The Bitcoin price experienced a slight decline as traders awaited key US inflation data, leading to increased uncertainty regarding the Federal Reserve's likelihood of a December interest rate cut.

BTC briefly dropped to $102,457.33 in the last 24 hours but has since recovered to trade at $104,555.73. During this period, over $317 million in leveraged long positions were liquidated, according to data from Coinglass.

The focus is now on the upcoming US Consumer Price Index (CPI) report, which is expected to be a crucial indicator for the Federal Reserve's next interest rate decision.

Market expectations for a December rate cut have diminished. The CME FedWatch tool indicates a decrease in the probability of a rate cut to 67.9%, down from 85% last week. This shift follows comments from Fed Chair Jerome Powell, who stated that further cuts are "not a done deal."

A higher-than-expected inflation reading could reduce expectations for further monetary easing, while a softer inflation report might boost risk appetite across cryptocurrency markets.

POWELL SAYS A RATE CUT IN DECEMBER IS NOT A FOREGONE CONCLUSION.

BEARISH STATEMENT… pic.twitter.com/XvrRQQavr6

— Mister Crypto (@misterrcrypto) October 29, 2025

Adding to the prevailing uncertainty, a Wall Street Journal report indicated that the US central bank is increasingly divided on the prospect of a December rate cut.

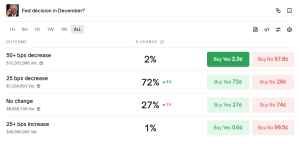

Meanwhile, traders on the decentralized predictions market Polymarket maintain optimism regarding a rate cut next month. A contract assessing the Fed's decision shows that traders have assigned a 72% probability to a 25 basis points cut.

Bitcoin Price Tests Major Technical Barrier Amidst Morgan Stanley's Profit-Taking Advice

From a technical standpoint, the Bitcoin price is currently challenging a significant resistance level at $105,795.

This price point coincides with the 9 and 20 Exponential Moving Averages (EMAs), which are currently acting as dynamic resistance for BTC. A successful breach and conversion of this resistance level into support could signal a bullish reversal in the market leader's current trend, potentially leading to an ascent towards $110,830 in the near term.

Conversely, a failure to close above the $105,795 resistance within the next 48 hours may trigger a pullback towards the nearest support level at $99,680.

Technical indicators on the daily chart, including the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), suggest a gradual return of buyer momentum. However, overcoming the $105,795 barrier is essential to ignite a sustained rally.

While Bitcoin navigates this critical technical juncture, Morgan Stanley investment strategist Denny Galindo has advised investors to consider taking profits in anticipation of a potential "crypto winter."

Galindo remarked, "We are in the fall season right now. Fall is the time for harvest. So, it’s the time you want to take your gains. But the debate is how long this fall will last and when the next winter will start."