Bitcoin Ready to Skyrocket – Analysts Say the Bottom Is In

Technical indicators from TradingView reveal that the daily Relative Strength Index (RSI) has cooled to 41.6, while the MACD hovers near a potential bullish crossover zone – both hinting that the market may be preparing for a rebound after weeks of consolidation.

According to prominent analyst Michaël van de Poppe, Bitcoin is “still holding up nicely,” suggesting that volatility caused by thin order books could soon give way to renewed strength.

He believes the market remains structurally healthy and anticipates a fresh all-time high once price breaks above the $118,000 resistance area.

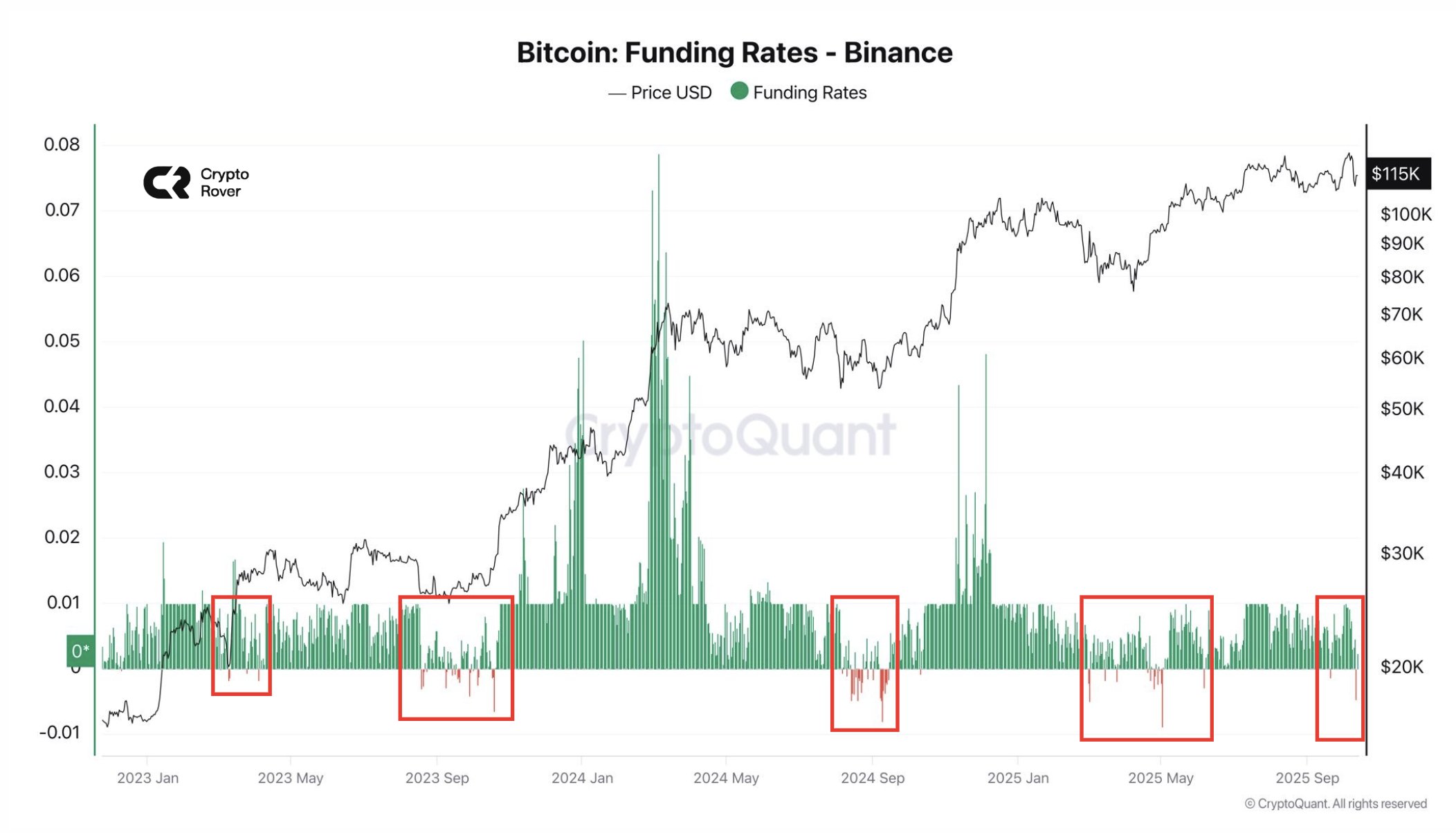

Adding to this bullish sentiment, Crypto Rover highlighted that Bitcoin funding rates on Binance have flipped negative – historically a strong “bottom signal.”

Negative funding rates typically indicate that short positions outweigh longs, often occurring near local lows before an upward reversal.

Market data supports this outlook, as every previous period of negative funding since 2023 has preceded a notable recovery phase. If this pattern holds, Bitcoin could be entering a similar accumulation zone before its next leg up.

At the same time, the overall sentiment remains cautious. The RSI’s current level reflects reduced momentum, suggesting that buyers are waiting for confirmation of strength. However, analysts agree that the key psychological level remains at $110,000 – as long as Bitcoin stays above it, the broader uptrend remains intact.

Traders are now watching whether Bitcoin can reclaim the $115,000-$118,000 range in the coming days, which could open the path toward retesting its $130,000 highs.

While short-term volatility may persist, the convergence of negative funding rates, stable technical indicators, and optimistic analyst commentary points toward a potential recovery phase ahead. If buying pressure strengthens as expected, Bitcoin could soon attempt to break new highs before the year’s end.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.