by a rising price trend alongside a declining momentum oscillator, suggests underlying buying power is accumulating despite recent selloffs. The divergence was observed during Bitcoin's dip in November when the cryptocurrency tested levels near $82,600.

Specifically, Bitcoin maintained a higher low compared to previous price swings, while the momentum indicator registered lower lows. This setup has historically preceded recoveries in 2024 and early 2025. Misterrcrypto's chart, utilizing daily candles, illustrates this discrepancy, implying that selling pressure is waning while buyers are quietly building positions. Such signals often precede upward price movements following a period of market consolidation.

$BTC HIDDEN BULLISH DIVERGENCE! pic.twitter.com/j4IonFICRi

— Mister Crypto (@misterrcrypto) November 26, 2025

Exchange Bids Fuel Quick Price Bounce on Bitcoin

Recent activity on major cryptocurrency exchanges indicates significant buying interest in Bitcoin. Analyst TedPillows highlighted strong bid walls on Binance and Coinbase, which contributed to a rapid price increase to $89,593. This surge followed Bitcoin's recent seven-month low around $82,600.

TedPillows shared a snapshot of the order books, showing substantial bids placed below the prevailing market price. This influx of demand from prominent exchanges can attract retail traders and amplify upward price momentum. The analyst noted that this activity represented actual spot buying, indicating genuine demand rather than solely leveraged trading. The price bounce occurred during U.S. trading hours, a period typically characterized by higher market liquidity.

Binance and Coinbase are bidding on $BTC today.

— Ted (@TedPillows) November 26, 2025

Some spot buying is finally happening. pic.twitter.com/7S8YeKyDsK