Market Stabilization Indicators

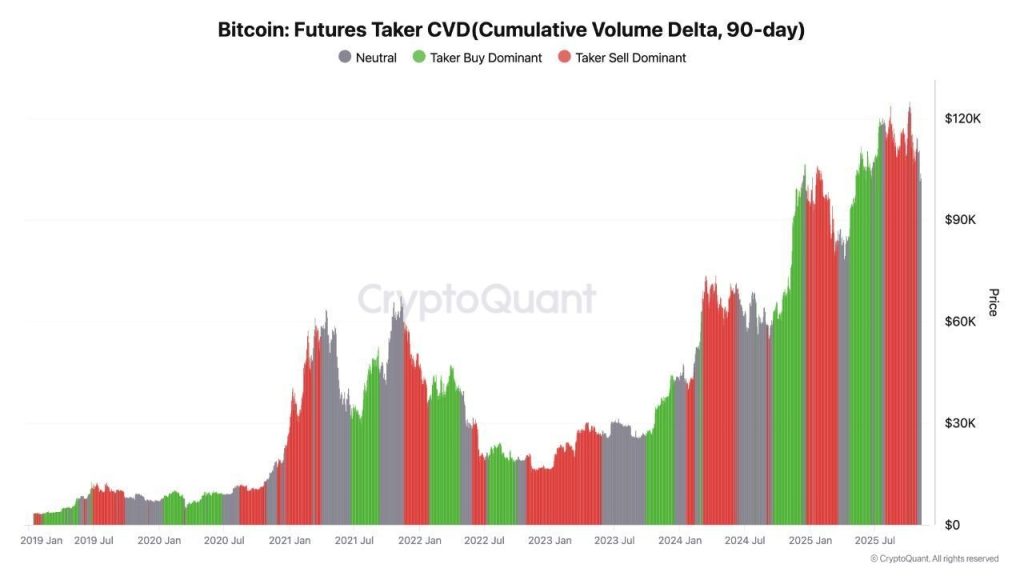

Bitcoin is beginning to show signs of recovery as several on-chain indicators point toward easing downward pressure and market stabilization. Futures Taker CVD (90-day) shows that dominant taker-sell activity is decreasing, signalling a slowdown in aggressive shorting and forced deleveraging.

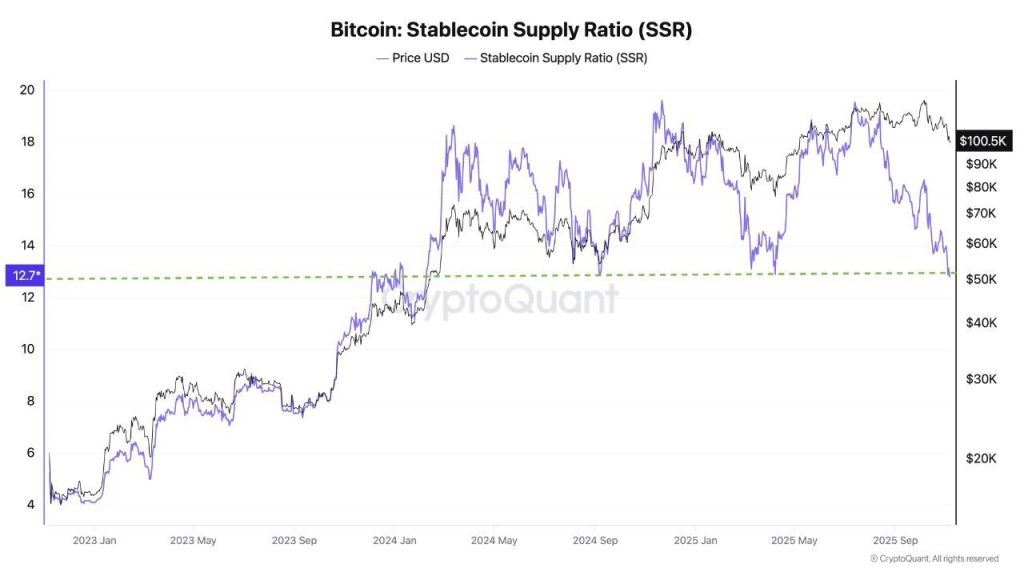

Spot Taker CVD remains slightly negative, yet the level of selling is much lower than previous capitulation phases, suggesting retail investors are cautious but not panicked. At the same time, the Stablecoin Supply Ratio has declined to 12.7, reflecting stronger stablecoin liquidity relative to Bitcoin’s market cap.

This lower SSR indicates growing buying power on the sidelines, which could support a shift in momentum if confidence returns. Additionally, the Adjusted Spent Output Profit Ratio (aSOPR) is hovering near 1.0, showing that most BTC is being sold at or near cost basis.

That behaviour suggests market participants are neither deeply in profit nor loss, a condition often associated with price equilibrium and early bottom formation. With forced selling mostly behind and liquidity improving, the market appears to be preparing for a potential reversal.

However, sentiment remains fragile and needs a positive macro or institutional trigger to shift momentum decisively. Without such a catalyst, Bitcoin may continue consolidating as investors await clearer signals.

ETF Outflows and Resistance Pose Hurdles

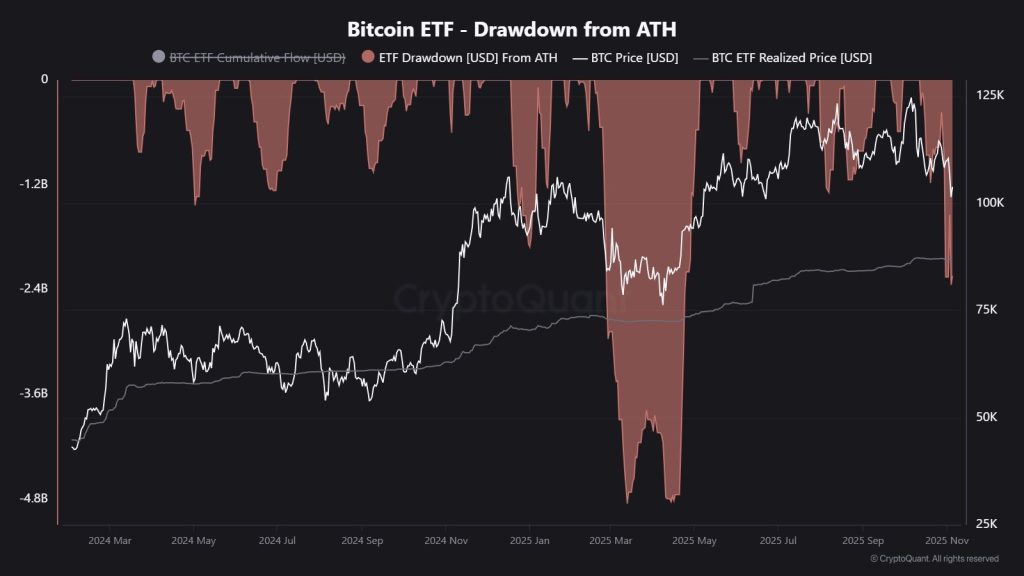

Bitcoin ETF flows have recorded a cumulative outflow of approximately $2.3 billion, marking the steepest decline since May 2025. This reduction in demand has contributed to the recent price weakness, as institutional inflows slow significantly.

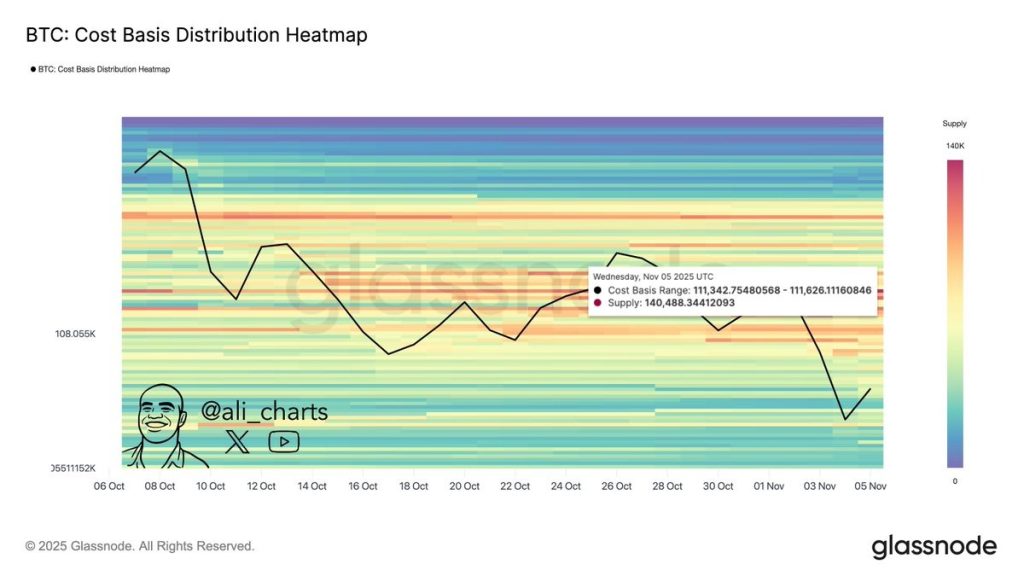

Cumulative ETF drawdowns have now fallen below -$2.4 billion, making it difficult for Bitcoin to regain strong upside momentum. At the same time, a large supply zone has formed between $111,300 and $111,600, where nearly 140,488 BTC were acquired.

This creates a major resistance level, as many investors may look to sell at breakeven if prices revisit that range. Meanwhile, Bitcoin continues to trade near $101,817, remaining well below this key resistance band.

Moreover, the absence of strong inflows and persistent overhead supply may keep the price capped in the short term. Bitcoin will likely need renewed investor confidence or favorable market developments to break through and sustain a bullish trend.