Market Overview

The Bitcoin price experienced a significant decline, dropping 5.6% over the past 24 hours to trade at $90,108. This downturn occurred on trading volume that surged by 43% to $114.6 billion. This price action follows a dip below the $90,000 mark for the first time since April, contributing to a broader slump that has seen BTC lose 13.5% in the past week and erase its year-to-date gains.

BTC has slid considerably from its all-time high of over $126,000. This reversal comes amid growing economic uncertainties, including renewed concerns regarding interest-rate policies and valuations across various markets that are considered stretched.

Key Investor Activity

Despite the ongoing price decrease, Michael Saylor's Strategy firm revealed a significant purchase of $835.6 million in Bitcoin during the seven days ending Sunday. This marks the firm's largest acquisition since July, bringing its total holdings to 649,870 tokens, valued at approximately $61.7 billion.

Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK

— Michael Saylor (@saylor) November 17, 2025

In parallel, El Salvador added 1,090 BTC to its national reserves on Monday evening. This represents the country's largest single-day Bitcoin acquisition to date, increasing its total holdings to 7,474 BTC, worth around $676 million.

Hooah!

— Nayib Bukele (@nayibbukele) November 18, 2025

Market Sentiment and Technical Analysis

Cameron Winklevoss's Outlook

With Bitcoin trading below $90,000, Gemini co-founder Cameron Winklevoss expressed his belief on X that this represents the "last time" investors will have the opportunity to purchase Bitcoin under this price threshold.

This is the last time you'll ever be able to buy bitcoin below $90k!

— Cameron Winklevoss (@cameron) November 18, 2025

Technical Indicators and Bearish Pressure

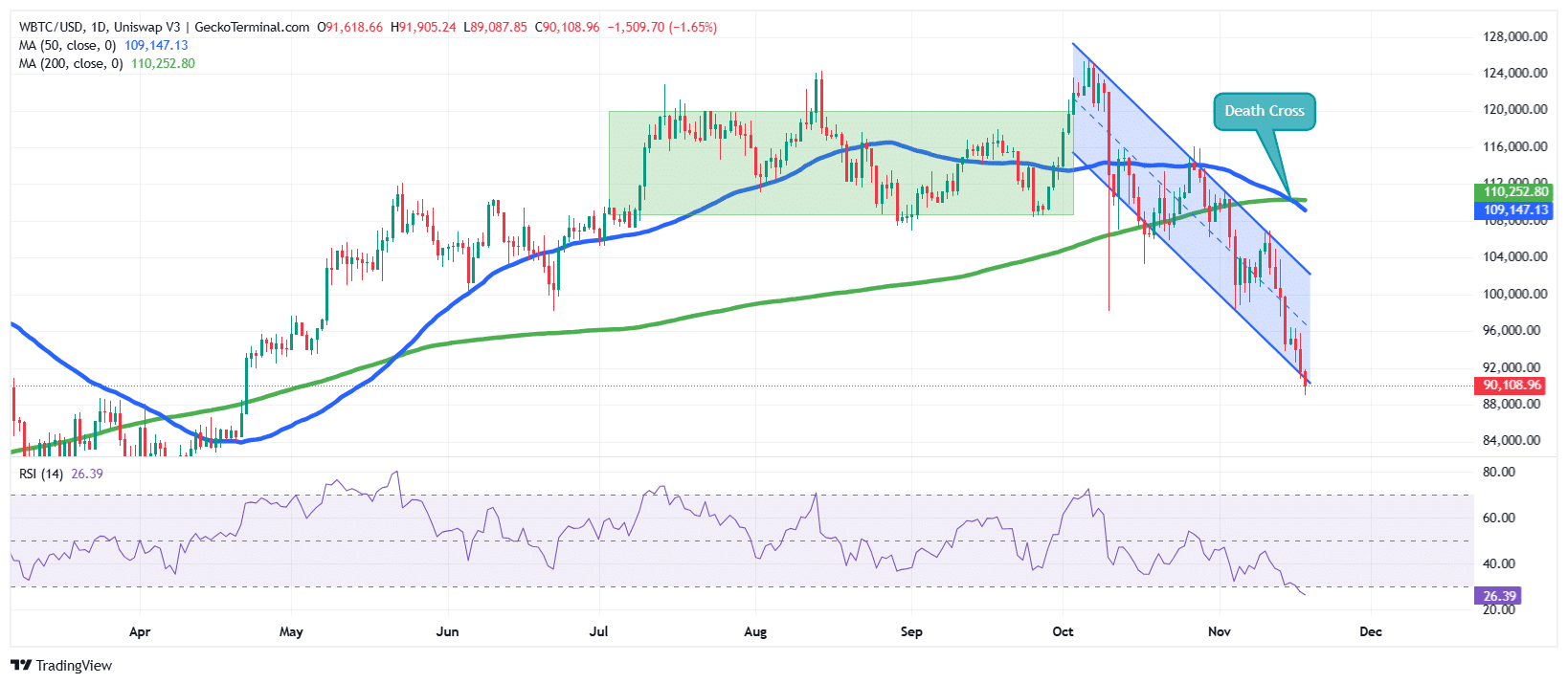

Following a surge from the $85,300 zone in April, the BTC price encountered resistance around the $120,000 level. This led to a consolidation phase, with the price trading within a sideways pattern from July to the end of September. Bulls eventually drove the price to its all-time high near $126,000. However, this marked a peak, and bears took control, pushing the price down within a falling channel pattern.

This bearish pressure has persisted, with BTC recently dropping below the lower boundary of the falling channel, reinforcing the downtrend narrative. The overall bearish sentiment is further underscored by the 50-day Simple Moving Average (SMA) crossing below the 200-day SMA, forming a death cross around $110,159. Bitcoin continues to trade below both SMAs, indicating support for the bearish outlook.

Additionally, the Relative Strength Index (RSI) has fallen below the 30-oversold level, currently trending at 26, which suggests intense selling pressure on the BTC price.

BTC Price Prediction

Based on the BTC/USD chart analysis, the Bitcoin price is exhibiting clear bearish momentum, trading within a falling channel and remaining below both the 50-day and 200-day SMAs. The recent death cross amplifies downside pressure, while the RSI near 26 indicates deeply oversold conditions, which can sometimes precede short-term relief bounces.

If the downtrend continues, the next anticipated support zone is around $87,000, where buyers may attempt to stabilize the BTC price. A breach below this level could lead to a further decline towards $84,000.

Conversely, if oversold conditions trigger a corrective rally, initial resistance is expected near the upper boundary of the descending channel, approximately between $97,000 and $100,000. A more substantial recovery would necessitate reclaiming the 50-day SMA, which is currently around $109,000, signaling a potential weakening of bearish momentum.

Ali Martinez, a prominent analyst on X, has observed that historically, every death cross on Bitcoin's daily chart has signaled a local bottom for the asset.

Over the past year, every death cross has marked a local bottom for Bitcoin $BTC, but in 2022, it kicked off a full bear market.

A new death cross is forming now… So which one is it this time: local bottom or bear market?

— Ali (@ali_charts) November 18, 2025

However, until the price of BTC breaks decisively above the channel and reclaims both SMAs, downward pressure is expected to remain the dominant force in the market.