The Bitcoin price experienced a significant drop of 6.4% over the past 24 hours, trading at $97,297 as of 2:21 a.m. EST. This decline occurred on trading volume that surged by 47% to $110 billion.

This slump contributed to a broader market downturn, with the total cryptocurrency market capitalization falling 6% to $3.37 trillion. The Crypto Fear & Greed Index indicated "extreme fear" within the market.

US spot Bitcoin ETFs (exchange-traded funds) recorded net outflows totaling $869.9 million on Thursday, marking their second-largest outflow on record, according to Coinglass. The largest single-day outflow previously occurred on February 25, when these ETFs lost $1.14 billion.

Bitcoin feeling the heat!

🔴 Spot ETFs saw $866.7M in outflows yesterday, the second highest in history.

Stay strong and HODL! 💪 pic.twitter.com/05oG86HPp0

— Carl Moon (@TheMoonCarl) November 14, 2025

Grayscale's Bitcoin ETF was the primary driver of these outflows, with $318.2 million exiting the fund. BlackRock's IBIT followed with $256.6 million in outflows, and Fidelity's FBTC saw outflows of $119.9 million.

Amidst the falling Bitcoin price, the Bitcoin mining firm CleanSpark announced it had repurchased 30.6 million shares for $460 million.

“Our repurchase of more than 10% of our outstanding shares for approximately $460 million reinforces our confidence in the business we’re building and our commitment to long-term value creation.”

What it isn’t.

Not an ATM.

Not an equity offering.

No insiders are… https://t.co/ahu88HgWCk— S Matthew Schultz (@smatthewschultz) November 13, 2025

The company stated that this share buyback aligns with its strategy to enhance shareholder value and optimize its capital structure.

With Bitcoin having declined by more than 13% in the past month, market participants are questioning whether the bearish trend will persist or if bullish momentum will return.

Bitcoin Price: A Healthy Correction

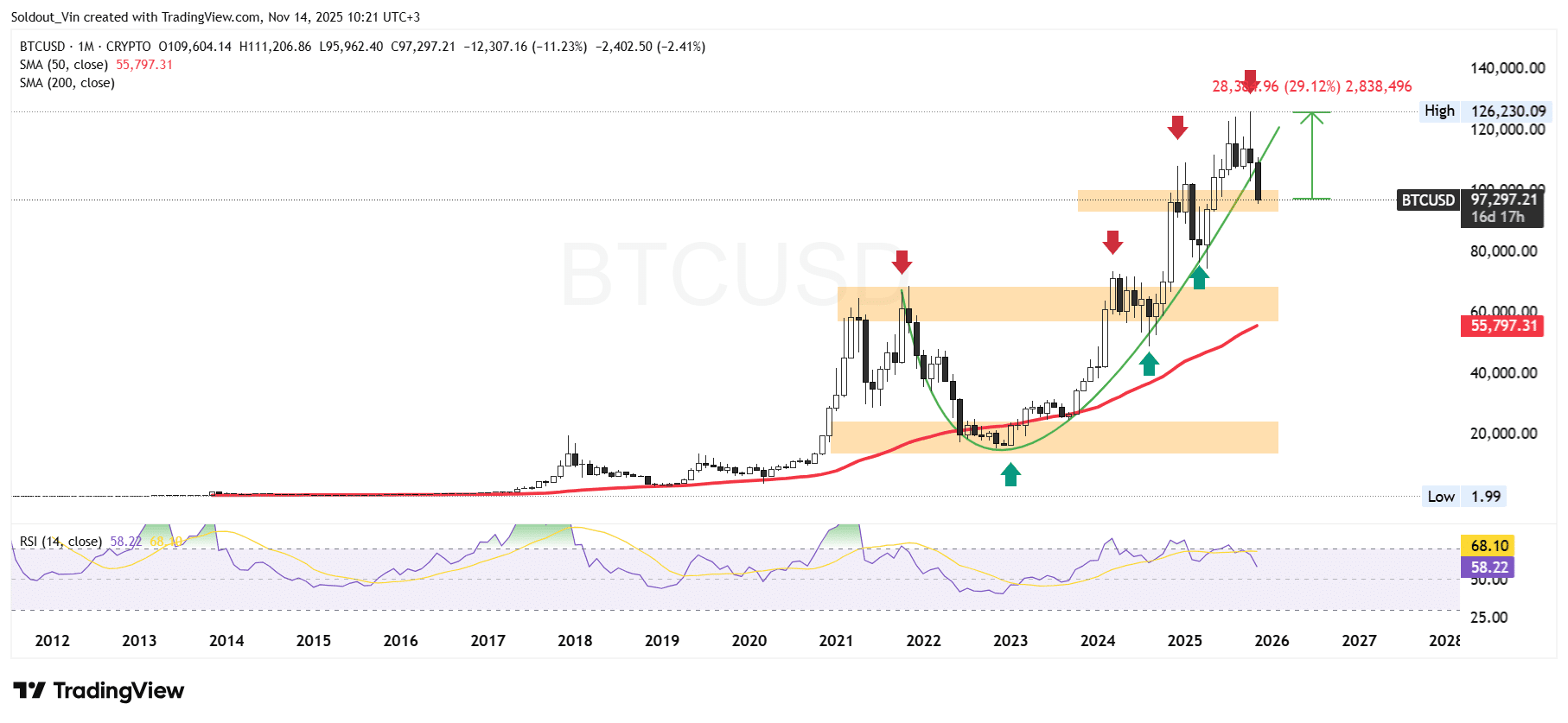

Following its peak at the $68,500 resistance level in 2021, the Bitcoin (BTC) price corrected to find support around $15,600 in 2022.

Bitcoin bulls have maintained control since successfully surpassing the $25,000 resistance level and the demand zones at $58,000 and $92,000.

As a consequence of this surge, Bitcoin's price has remained within a clearly defined parabolic curve.

The sustained upward movement has kept the BTC price above the 50-day Simple Moving Average (SMA) on the monthly chart.

However, after reaching an all-time high (ATH) of $126,230, Bitcoin's price appears to be undergoing a correction, with the most recent candle falling below the curve's boundary.

In response to the bearish market pressure, the Relative Strength Index (RSI) has also decreased, moving from the overbought zone of 70 down to 58.

As the RSI continues to trend lower, the Bitcoin price may experience further declines. The next potential support zone is identified at $81,479. Should the bears manage to breach this level, the subsequent support zone would be the 50-day SMA, located at $55,797.

According to prominent crypto analyst Ali Martinez on X, if BTC falls below $95,930, the next critical support levels to watch are $82,045 and $66,900.

Below $95,930, the next key support levels for Bitcoin $BTC sit at $82,045 and $66,900. pic.twitter.com/EmxusQlQde

— Ali (@ali_charts) November 14, 2025

Conversely, if the bulls successfully defend the $94,000 support zone, Bitcoin could potentially rally back towards its ATH of $126,230, representing a 29% increase from its current trading price.

Michaël van de Poppe, a well-known analyst on X with a substantial following of over 814,000, suggests that BTC needs to reclaim the $101,000 level for any significant rally to materialize.

In order to have a trendswitch, markets need to bounce above the previous support level to reclaim that level for support.

Of course, $BTC is showing weakness here, and it's sub $100K, so then you'd like to see a reclaim of $101K to think of any upwards rally.

Key reason for… pic.twitter.com/WsJA5ZwHBZ

— Michaël van de Poppe (@CryptoMichNL) November 14, 2025

Market sentiment will also be significantly influenced by the Federal Reserve's decision on interest rates next month. Currently, the probability of a rate cut has decreased to just 49.6%, according to CME Group's FedWatch Tool.