The Bitcoin price edged up over 1% in the past 24 hours to trade at $87,008 as of 2:28 a.m. EST on trading volume that rose 50% to $66.8 billion.

This development occurs as Michael Saylor, head of Bitcoin treasury firm Strategy, adopted a defiant stance amidst growing skepticism regarding the sustainability of the business model his company pioneered, which has recently been replicated by numerous other companies.

"I won’t back down," he stated to his 4.7 million followers on X.

I Won’t ₿ack Down

— Michael Saylor (@saylor) November 23, 2025

Last week, the firm acquired 8,178 Bitcoin for $835.6 million, increasing its total Bitcoin holdings to 649,870 BTC.

Concurrently, investor sentiment received a boost from remarks made by New York Fed President John Williams, who indicated that the central bank still has room to implement further rate adjustments in the near term.

According to the CME Group’s FedWatch tool, expectations for a rate cut on December 10th have surged to 75.5%, up from just 42.4% a week ago.

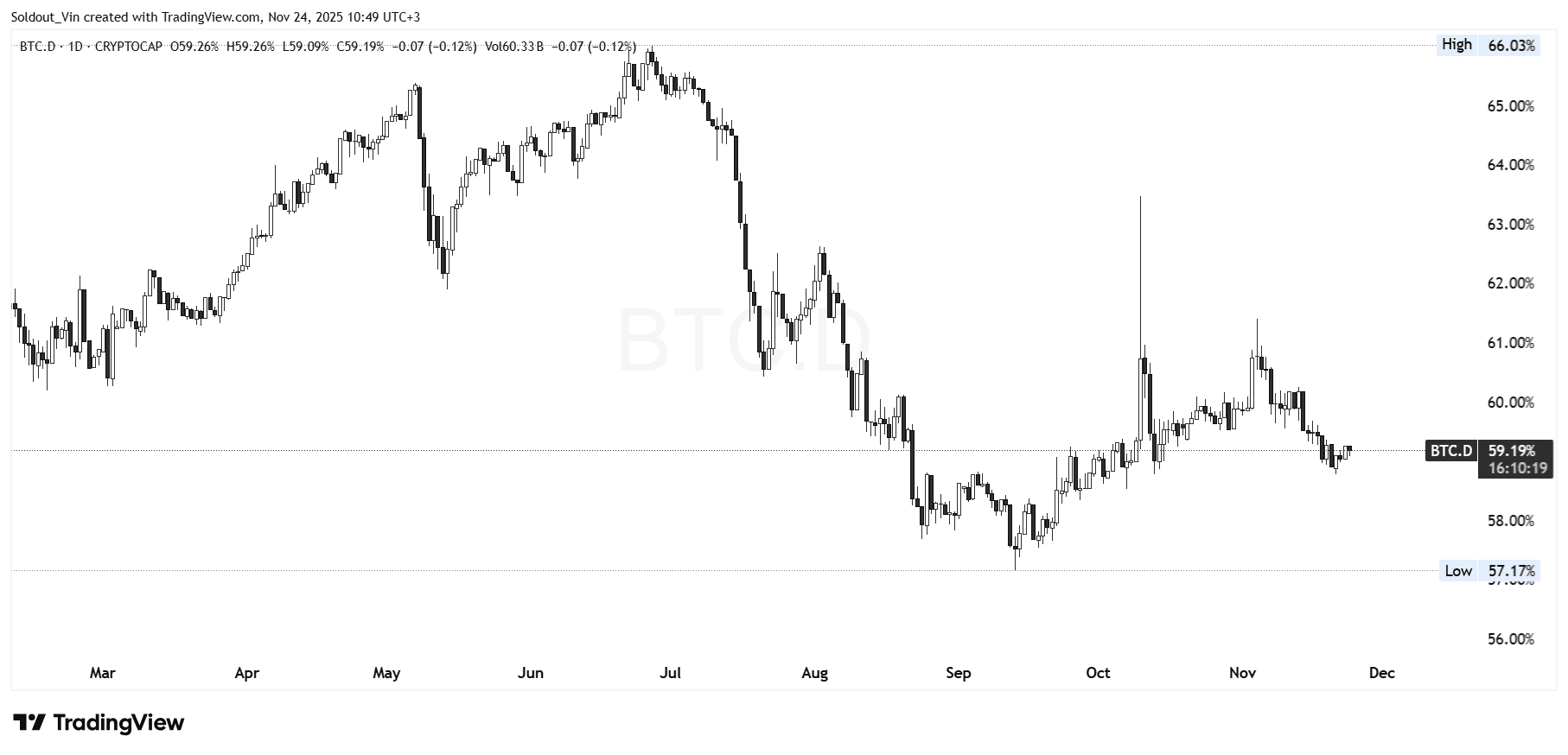

BTC Dominance Strengthens

As the cryptocurrency market experienced a correction in recent weeks, BTC dominance has nevertheless seen a surge. Bitcoin dominance typically strengthens during cyclical drawdowns, as speculative assets unwind more aggressively and capital consolidates back into the most established and liquid asset within the ecosystem.

Bitcoin dominance climbed back above 60% in early November and has since settled to approximately 59%.

Bitcoin Price Analysis: Aims For Recovery

Following its surge to an all-time high exceeding $126,000, the BTC price experienced a decline and is now trading within the $113,000 consolidation zone.

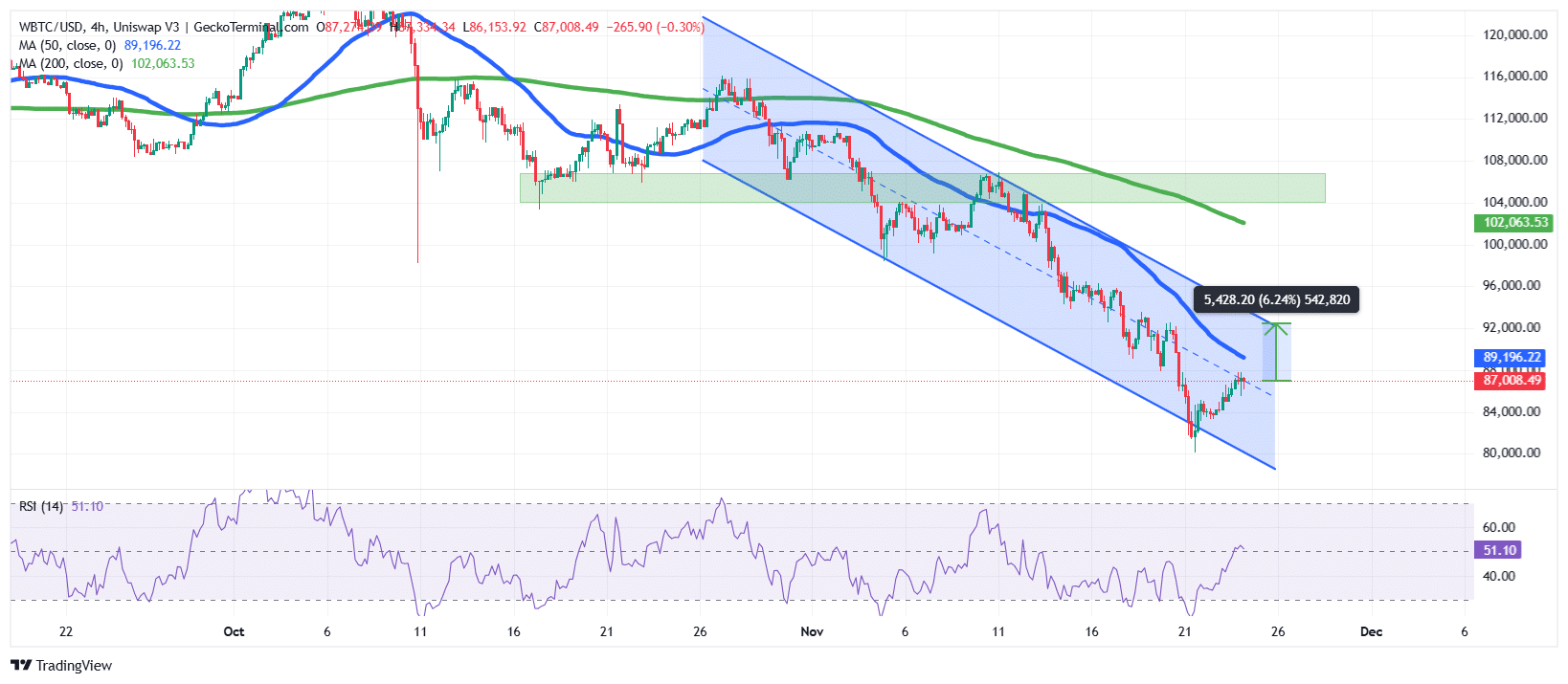

The bears ultimately gained the upper hand in the battle between buyers and sellers, as the Bitcoin price dropped into the $81,000 range, forming a falling channel pattern.

However, after reaching this support level, the price of Bitcoin appears to be recovering above the lower boundary of the falling channel, and is now trading within the midline of the channel.

As a consequence of the ongoing downtrend observed on the 4-hour chart, BTC is currently trading below both the 50-day and 200-day Simple Moving Averages (SMAs), which are positioned at $89,196 and $102,063, respectively. This situation further solidifies the overall bearish trend.

Meanwhile, as the BTC price recovers from the lower boundary of the channel, the Relative Strength Index (RSI) is also showing signs of recovery, having surged above the 50-midline level and currently standing at 51.

Potential for a 6% BTC Price Surge

Based on the current 4-hour chart analysis, the BTC price seems to be attempting a relief bounce subsequent to a decline within a clearly defined falling channel pattern.

The recent upward movement towards the upper boundary of the rising channel indicates short-term bullish momentum, particularly as the Bitcoin price tests the 50-day SMA, which frequently acts as resistance during downtrends.

Should bulls successfully achieve a decisive breakout above the 50-day SMA, the Bitcoin price could potentially increase by 6.24%, reaching $92,039. Following this resistance level, BTC might target the next liquidity pocket situated near $94,000, an area where previous consolidation and seller interest were observed.

A sustained advance beyond that zone could pave the way for a retracement towards the 200-day SMA, located around $102,000, although this level is expected to remain a significant obstacle.

Conversely, an inability to break through the channel resistance may lead to another downward movement towards the $82,000 support level.

In summary, the chart suggests the possibility of a short-term rebound, but the broader trend continues to exert influence.

Related News

- •Eric Trump Says Now Is A “Great Time To Buy Bitcoin,”

- •Peter Schiff Says Bitcoin OGs Selling To ”Weak Hands” Is Setting Up Steeper Drops

- •‘Rich Dad Poor Dad’ Author Robert Kiyosaki Sells $2.25M Bitcoin, Says He’s Still Bullish