Market Volatility and Price Drop

The cryptocurrency market experienced significant volatility today, with Bitcoin briefly falling below the $106,000 mark. This sharp decline led to a massive liquidation cycle in futures trading.

Bitcoin (BTC) has since recovered to trade at $106,376 after its dip below $106,000, according to available data. The cryptocurrency registered a daily loss of 3.74%, contributing to a weekly decline of 7.5%.

Futures Market Liquidations

The sudden price drop triggered extensive liquidations in the futures market. In the last 24 hours, a total of $1.13 billion worth of positions were liquidated. The majority of these liquidations, $1.05 billion, came from long positions, while only $79.8 million originated from short positions.

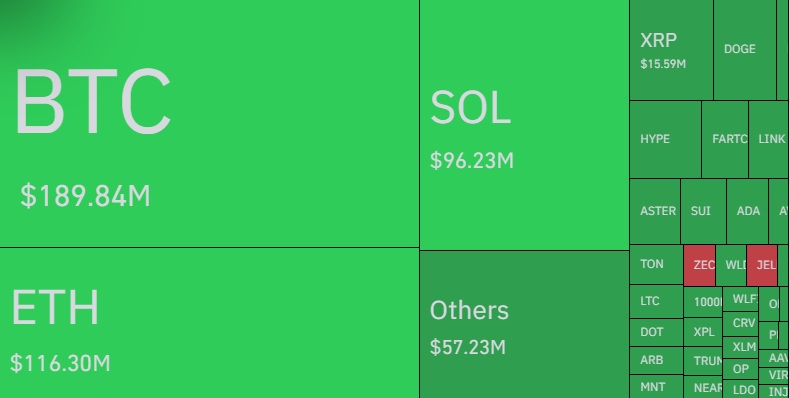

Bitcoin investors bore the largest share of these liquidations. The breakdown of liquidated positions is as follows:

- •BTC: $189.84 million

- •ETH: $116.30 million

- •LEFT: $96.23 million

- •XRP: $15.59 million

Further data indicates that $610.8 million worth of positions were liquidated in the last hour alone, with $595.7 million of that amount stemming from long trades.

Impact on Major Altcoins

The panic selling sentiment extended beyond Bitcoin, affecting other prominent altcoins as well. Several major cryptocurrencies saw significant price drops:

- •Ethereum (ETH) is currently trading around $3,625, marking a 6.22% decrease.

- •Solana (SOL) experienced an 8.53% decline, falling to $169.

- •BNB is down by 8.46%, trading at $991.

- •XRP has dropped 5.95% to $2.36.