Key Takeaways

- •Bitcoin outflows from Binance have surged, indicating a decrease in selling pressure and a rise in accumulation.

- •The 30-day average netflow shows consistent negative trends, suggesting increased investor confidence.

- •This trend is being linked by analysts to a bullish phase, as more Bitcoin holders choose to keep their assets off exchanges.

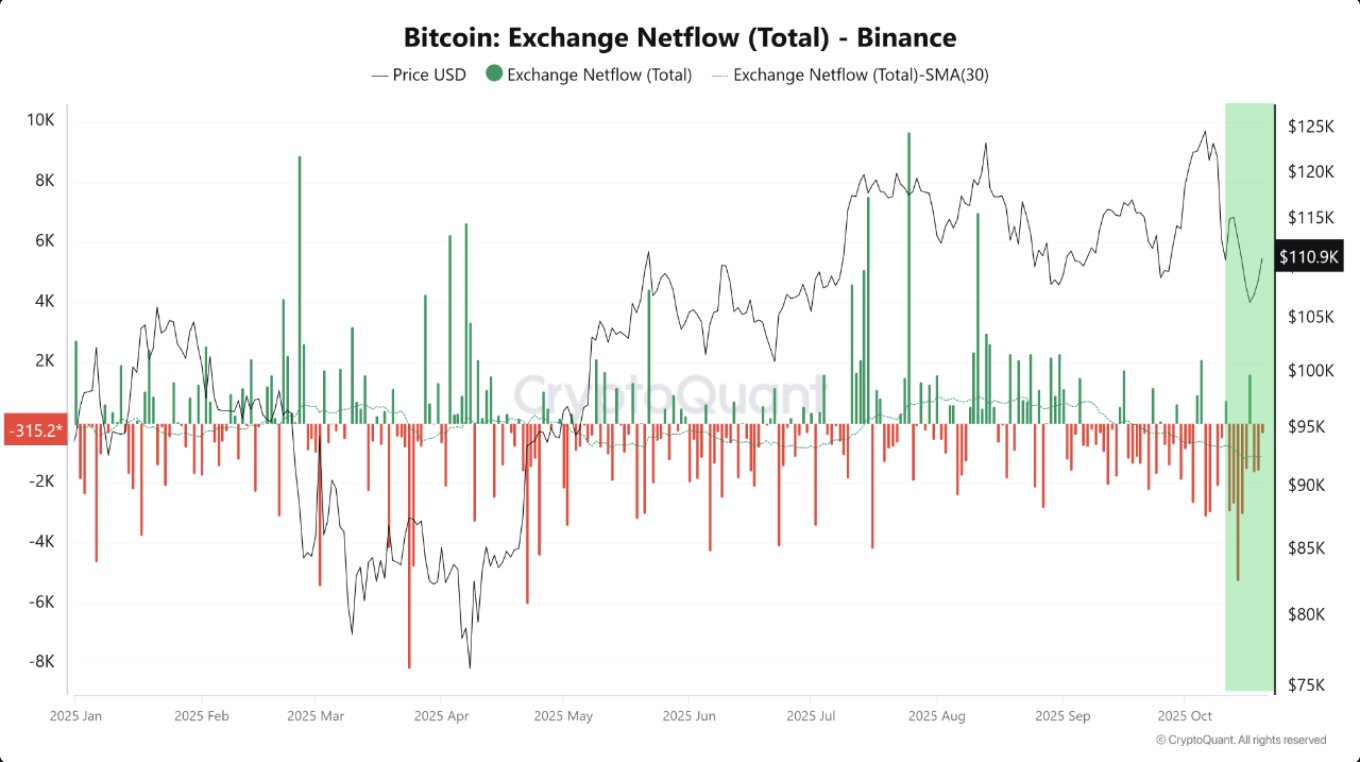

Bitcoin investors appear to be shifting their focus from short-term trading to long-term holding. Data from CryptoQuant reveals a significant decline in Bitcoin inflows to Binance, signaling a reduction in selling pressure and a resurgence of accumulation momentum across the market.

More Bitcoin Leaving Exchanges Than Entering

On-chain data indicates that Binance's Bitcoin Netflow has remained strongly negative when measured by the 30-day moving average (SMA30). This sustained outflow trend signifies that more Bitcoin is being withdrawn from exchanges than deposited, a behavior commonly associated with accumulation.

Analysts emphasize that while daily inflows and outflows can exhibit fluctuations, the longer-term moving average provides a more reliable indicator of investor sentiment. The consistent decrease in exchange balances suggests that traders are opting to transfer their holdings into private wallets or long-term storage solutions rather than keeping them readily available for sale.

Declining Selling Pressure Hints at Market Confidence

Historically, extended periods of negative exchange netflow have often coincided with bullish accumulation phases, frequently preceding significant market uptrends. The current trend suggests that investors are positioning themselves for potential future gains rather than engaging in short-term liquidation.

Furthermore, both retail and institutional participants appear to be aligning with this broader trend of holding assets. This is occurring as market volatility stabilizes and macroeconomic uncertainty begins to subside. Analysts view this development as a positive signal for Bitcoin's near-term price trajectory, reinforcing confidence in the asset's long-term value.

CryptoQuant's data highlights that the 30-day trend, rather than daily fluctuations, offers a more dependable gauge of market behavior. At present, this trend clearly points toward continued accumulation. Such movements typically involve coins being transferred into cold storage, staking pools, or institutional custody, which effectively reduces the available liquid supply.

In addition to these accumulation trends, Bitcoin may also be experiencing technical recovery. According to İbrahim Coşar, a contributor at CryptoQuant, BTC has reclaimed its 50-day exponential moving average (EMA). This level has historically served as a precursor to short-term rallies. If this upward momentum is sustained, it could provide additional bullish impetus to complement the current caution driven by reserve levels.