Bitcoin is attempting to stabilize around the $95,000 zone following a sharp correction from the $110,000 region. While the broader trend remains under pressure, signs of temporary support are emerging. A breakdown of market conditions across the daily chart, the 4-hour timeframe, and a key on-chain metric can help assess potential future movements.

Technical Analysis

The Daily Chart

The daily structure remains negative, indicated by a bearish cross occurring between the 100-day and 200-day moving averages. A death cross, between the 50-day and 200-day moving averages, has already formed.

These signals have precipitated a swift move down into the $93,000–$95,000 demand zone. This area is currently acting as short-term support, with bulls attempting to initiate a reaction. The Relative Strength Index (RSI) is also nearing oversold territory, hovering just below 35, which suggests some exhaustion in selling pressure.

Despite these signs, the trend has clearly shifted, and lower highs have dominated recent price action. Buyers need to reclaim the $100,000–$105,000 range and flip it into support to regain momentum. Until this occurs, the price action is likely to remain capped.

The 4-Hour Chart

The 4-hour timeframe reveals a breakout and subsequent consolidation below the falling wedge pattern that formed during the broader downtrend. The asset is now retesting the pattern’s lower trendline near $96,000, supported by a clear bullish divergence on the RSI. This divergence could lead to the price climbing back into the wedge.

If buyers manage to reclaim this level, a short-term bounce toward $99,000–$100,000 is probable before encountering strong supply again. However, a failure to hold $95,000 and a rejection from the lower boundary of the pattern would open the door for a deeper drop to $90,000 and potentially even $88,000, which represents a key untested support zone from earlier in the year.

The overall structure remains bearish, but short-term relief is possible as momentum builds.

On-Chain Analysis

Exchange Whale Ratio (30-Day Moving Average)

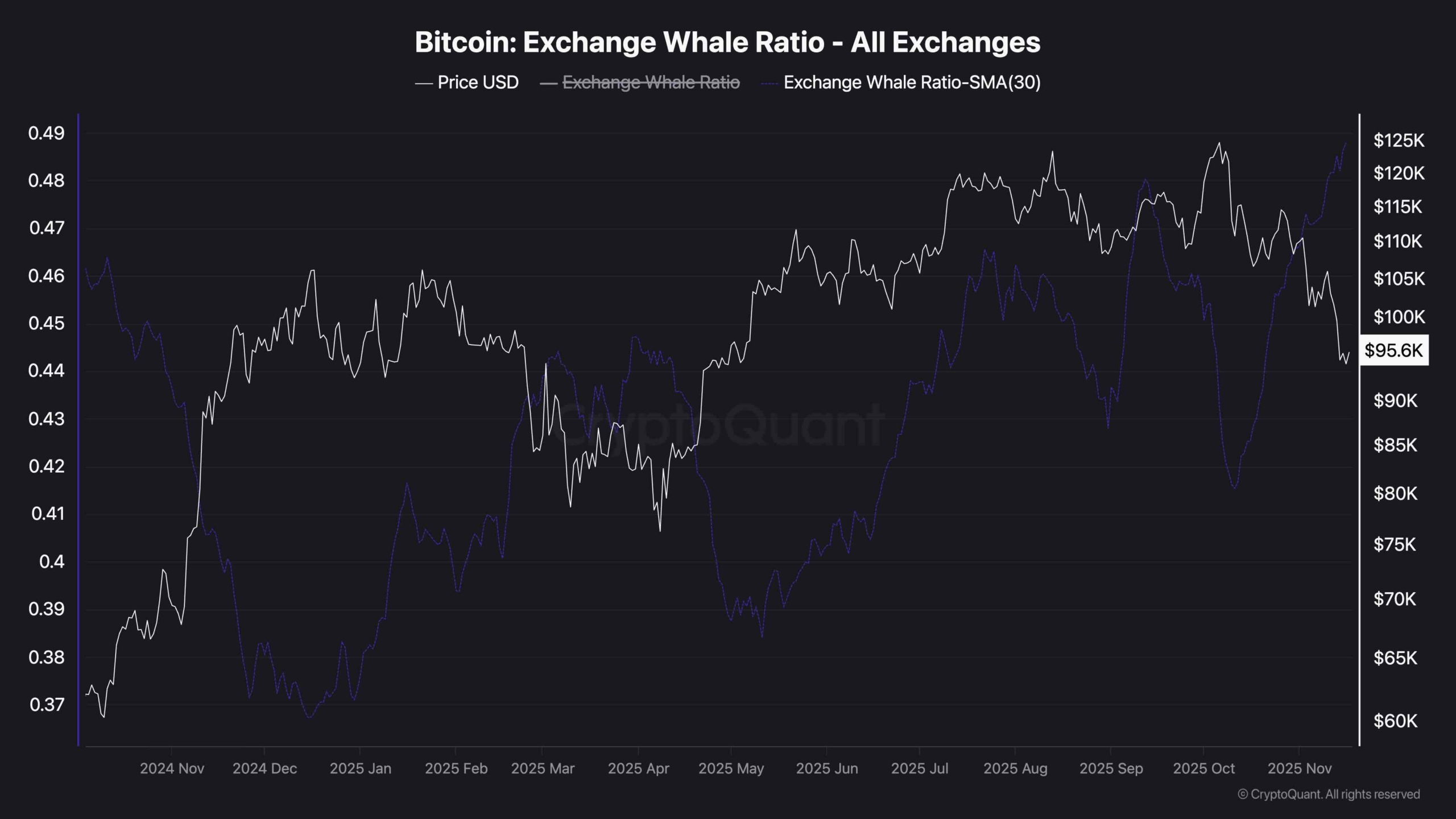

The exchange whale ratio has been trending upward again, with the 30-day Simple Moving Average (SMA) rising above 0.48, reaching its highest level in months. This indicates that large holders are increasingly dominating exchange inflows, a trend that often precedes sell-offs or heightened volatility.

Historically, spikes in this ratio have coincided with local tops or high-risk zones, particularly when the price is under technical pressure, as it is now. If this trend persists, further downside driven by whale activity could be anticipated, especially if the price fails to reclaim resistance levels in the near future.