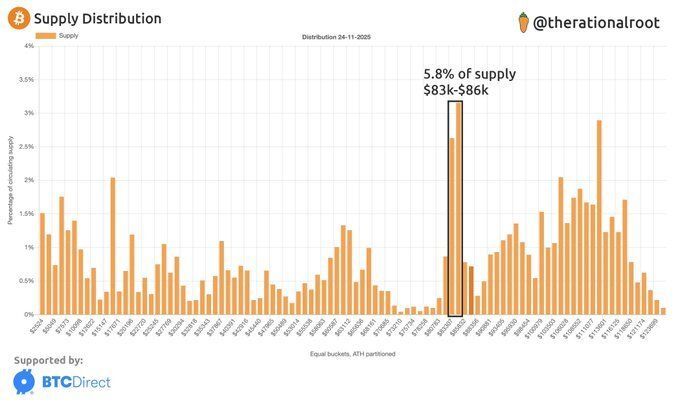

Bitcoin’s latest sell-off is leaving behind some unusual fingerprints on the blockchain. New on-chain data shows that a single price band, $83,000 to $86,000, absorbed 5.8% of the entire circulating BTC supply during the recent volatility spike. For comparison, redistribution events of this magnitude occur only a few times per cycle and are typically tied to emotional capitulation, not the start of a prolonged downturn.

On-chain analysts describe this as a transfer from short-term speculators to investors with deeper conviction. Many of the buyers near the top, often late-cycle tourists, exited in panic as prices reversed. Meanwhile, long-term holders stepped in, soaking up supply and effectively resetting the cost basis of a significant share of the market. Sharp concentration like this is rarely just “noise”, it tends to signal the late stages of large drawdowns rather than the beginning of a fresh collapse.

Macroeconomic Alignment and Cycle Dynamics

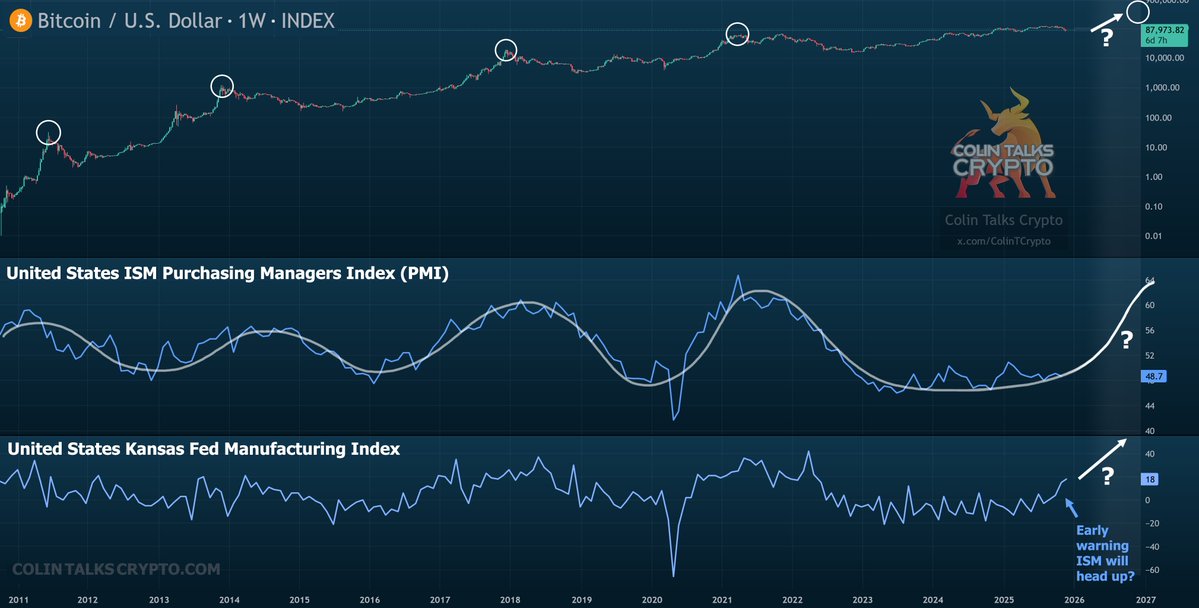

This internal shift is happening at the same time macro analysts are tracking a different signal altogether: the business cycle. An updated BTC-versus-ISM chart highlights something unusual about this bull run, Bitcoin never reached full euphoria.

Traditionally, major tops coincide with the ISM Manufacturing Index rising sharply, reflecting an “excess liquidity” environment. But this time, Bitcoin has been mirroring the ISM more closely rather than outpacing it. With the ISM now extended, Bitcoin is also cooling off, creating an atypical alignment.

If the ISM is indeed leading Bitcoin’s path, one possible scenario is forming: a milder-than-normal bear market, followed by a much earlier next top, possibly in late 2026 or even 2027, accompanied by real euphoria instead of the muted sentiment seen this cycle. The follow-through effect could break the traditional four-year cycle and extend the broader crypto cycle into a multi-year curveball.

Conclusion: A Structural Reset

Both narratives, the on-chain supply flush and the macro-cycle lag, point to the same core idea: what’s happening now may not be the end of the cycle, but a structural reset inside it. Emotional sellers have exited, strategic buyers have stepped in, and the macro environment suggests the bigger moves may still be ahead.