Bitcoin experienced a rebound, surpassing the $110,000 mark following an agreement between President Donald Trump and China's Xi Jinping on a one-year trade truce. This development helped to de-escalate tensions in the ongoing trade confrontation that had previously posed a threat to the global economy.

The agreement provided relief from fears of further escalation in the US-China trade war, which had caused significant fluctuations in global markets earlier in the month. Bitcoin, which had dipped close to $108,000 before the announcement, recovered to trade at $110,318.60 as of 5:35 a.m. EST, according to data from CoinMarketCap.

Under the terms of the pact, China has agreed to postpone export controls on rare earth minerals for a year. In parallel, the United States will cancel planned 100% tariffs on Chinese goods and reduce a fentanyl-related duty by half. However, the truce did not resolve numerous existing trade disputes, which contributed to a tempered optimism across risk-sensitive assets.

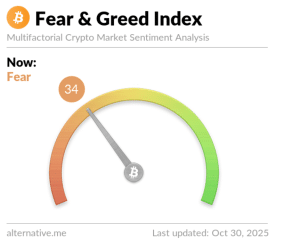

Despite Bitcoin's recovery, the overall sentiment in the cryptocurrency market remains cautious. The Crypto Fear & Greed Index saw a significant drop to 34, indicating a "Fear" sentiment. This represents a 17-point decline from the previous day's "Neutral" reading of 51.

Ethereum (ETH), a leading altcoin, experienced a decline of over 2%, with XRP also seeing a similar drop. BNB and Solana recorded only minor losses. Meme coin Dogecoin (DOGE) fell by more than 1%, while TRON (TRX) and Cardano (ADA) saw price decreases of less than 1% and over 1%, respectively.

Collectively, the broader cryptocurrency market capitalization decreased by more than 2%, settling at $3.73 trillion.

Investors Remain Fearful As Dalio Warns of a Bubble

Billionaire investor Ray Dalio expressed concerns about "a lot of bubble stuff going on" in the current market conditions during a recent interview with CNBC. He drew parallels between the present economic climate and the late 1990s.

This warning was issued shortly after the Federal Reserve announced a 25 basis point interest rate cut, which could potentially contribute to inflating the bubble Dalio is concerned about by lowering borrowing costs.

Dalio highlighted similarities between the current market landscape and the periods leading up to market crashes in 1998-1999 and 1927-1928.

Ray Dalio has a history of calling crises before they strike.

He accurately predicted:

✅ Dotcom Bubble – 2000

✅ Great Recession – 2008

✅ Covid Crash – 2021Now he warns: “𝙎𝙤𝙢𝙚𝙩𝙝𝙞𝙣𝙜 𝙬𝙤𝙧𝙨𝙚 𝙩𝙝𝙖𝙣 𝙖 𝙧𝙚𝙘𝙚𝙨𝙨𝙞𝙤𝙣 𝙞𝙨 𝙘𝙤𝙢𝙞𝙣𝙜!” ⚠️

Here’s what he… pic.twitter.com/7PDmbJFzOj

— Karan Singh Arora (@thisisksa) September 3, 2025

Dalio stated, "We certainly must say that whether or not it’s a bubble and when that bubble’s going to burst, maybe we don’t know exactly," adding that there is currently "a lot of risk" present in the market.