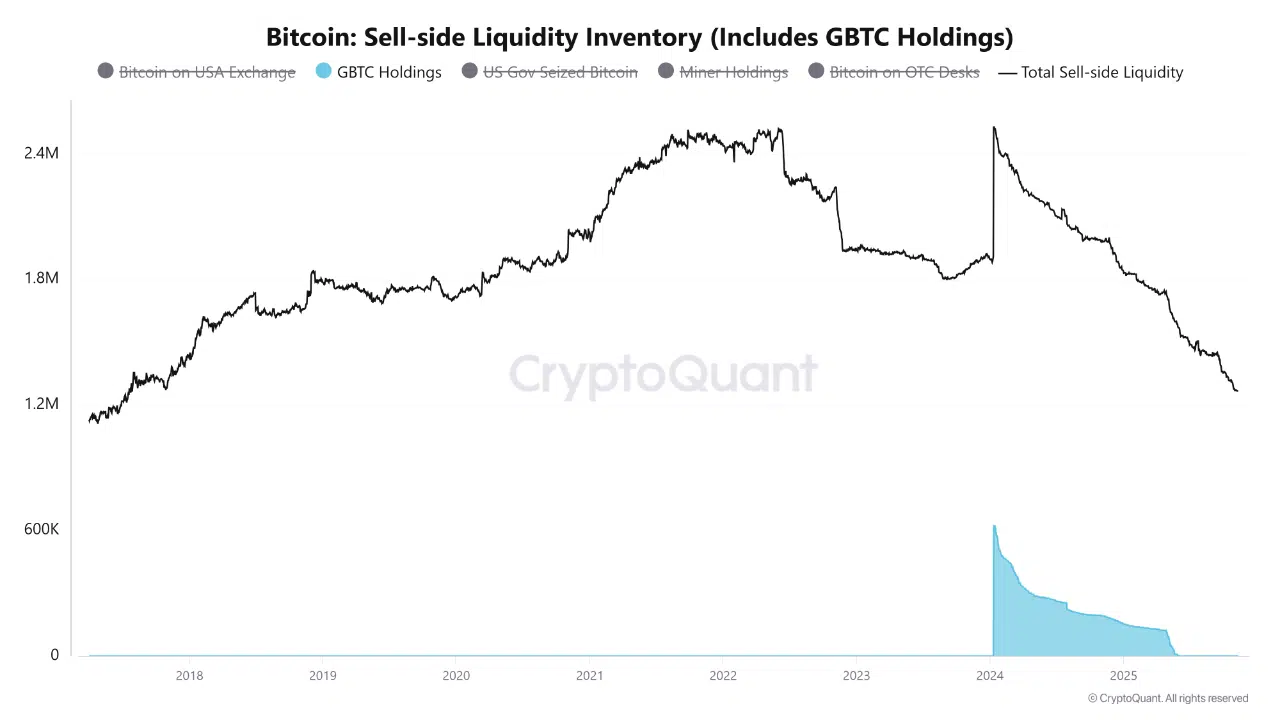

Fresh data from CryptoQuant reveals that Bitcoin’s market structure is undergoing a notable supply contraction. The Bitcoin: Sell-Side Liquidity Inventory, which tracks coins available for sale across exchanges and institutional vehicles like GBTC, has dropped to just 1.27 million BTC, marking its lowest level in recent years.

This ongoing liquidity squeeze indicates that whales and institutional holders continue pulling coins from trading venues, reinforcing the trend toward self-custody and long-term accumulation. Despite the global decline, Binance remains a stabilizing force, with exchange reserve data showing approximately 566,000 BTC, or about 45% of the world’s active sell-side liquidity.

Analysts interpret this divergence as evidence of redistribution, where liquidity leaves competing exchanges but consolidates within major venues such as Binance, a setup often observed before significant directional price movements.

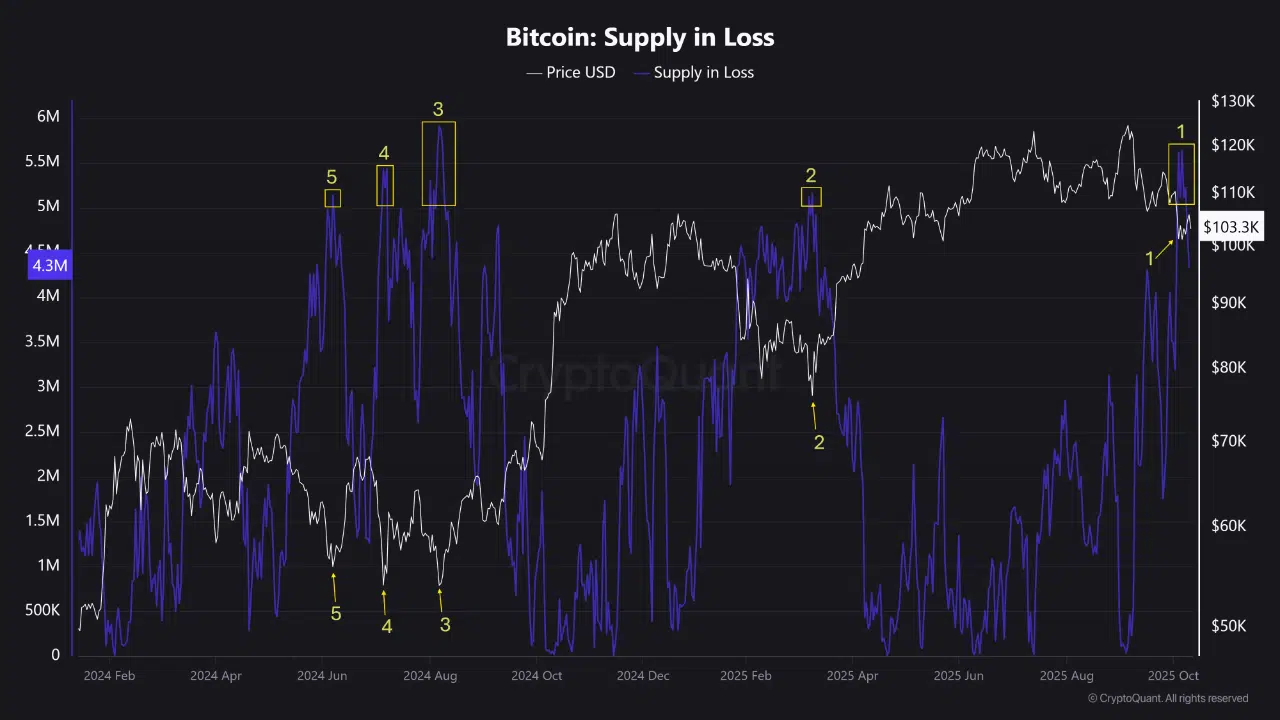

Bitcoin Supply in Loss Hits Key Threshold

Complementary on-chain data shows that more than 5.6 million Bitcoins are currently held at a loss, a condition last seen during the April 2025 bottom, when Bitcoin traded near $74,500. The current reading, taken at a market price of $98,966, mirrors similar levels from mid-2024, which historically marked strong accumulation phases.

Outlook: Consolidation Before the Next Move

The convergence of shrinking sell-side liquidity and rising supply in loss suggests that the market is in a late-stage correction or consolidation phase. With fewer coins available for sale and exchange reserves stabilizing, analysts expect volatility to compress further before a potential major upward reaccumulation breakout.

As supply tightens and large holders continue to absorb available liquidity, Bitcoin’s structural backdrop increasingly resembles prior pre-rally environments, setting the stage for what could be the next significant shift in the market cycle.