Bitcoin’s latest rebound is being led by real buying activity in the spot market rather than speculative leverage, according to fresh on-chain data shared by CryptoQuant and highlighted by analyst Amr Taha.

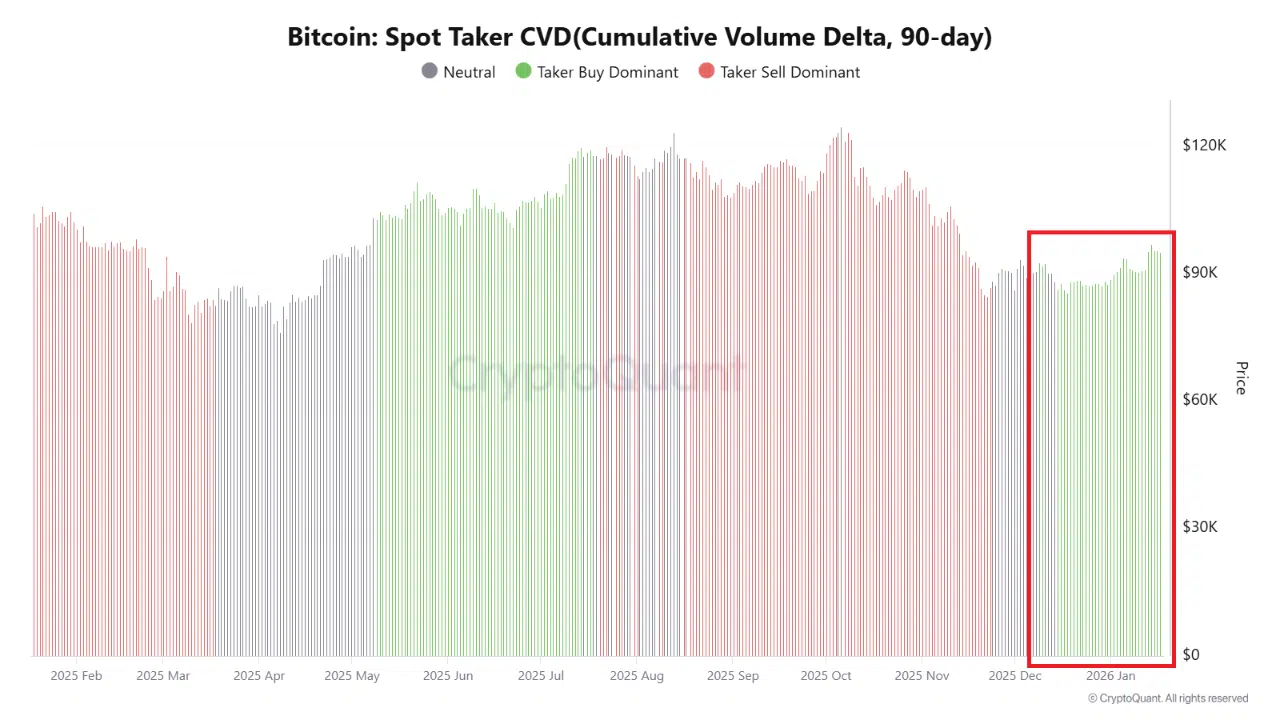

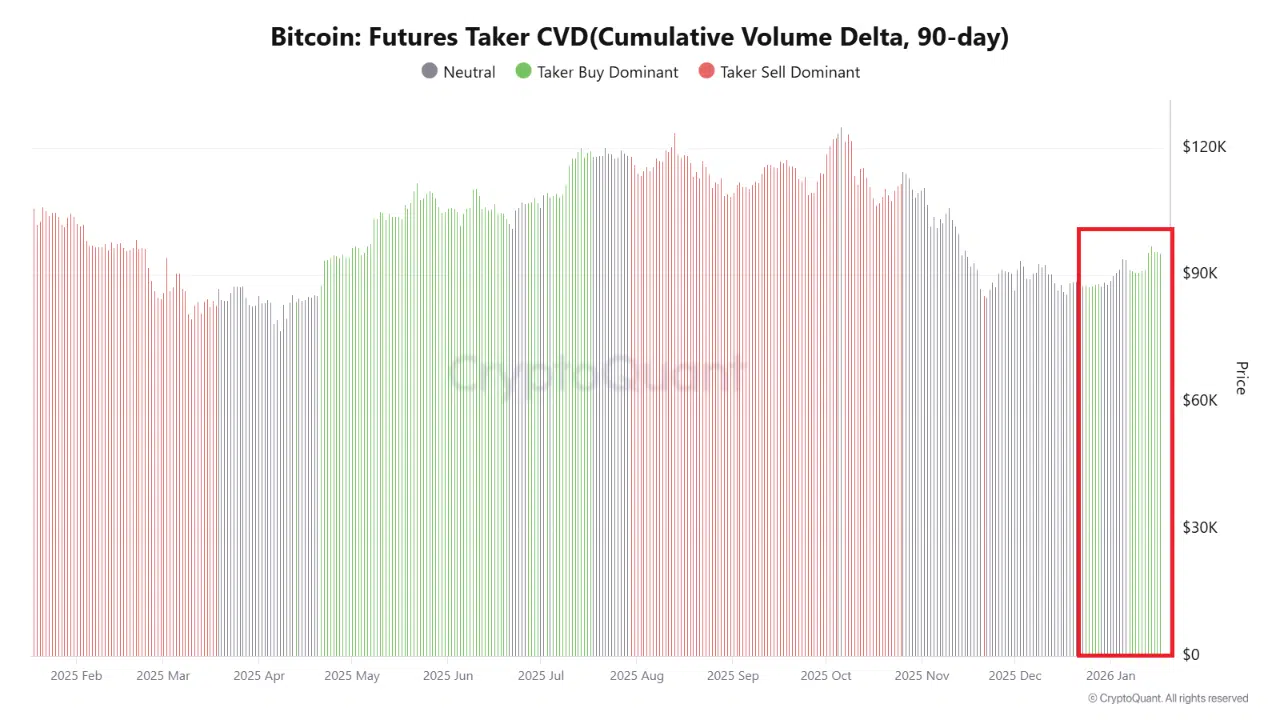

The charts track Spot and Futures Taker CVD (Cumulative Volume Delta) over a 90-day period, a metric that reveals whether aggressive buyers or sellers are in control. Unlike price alone, Taker CVD shows who is initiating trades, offering insight into the quality of a market move.

Spot Market Flips Back to Buyer Control

The first chart shows Bitcoin Spot Taker CVD turning decisively green in late December and continuing into January. Green bars indicate taker-buy dominance, meaning market participants are aggressively buying BTC on spot exchanges rather than passively bidding.

This shift is notable because it follows an extended period earlier in the quarter where spot flows were dominated by sellers. The recent transition signals a return of genuine demand, rather than short-lived price support from derivatives positioning.

During this phase, Bitcoin’s price stabilized and rebounded into the $90,000–$95,000 range, aligning closely with the improvement in spot-side demand.

Futures Follow, But Do Not Lead

The second chart, Bitcoin Futures Taker CVD, tells a complementary story. Futures activity also turned buy-dominant, but only after the spot market had already flipped.

This sequencing matters. In overheated rallies, futures leverage typically leads first, pulling price higher before spot demand arrives. In this case, the opposite occurred: real spot buying emerged first, and leveraged traders followed later.

According to CryptoQuant, this pattern suggests the market is not in a late-stage leverage-driven rally, but rather in an early-to-mid phase of demand recovery.

Why This Matters for Market Structure

Leverage-driven rallies often unwind violently, as small price moves trigger cascades of liquidations. By contrast, spot-led advances tend to be more durable because they reflect outright capital deployment rather than borrowed exposure.

With spot capital currently leading:

- •Downside risk from mass liquidations is reduced

- •Price action appears structurally healthier

- •Medium-term upside becomes more plausible without immediate overheating

As Amr Taha notes, the current rebound is “built by spot demand, not leverage”, a key distinction for traders watching sustainability rather than short-term momentum.

Big Picture Takeaway

CryptoQuant’s data suggests Bitcoin’s recovery is being underpinned by real buyer interest, not speculative excess. While volatility remains part of the equation, the dominance of spot buying points to a market that is rebuilding strength rather than chasing a fragile breakout.

If spot demand continues to absorb supply near current levels, Bitcoin may have room to consolidate or grind higher without the instability typically associated with leverage-heavy rallies.