Bitcoin just posted one of its steepest retracements of the cycle, falling roughly 24% from recent highs. But beneath the volatility, two major on-chain indicators shared by CryptoQuant analysts, the Puell Multiple and whale accumulation trends, reveal a more nuanced picture of where the market may be heading next.

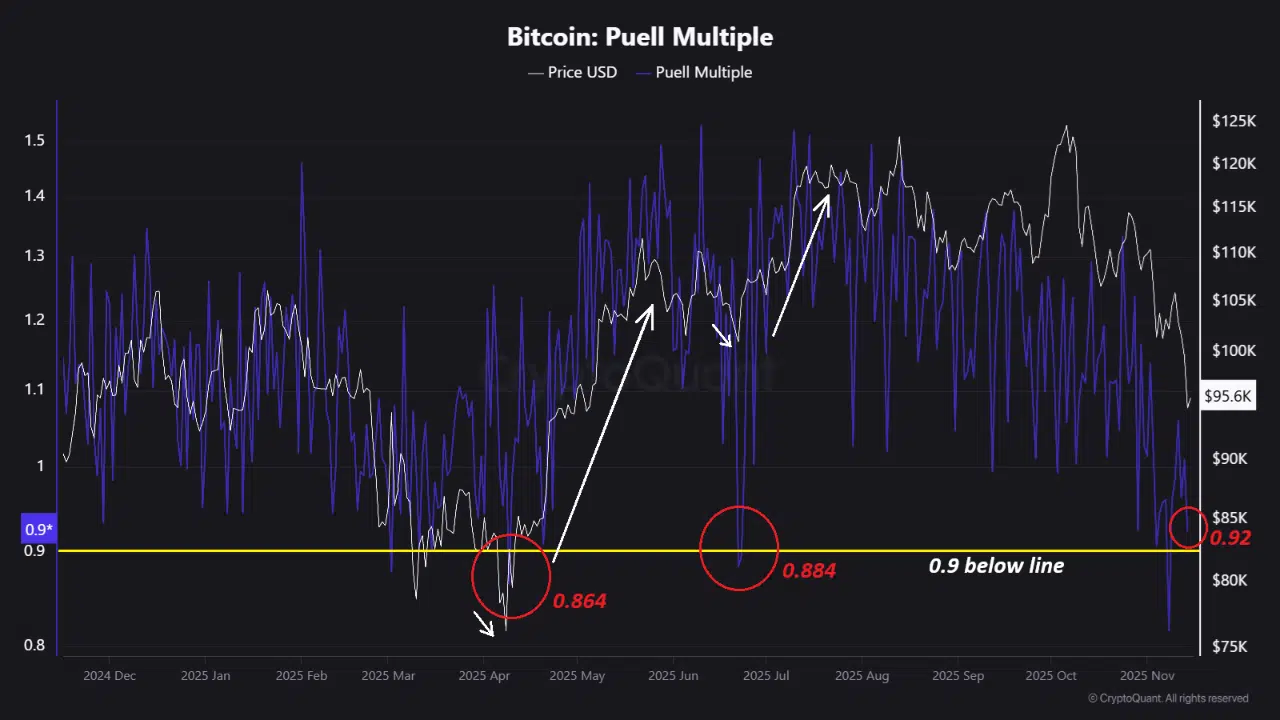

The Puell Multiple Is Cooling Into a Classic Rebound Zone

Analysts note that Bitcoin’s Puell Multiple, which tracks miner revenue relative to historical norms, has slipped to 0.92, almost perfectly touching the boundary that has repeatedly aligned with market recoveries in the past.

Since BTC broke above $90,000 earlier this year, the Puell Multiple has mostly moved inside the 0.9–1.3 band. Historically, dips below 0.9 signaled relative undervaluation and often triggered strong inflows. Previous touchpoints at 0.864 and 0.884 in 2025 both preceded sizable price rebounds.

With the metric now just above that threshold, the market appears to be transitioning from “overheated” to “cooled,” suggesting miners are no longer under pressure to sell aggressively.

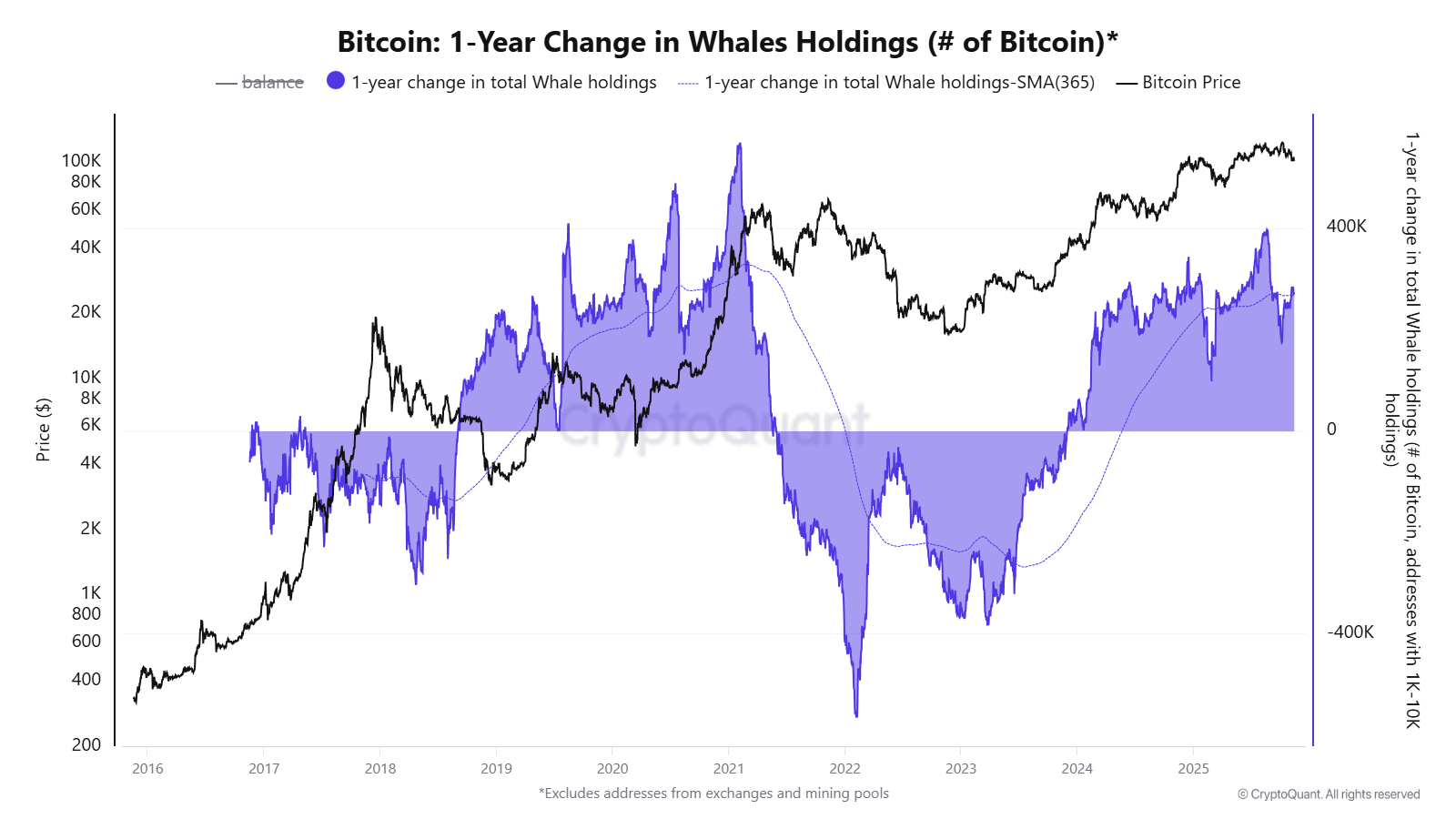

Whales Aren’t Selling – They’re Still Accumulating

A second CryptoQuant update highlights another important trend: despite the month-long decline in Bitcoin’s price, whale wallets continue to add to their positions.

The 1-year change in whale holdings (tracked for wallets with 1,000–10,000 BTC) has remained in positive territory since early 2024. Historically, Bitcoin peaks only occur after whales begin distributing heavily. Today, the opposite is happening, accumulation is ongoing.

In past cycles, whale selling peaked after the bull market topped. The current data shows no such behavior, implying that larger players are positioning for longer-term appreciation rather than exiting the market.

What This Means for the Market

Taken together, the two indicators offer a split view:

- •Short-term sentiment is fragile, price has broken key support levels, and the market remains highly sensitive to macro conditions.

- •Long-term structure is strengthening, miners are entering undervaluation territory, and whales are buying, not selling.

This is consistent with the typical late-stage accumulation phase seen in previous cycles. Deep pullbacks often precede stronger expansions, shaking out overleveraged traders and handing supply to long-term holders.

The Bottom Line

The Puell Multiple cooling toward historical rebound zones and whale accumulation continuing despite the drawdown suggest that Bitcoin’s long-term outlook remains constructive. While more volatility is possible in the short term, the underlying supply dynamics show no signs of a cycle top, only consolidation before the next major move.